Do The Homework – Selling In May Is For The Lazy

Before May gets away from us I wanted to comment on the media’s obsession with the “Sell in May and Go Away” calendar investing advice that makes its round annually. First, like many of these, they were data mined and really only worked until they were discovered and published. Second, selling in May works sometimes, in some years. Other times, June is a better month. In election years with the incumbent running, it doesn’t work at all.

Overall since 1950, selling in May and buying in November leads to a roughly 2% return. Not so bad. Certainly not the fire and brimstone that we are led to believe. November through May returns roughly 7%, much better. In the last 10 years, 8 May through Octobers were up.

In election years with the incumbent running, stocks typically see a bottom in May with June through August being strong. My best advice? Take this stuff with a grain of salt and do your own homework like I do.

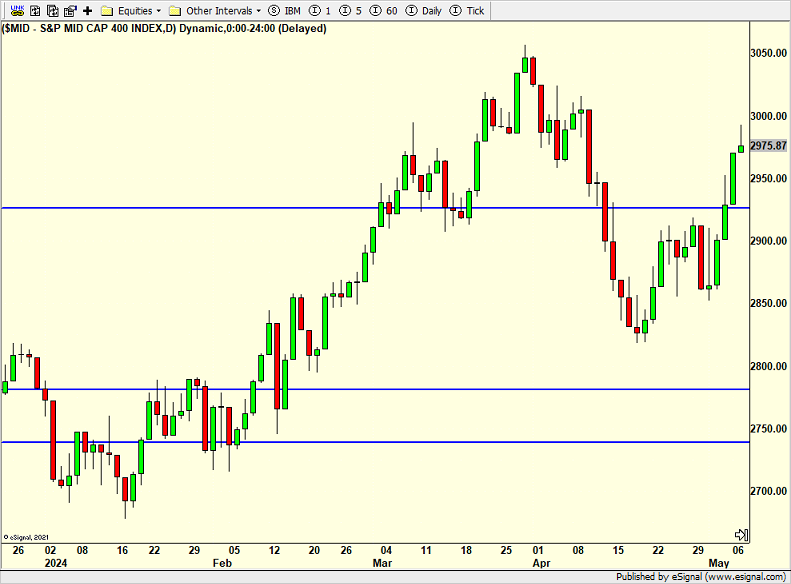

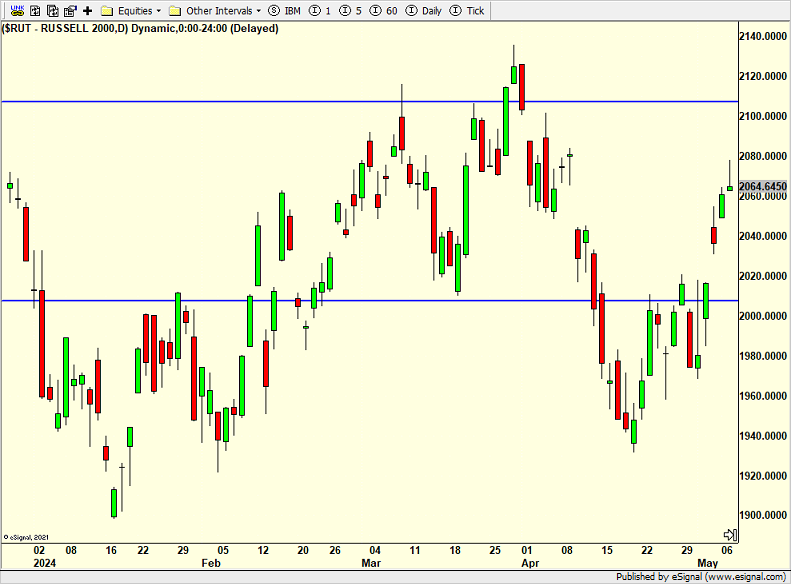

Pivoting to Monday’s update, as promised here are the charts of the S&P 400 and Russell 2000 so I can’t be accused of cherry picking the S&P 500 and NASDAQ 100 to lay out my thesis of the stock market being in an uptrend. I don’t know how these bears scream about the sky falling when every single major index is making higher highs and higher lows.

Now, I will give them that not every major index behaves well, but isn’t that in every market? Bottom line is that stocks have risen really hard and fast. A little pause would be welcome.

On Monday we bought RYMBX. On Tuesday we bought BIPIX, levered inverse S&P 500 and more EIFAX.