Dotcom Bubble Again?

On Wednesday I wrote about the meme stocks being back in Vogue with epic volume. I know. I know. Why should we care about a few stocks that trade like Dotcom stocks from yesteryear? In a vacuum it doesn’t really matter. However, we don’t live nor invest in a vacuum. Meme stocks like Gamestop, AMC and Blackberry are indicators of overall market sentiment. All three companies have poor fundamentals which is why many professional investors have positioned against those stocks, seeking them to go to $0.

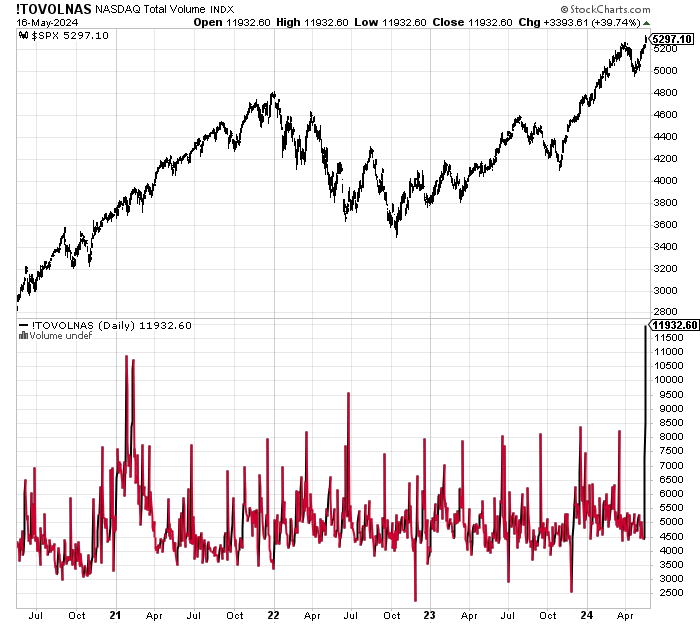

Let’s start with the number of shares traded on the NASDAQ in the chart below. Look at the far right. See the vertical line going straight up? That’s just under 12 BILLION shares in one single day. See any other days over the past few years like that? Nope. Think there’s interest among investors? Yup.

What you don’t see unless you look under the hood is where the volume came from. I absolutely hate to qualify data. It’s much better to take it at face value since it’s fact. In this case looking under the hood makes it worse. Penny stocks are getting a huge amount of love this week. Yikes! That’s not good. That is the purest form of speculation. It’s penny stocks for heaven’s sake. Investors are feeling confident, cocky and greedy.

Pivoting to the meme stocks below, let’s look at Gamestop which was made popular by the Reddit crowd forcing a major hedge fund and Gabe Plotkin to blow up several years ago. Over the past week or so, Gamestop went from $10 to $65 to $28. And look at the volume underneath price. 200 MILLION shares in one day this week. In my view traders knew some big funds who positioned for the stock to go down. They got Gamestop moving sharply higher which forced those negatively positioned to run for cover, further pushing the share price even. That’s also known as a short squeeze.

FYI, Gamestop is basically a retail store that sells games. It’s not AI. It’s not a play on electric vehicles. It’s not a crypto company.

Before moving on, I want to zoom out and show you that while what has happened lately is insane, it’s nothing compared to what happened in 2021. Look at the chart below on the far left when price soared to $120. Look at the volume underneath where BILLIONS of shares traded.

I was going to show another meme stock as well, but I think I sufficiently beat the proverbial dead horse and you understand my points. Investor sentiment and market behavior this week has been the craziest, the greediest and the most giddy since 2021. NASDAQ volume makes me shake my head.

However, and this is a big one, the rest of the stock market and “risk on” markets are not behaving like it’s the Dotcom Era all over again. They are much more subdued. Since the mid-April bottom, we have seen a number of thrusts higher, like when a rocket is clearing the tower. While the initial few miles are the most powerful for a rocket ship, that powerful thrust leads to much higher altitudes to escape the atmosphere.

Stocks are the same way after bottoms. In bear markets, we rarely see escape velocity and thrusts. In bull markets they happen more frequently which is why those markets persist.

Finally, below is the Voaltility Index (VIX). It is scraping along the lowest levels since 2019. In and of itself that does not mean bad things are about to happen. Low volatility can and does persist in ongoing bull markets. But it does mean, however, that we can easily see a quick downdraft at anytime to punish the late comers.

As I finish this up, the best golfer on earth, Scottie Scheffler, has just been arrested as he tried to drive into the club at the PGA tournament in Kentucky. Jokes are all over social media that Rory McIlroy, Xander Schauffele and other top golfers finally found a way to stop him. Others created memes that the LIV golf tour paid the police. It’s certainly odd and the body camera footage from the police should confirm what really happened and if Scheffler did something wrong or was a case of mistaken identity. I hope it’s the latter as he has been one of the good guys, an ambassador for the game and a brand new, first time father.

On Wednesday we bought BP, CYPIX and RYVIX. We sold CLX, FMAT and some RYCIX. On Thursday we bought more levered NDX.