Cherry Picked Indicators Screaming Buy

Good morning everyone. It’s always a good Monday when I can get out of bed without too many aches and pains from skiing. I did more reading over the weekend than I have since COVID first spread and I found it so interesting how the opinions about the Russian invasion were across the spectrum. It was everything from Putin is cognitively impaired and going to launch nukes to Putin is a genius, sending only a fraction of the troops into Ukraine and the worst ones he has. I know I am no geopolitical expert, but I do keenly watch the markets to tell me what’s priced in and what’s not.

The single biggest question I have received over the past few days is whether the stock market has hit the bottom. As you know I was waiting for the major stock market indices to breach their mini-crash lows of January 24th to begin the next bottoming process. That occurred last Thursday and Friday was a decent follow through day for the bulls although volume was less than inspiring. There are literally dozens of things I watch to help me determine the odds of a low forming.

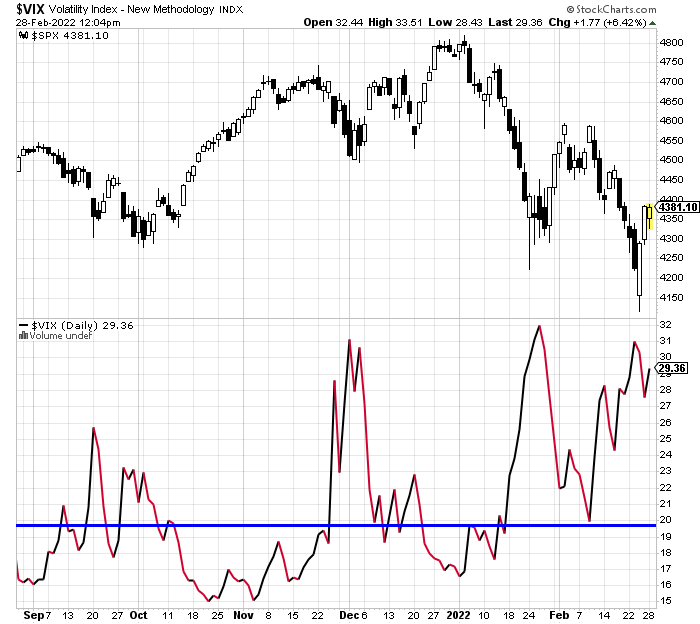

The first was met in that the previous internal or momentum low on January 24th was exceeded. At that same time, we want to see less downside momentum and less “bad things”. Take a look below at the Volatility Index (VIX). On January 24th, it hit 32. Last Thursday at lower prices in the S&P 500, it stopped at 31. That’s a positive and one very small indication of a low. Down the road and likely at much higher prices, it will cross below 20 which will be another sign the bottom is in.

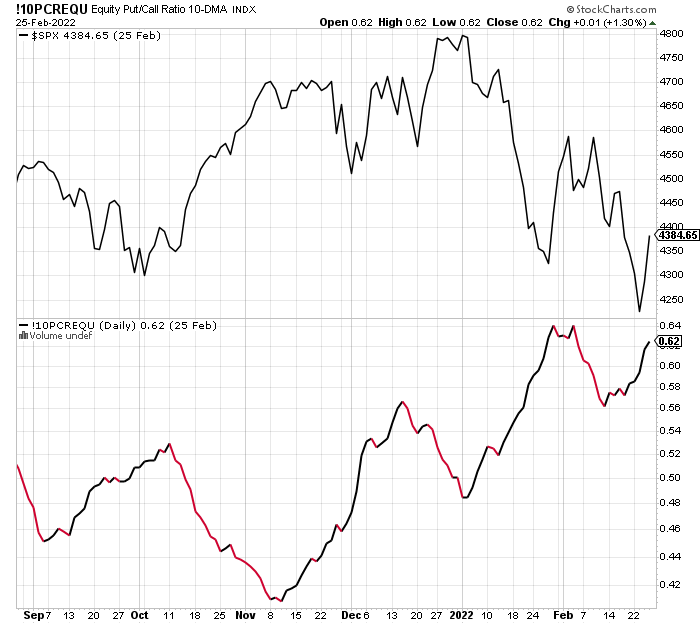

Next, I will show you how options traders were behaving. When the masses scramble to position for lower prices, the market is usually close to a low. Below you can see the 10-day average getting up to .62, a similar level seen at the last low on January 24th. More panic.

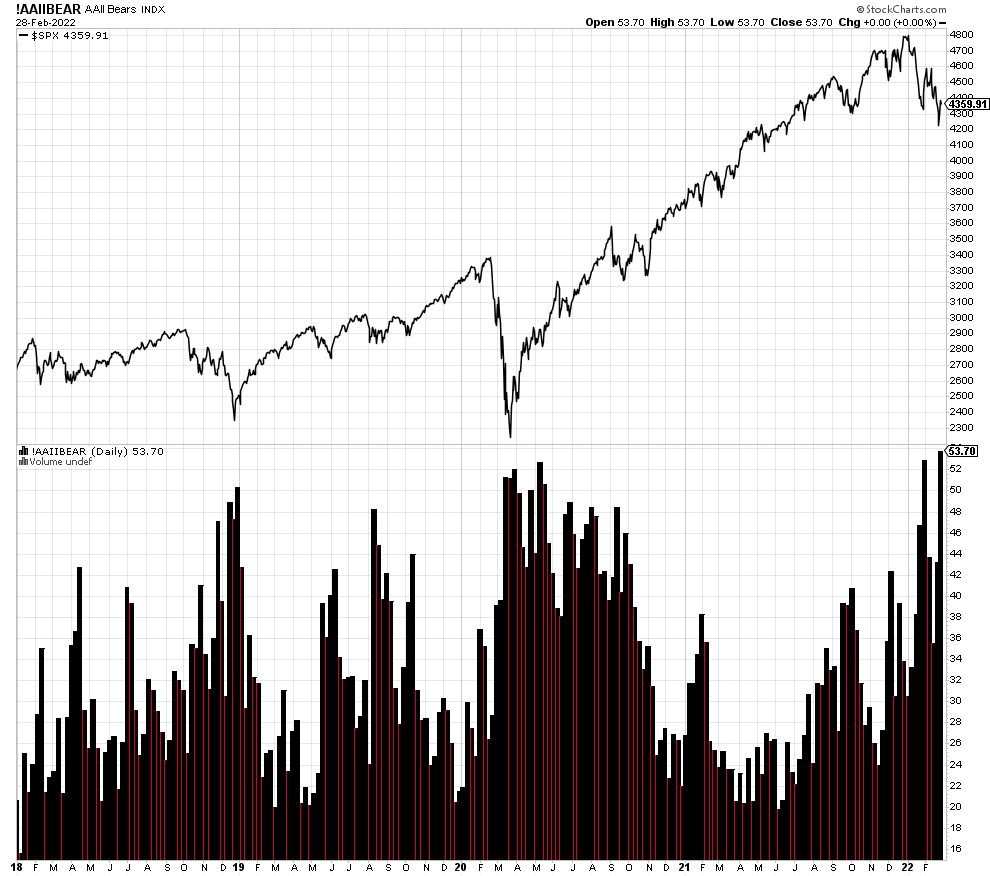

Finally, I will cherry pick some more and show you the percentage of bears in the AAII survey below. Right now, there are almost 54% in that category and that’s historically extreme. Take a look at the same number at the bottoms in March 2020 and December 2018.

Again, please keep in mind that I cherry picked those charts. Not everything I watch is screaming that this is the ultimate bottom, but there is certainly enough information to have me add risk as we did last Thursday.

On Friday we bought a levered position in the QQQs and slightly reduced a levered position in the NASDAQ 100.