Dog Days of August

I can’t believe it’s already August. I am not ready for the countdown to end summer, even though ski season may only be 100 or so days away. I like wearing shorts, tee shirts and flip flops. Where has the year gone? Can we slow down a bit?

July’s market action was a whole lot more fun for the bulls than June, May, April, etc. The S&P 500 was up more than 9% and the bond market rallied by 2.5%. The most beaten down stocks and sectors bounced the hardest, one of my main themes off the June bottom. Crude oil fell by roughly 6%,

I had lots and lots of comments from last week’s posts and videos regarding recession and I will address them later. Just know that never did I say recession wasn’t or couldn’t come, just that in the data I look at, I didn’t see it here right now. And calling me names and casting aspersions certainly won’t get me to change course nor consider your argument.

August is here and that’s nothing to celebrate in the markets. The first day of August is the weakest first day of any month of the year with very few rallies. However, given the very strong close to July, there should be some follow through. In short weakness on Monday can be bought for a few days or so.

Also, overall, August returns have been right around the 0% line, regardless of whether stocks are in an uptrend or downtrend. So if you wanted to be cute and try and map it out, you would buy early weakness for a trade and sell into strength for a few weeks and then regroup. Of course, markets will do their best to confound the masses.

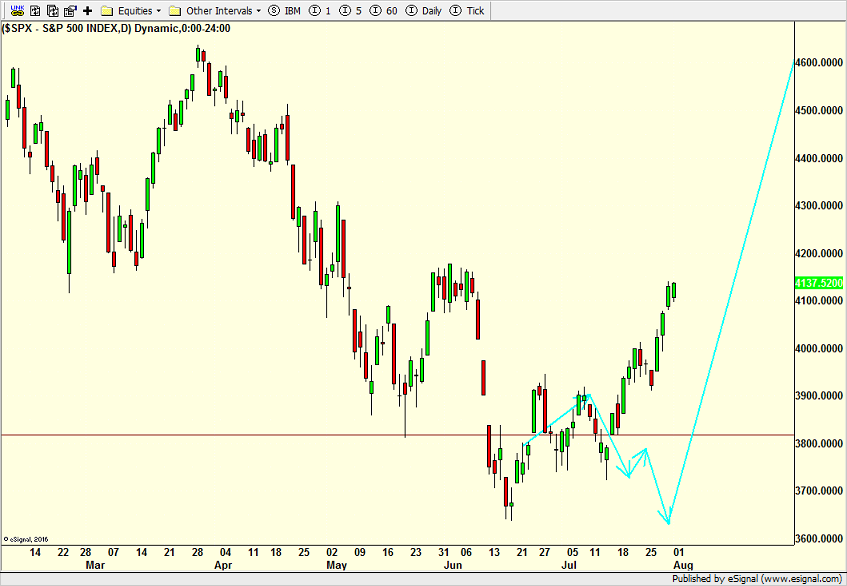

When I was pulling up indices to review I was reminded of the light blue path below as one possible scenario right off the June bottom. On balance, it hasn’t been too bad, just more compressed than I thought.

I do think stocks will pause or mildly pullback or struggle a bit as they approach the early June highs and area of congestion. But ultimately, that area should be exceeded before the next more moderate pullback begins.

On Friday we bought levered inverse S&P 500 and more ABBV. We sold some ARKK.