Conflicting October Stats, Heightened Risk, Dow 50,000 And Something Shutdown

Q4 is here. I always feel like Q3 flies by because it’s summer and the weather is warm. Of course, Q1 crawls by with winter and low daylight. Anyway, we have a number of studies that are relevant to year-end. Let’s start with October.

We know that October is one of the few months that performs better when it begins in an downtrend, unlike the present. When the month starts in an uptrend, it shows a slight loss. Getting more granular, in an uptrend, October performs well during the first five days and then on the weak side over the last 15 trading days.

Longer-term, when the S&P 500 is up 10-20% through September 30th, October shows a median return of +1.50%. Since 1950 Q4 has been up 17/20 times with a bullishly median return of +5.50%. The three losses were all less than 1.50%. And I don’t have tell you that Q4 is an historically positive time of year.

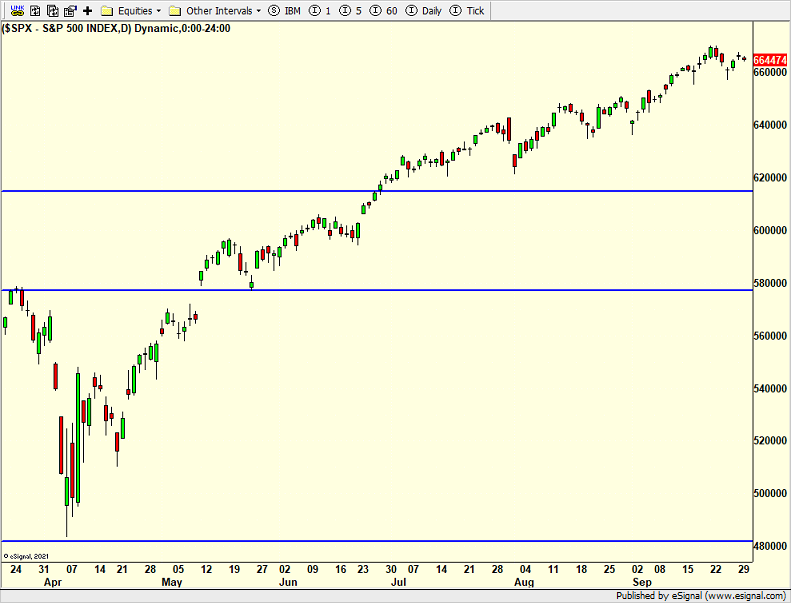

Pivoting away from seasonal trends, it appears very likely that the government will shut down for more than a day or so. It doesn’t matter who is to blame. That’s not relevant in my professional world. What I see is a market that has powered ahead since April, grinding and creeping day after day after day. Clearly, markets are not worried about a government shutdown. Historically speaking, why should they? Shutdowns have been non-events for the markets. And that may be the case this time as well. However, given the rise and overall investor complacency, my Spidey senses are a bit heightened.

Some of you noticed that my posts have a bit more of a cautionary note of late, or at least not as wildly bullish as I have been although Dow 50,000 is still coming next quarter. Yes. I know. And that’s true. I have loved and enjoyed every minute of the ride since April. Back then, the masses were calling for recession, soaring inflation and even a repeat of 2008. I deemed the tariff tantrum as the single largest mass liquidation of stocks in history. You know how I viewed everything. April would be the worst of the tariff reaction. Each successive tariff announcement would be met with a smaller and smaller market reaction until only a yawn was seen. Not a bad forecast when the pundits, economists and media were certain that tariffs would only spell doom. Of course, now they are all revising history or changed their tune.

Market-wise, the only logical scenario was a path to fresh, all-time highs although I thought it was going to take at least until Q4 2025 which was the most bullish forecast out there. I went back and read how our models suggested 6500, 6600, and 6700 on the S&P 500 by Q1 2026 when the index was trading below 5500. Today, our models are less bullish, but definitely not negative. The easiest money has been made, something I have said multiple times in Q3. Some of our models will start to prune where appropriate and plant in less trafficked areas.

The great performance chase to year-end remains in full motion. As hard to believe as it is, there remains way too many professionals with large cash positions or hedged portfolios from back in late Q1 and early Q2. Their portfolios are woefully trailing a benchmark they are paid to keep pace with. They keep hoping and praying for a 10%+ correction which is one reason why it’s not coming. Of course, after a 20% decline like we saw earlier this year, it is very rare to see another double-digit decline within a year. This situation alone is reason to believe that while stocks do not need to stay on this trajectory, declines should be shallow, 5% or less, and met with buying.

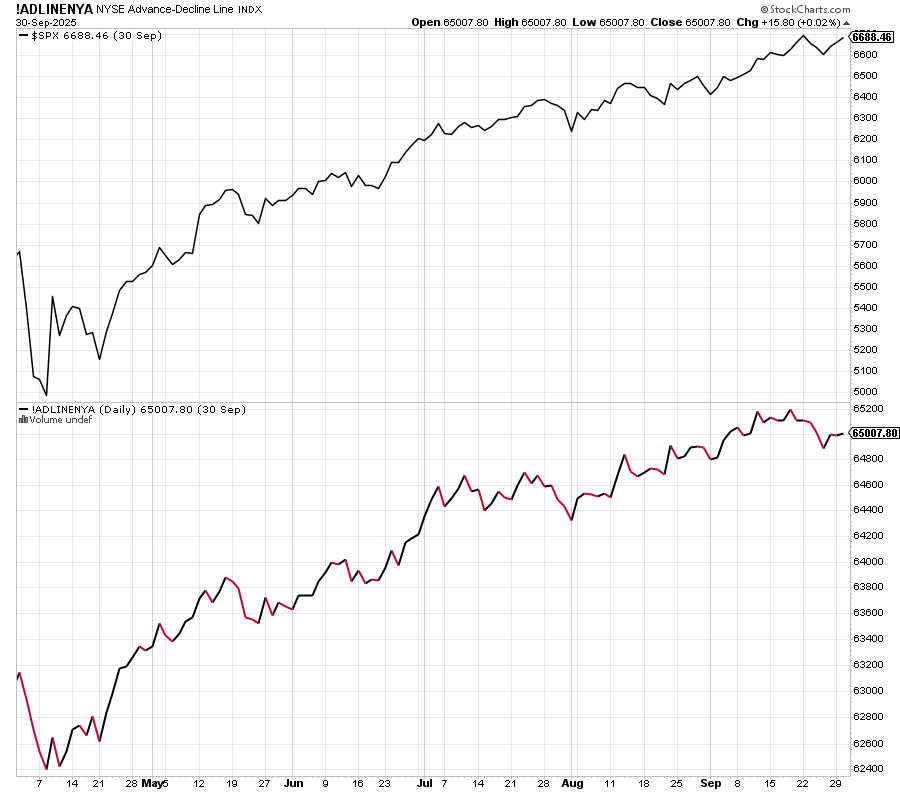

I will leave you with this. For all the Chicken Little cries that the sky is falling and the bull market is over because of a bubble that doesn’t exist, participation as measured by the chart below remains adequate to solid. Bear markets do not begin with the New York Stock Exchange Advance/Decline Line two weeks removed from all-time highs.

On Monday we bought CHD and PCY. We sold FDLO, VVV, some NEM and some GOOG. On Tuesday we bought more IWO, more MQQQ, more HYG, more BOCT and more UWM. We sold EMB, some XLF, some OIH, some PINK, some XBI, some XLP, some XLRE and some XHB.