Dumb Money Finally Buying Stocks

Smart money usually is early to the rally and then slowly reduces exposure as the dumb money throws in the bearish towel and starts to embrace the market strength. This happens over months and quarters. Rinse and repeat. During the tariff tantrum in early April I noticed that big money was selling at any price while small money was patiently buying the plunge in what was a role reversal.

The stock market has come very far and very fast from the depths of despair during that April mini-crash. Several folks almost perfectly timed the bottom as they told they were liquidating their portfolios the day of the low. Of course, I have no idea if that actually happened as those folks haven’t engaged in conversation after I told them it was one of the worst investing decisions they could make.

I sense the opposite is happening now. Dumb money is chasing the market higher while smart money is either sitting tight or feeding the ducks as they quack. Of course, the market can soar higher from here, but the risk is much more than it was in April when the easiest money was made.

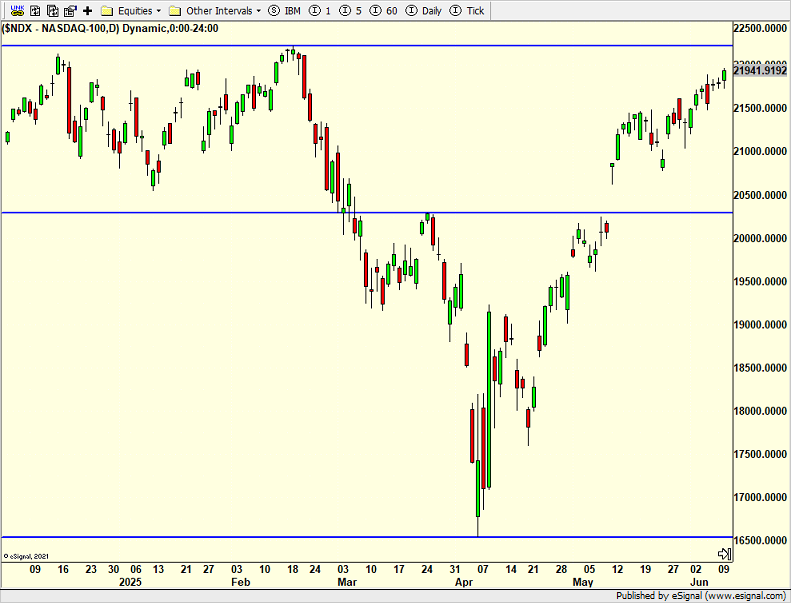

The NASDAQ 100 is now just a good day away from all-time highs. Let me repeat that. All-time highs. I was looking for that late this year, certainly not in Q2. And I think I was among the very few who even thought that was possible. Now, I am sure we will hear from the pundits who revise history and let us know that they saw this coming.

About a week ago I discussed the opportunity in small caps, a group I have been run over many times since 2009 trying to own. Since my road rash has healed I tried again.

Below is a relative chart of the S&P 500 versus the Russell 2000. You can see the last week or so on the far right of the chart going up, meaning that the small caps are outperforming in the very short-term. Obviously, I would like to see that continue, especially during the next pullback.

On Tuesday we sold some QLD.