Early or Wrong?

The stock market has had a strong rally, at least price-wise since the earthquake 11 days ago. My thesis has been for several more aftershocks over the ensuing weeks and possibly longer. One thing I cannot argue with is the acceleration in what I have labeled as a bounce. I also have said that I would be surprised if the stock market went straight back to new highs.

Aside from one aftershock last week, the bulls have powered ahead unabated. I can act like the pundits on TV and say that I am early which I may be. Or, I can realize that my original thesis is wrong and move on. Was it really an earthquake? Or was a rogue wave? As a diehard fan of Deadliest Catch, I can speak firmly from the couch that a rogue wave is one that comes out of nowhere and it’s multiples higher than the waves around it. It’s not like the seas build and build and build before a giant wave hits. A rogue wave hits and then the seas go back to normal.

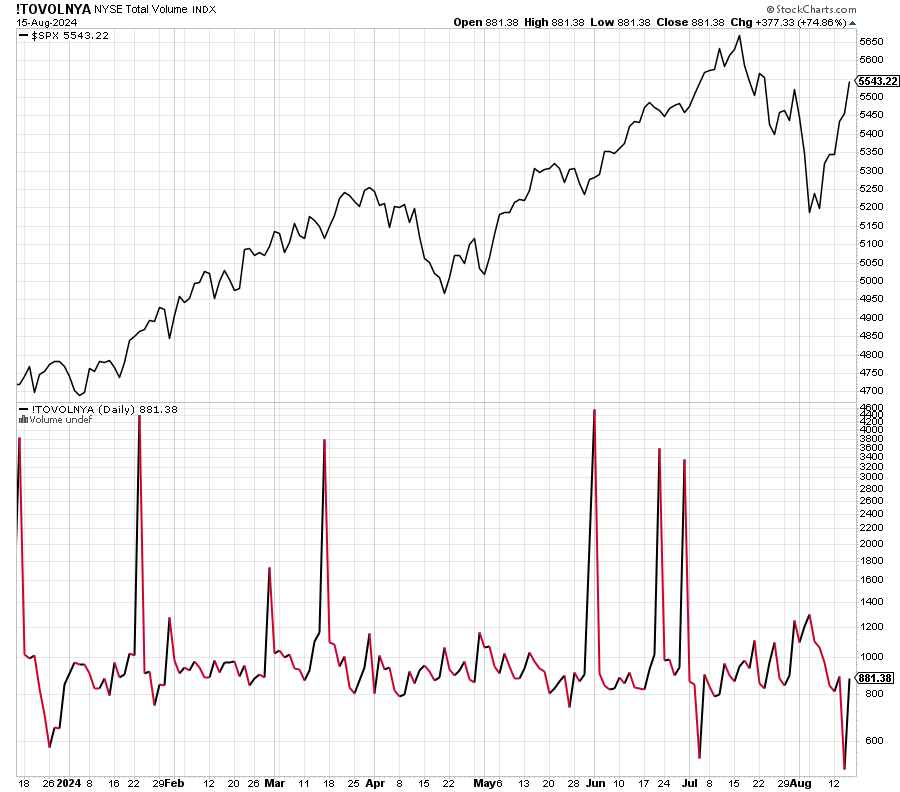

Volume on the rally as you can see in the lower chart below remains anemic. With that kind of price move I would expect volume to rise at some point. Yes. I do know that it’s August and “everyone” is in The Hamptons hobnobbing instead of working. If only history and the data supported that claim.

The Volatility Index is below. After spiking to 65 11 days ago, it has literally collapsed under 20 and is a teenager again. That behavior is highly unusual historically and seemingly bullish.

I need to do some more work on other rogue waves or earthquakes. My plan was to show 1997 and 1998 but I haven’t had the chance to get that done. Perhaps in Monday’s blog. I think we will learn something.

I finish this up from the Fast Ferry to Martha’s Vineyard as we embark on a long weekend with the family. Mother Nature doesn’t look to be cooperating, but I am not surprised. She poured water on our parade all winter.

On Wednesday we bought more levered NDX. We sold some ARKK, SOXL, RYRHX and RYAZX. On Thursday we bought EWT, EEM, FDEM, EFA and more RYFIX. We sold EPI, TLT, RYGBX, levered inverse S&P 500 and some levered NDX.