Downside Set Up & Small Caps

It has been a quiet week for stocks, but you would have concluded that had you listened to all of newly minted geopolitical experts calling for WWIII, oil to $150 and risk assets crashing. Once again, managing money by using global events is a fool’s errand, not that those events won’t impact. It’s just that the world is always, always, always a volatile place. Iran, Russia, China, Gaza, COVID. There is always something. When investors make emotional decisions based on geopolitics, they have already lost.

The high probability outcome for post-2pm on Wednesday did not materialize. While stocks closed marginally higher it was really a wash at best. The set up for weakness today did trigger and we reduced exposure in a few strategies where positions were not behaving well.

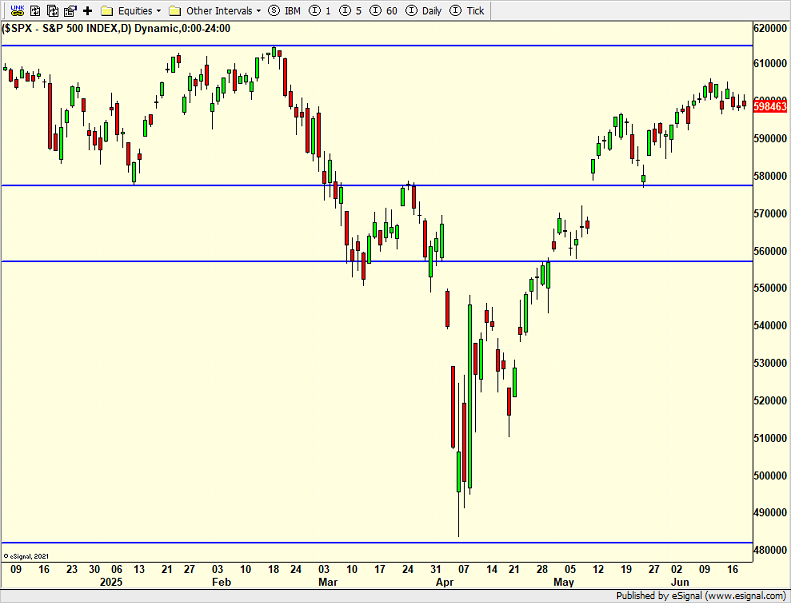

The S&P 500 is below. Having met my general upside target of 6000 before a pullback, we have only seen very mild weakness. In an absolutely perfect world, there would be one more pop above the June highs before a deeper pullback and then a run to new highs. Of course, stocks can just pull back right now or they can scream to new highs. They certainly don’t have to follow my scenarios although that would be nice and easier.

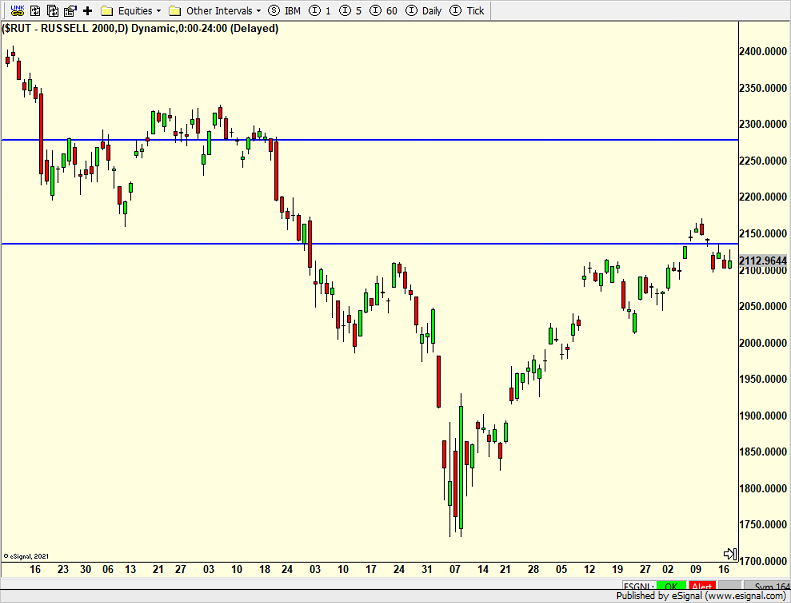

I am ever so slightly disappointed that the Russell 2000 below has led the mild pullback. I would have much preferred it declining less, but maybe I am being to picky. Regardless, I am a buyer on weakness until proven otherwise which may be sooner than later.

The weekend is here. Can CT break the streak of 16 straight weekends with rain? I am betting it. We have all three kids home for the next 8 days so I would like to enjoy some golf, pool, BBQ and bonfire. And while I love when everyone is home, I would also like some peace and quiet by 11pm. I know. I know. That’s a lot to ask for.

On Wednesday we sold SSO, EMB, PCY and some SPLV.