Coronavirus & Stock Market Playbook

As I mentioned the other day, I have been reading an incredible amount, just like many of you, about the Coronavirus. I even pestered a relative at the CDC as well as my friend who runs a research lab at Yale for their opinions. Interestingly, the professionals are a whole lot less alarmed than the masses. The two I annoyed both texted me science articles of why Corona is just another in a long line of bad viruses to be spread around the globe. And they both thought there would be more in the coming years.

Shortly, I will be flying internationally and then to California and I don’t feel overly concerned about my health and well being. Perhaps I am being complacent or just stupid. Coincidentally, we just updated our wills this week, having absolutely nothing to do with Corona. It was just time, and the need to make sure my kids vie for most favorite child status. Of course, I am kidding. My wife doesn’t like when I talk about my mortality. After all, the day before I was hit by that silver maple tree last May, I was reviewing my emergency business succession plans with great friend, Sam Jones. And then Teri had to call Sam from the ER to let him know what happened. As you would imagine, Sam thought she was kidding.

People at Risk

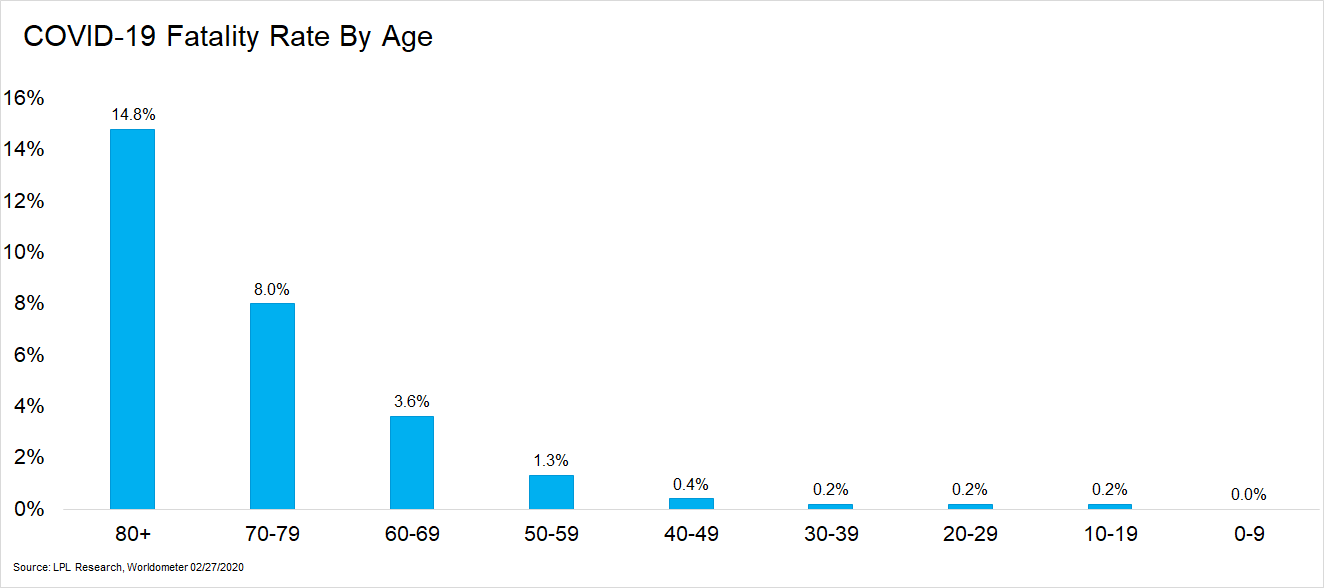

Anyway, I found the chart below interesting from LPL’s Ryan Detrick. As the experts have been telling us, the virus is most dangerous to those with compromised immune systems, including older people, smokers, diabetics, etc. If you believe the stats, while the virus has higher mortality rates than influenza and SARS, it’s still in the low single digits and that may be overstated.

I found this wonderful post on Twitter with comments from Professor John M. Nicholls, department of pathology at the University of Hong Kong. There is so much hysteria surrounding this because of the speed of the outbreak and difficulty in detecting it. Even our own officials are contributing. But Spanish Flu? Really???

EVERYONE should read it and judge for yourself. https://twitter.com/saxena_puru/status/1227065623139606533

When I read Professor Nicholls and get laughed at from the experts whom I know, I almost feel silly having discussions about “what if” with my wife if the virus doesn’t die out by the summer. But just like I try to do with our clients’ portfolios, there is always a point where action needs to be considered or taken. I just prefer it from strength instead of weakness.

From All-Time Highs to Three Month Lows in One Week

And that’s a good segue to the financial markets which have been under tremendous attack for the past 6 trading days. Just last week, stocks were making all-time highs. In just 6 trading days, stocks are making three month lows and down 10%. As recently as last week and for all of 2020, there has been a dearth of reasons why stocks could go down more than 5% as all of the big picture concerns had been eradicated.

Of course, we have seen market sentiment go from overly bullish in November, to giddy in December to exuberant and greedy in 2020. As I have said in the media and written about many times, markets with that kind of sentiment backdrop that just keep grinding higher and higher each and every week eventually get punished with a short, sharp and sometimes terrifying elevator shaft drop that usually scares all of the Johnny Come Latelys out of stocks and back to bonds or cash. The problem is that greed is not a good timing tool to forecast an imminent decline, just like valuation isn’t. Investors can get greedier and greedier just like stocks can and do get more and more expensive until here is always a catalyst to change course.

An issue for me this time, which is why I didn’t start pounding the table that a large decline lay ahead, was that the market’s foundation was fairly stable and arguably strong. I will be emailing part I of Canaries in the Coal Mine shortly, when market volatility calms a bit. The key takeaway will be that the while the bull market is wounded, it nevertheless remains alive and poised for Dow 30,000 before the election. That’s a big statement to make amidst a panic crash.

Carnage and Escape

To get a feel for the carnage on Monday and Tuesday which was extreme, only 10% of stocks traded higher on each day, meaning 90% went down on back to back days. As you might expect, 90% of the volume on each day was in stocks going lower. That just doesn’t happen very often and never so close to all-time highs. Really, the only way it could have happened was with the historic level of euphoria in stocks as everyone went all in.

What escaped the wrath? Certainly not gold as many pundits predicted. Gold had been very strong since early February, but began to look tired. On Twitter, I shared that I expected gold to see a short-term peak Monday morning. The sector has been down since.

Normally, during periods of market stress, the U.S. dollar acts as a safe haven investment. But not this time as the greenback has gone down over the past week and the yen and euro have rallied. along with U.S treasury instruments which see economic weakness and a potential Fed rate cut coming.

What’s going on today “feels” a whole lot more unnerving that the Fed being too restrictive or a war in the Middle East or China slowing. This market correction is based on a health crisis that can impact more than just our investments. However, I am anything but a scientist, let alone an epidemiologist, and regardless of the reason, markets trade between fear and greed. Human behavior hasn’t changed in generations and it’s not changing now. The markets don’t know Coronavirus from Corona beer and nor do they care. They are trading lower on extreme fear which will eventually lead to an extreme bottom and strong rally. In fact, I believe we will see fresh, all-time highs by summer. That forecast is predicated on the virus slowing and then dying out as the weather in the northern hemisphere warms.

9/11

This correction looks a lot like what we saw post 9/11 when the media had a constant barrage of scary headlines that it was unsafe to travel and the whole world would tailspin into a deep recession. Of course, it didn’t and the recession was mild, barely noticeable by people outside the travel and hospitality industry. In the here and now, Corona could certainly end up being that very mild recession I have been forecasting. However, the origin would be from not being able to get supply rather than the usual plunge in demand. I can’t find another instance in the past 100 years.

Market Playbook

The market is pricing in some very nasty Q1 and Q2 earnings reports and economic numbers. We will start to hear from thousands of companies warning of this very shortly. I sense that the stock market will begin to hammer out its internal or momentum low in the coming few days. From there, a strong bounce should follow with perhaps another bout of selling later in March or April, something we did not see post 9/11. After that, new highs are in order for summer. While volatility should continue to run high, I think the market is in the worst of it right now. Again, crash mode usually means that the market is close to a low in time, but price is another story. That’s the playbook.

Market declines are always a good time to take your temperature on risk tolerance and investing objectives, something we have been doing with clients for a few months. If the volatility is too much for you to comfortably handle, then perhaps your risk tolerance and investing objectives should be taken down a notch or so.