Eggs or Energy?

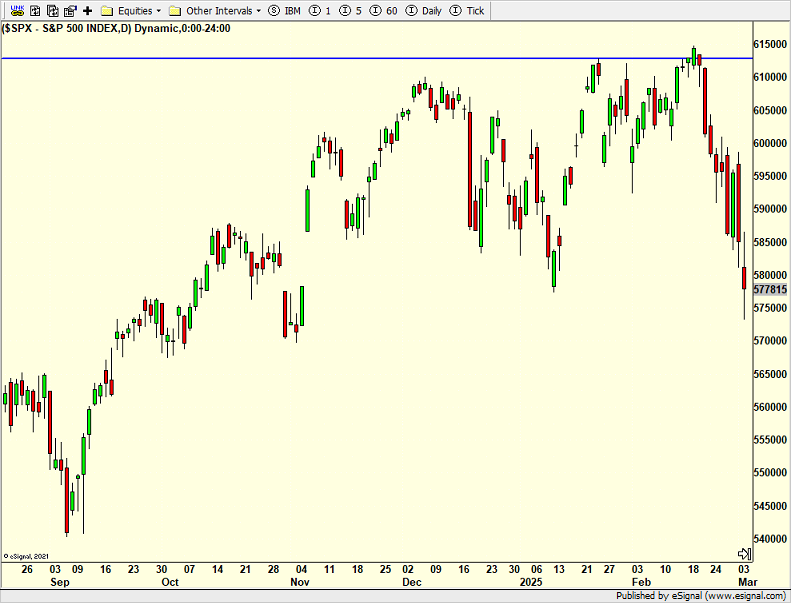

The S&P 500 is now down 6% on a closing basis and the NASDAQ 100 is down 8%. The opportunity I just wrote about on Monday evaporated quickly that day and we took action in both directions as I wasn’t willing to let small losses turn into large ones on new positions.

The magnitude of this pullback is stretching what I expected if this decline was to be the appetizer for the 7-9 week, 10%+ correction I saw coming in Q2 or Q3. More evidence is pointing to continued downside after a bounce that would satisfy my downside target of 10%. The building blocks are growing for a low, but price behaves like it needs to visit the 5500-5600 range.

I am going to record a video shortly to discuss the myriad of questions I am receiving about the tariffs, deportation and other unsettling policies.

In short I absolutely do not believe the 6% pullback is because of tariffs. The media is focused on them and there always needs to be blame assigned. Rather, as I have written, I think this is a growth scare. Look no further than granddaddy retailer, Wal-Mart, to understand my point. The company surprised the markets a few weeks ago.

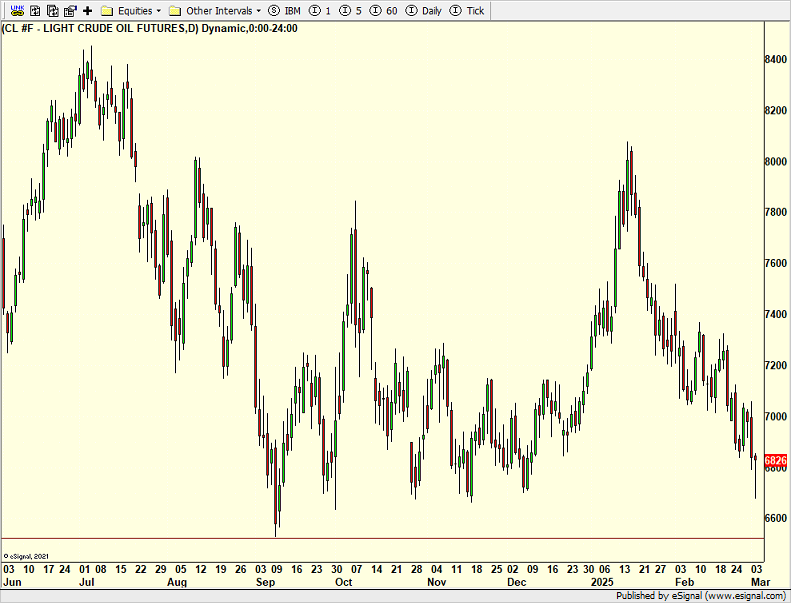

And with that, the markets finally accepted my thesis that inflation is basically dead as the year goes on. Sure, people are absurdly fixated on single product price spikes, like eggs. Look at energy. Do Americans spend more on eggs or energy? I know I don’t know much. But I do know that we can all substitute for eggs temporarily. We cannot do that with energy so easily.

Crude oil is below. No one on earth can argue that the price collapse is inflationary. Growth is slowing. The Fed needs to resume rate cuts on the 19th. I doubt they will.

On Monday we sold SG, some XMMO, some CHWY and some BRK.B. On Tuesday we bought GDX, GDXJ, more FDN and more AIOT. We sold some JNJ and some PEP.