Fed Delivers – Markets Too – Rally Broadens

Fed cuts. Check. Stocks rally post-2pm. Check. New closing highs in the major indices. Mixed.

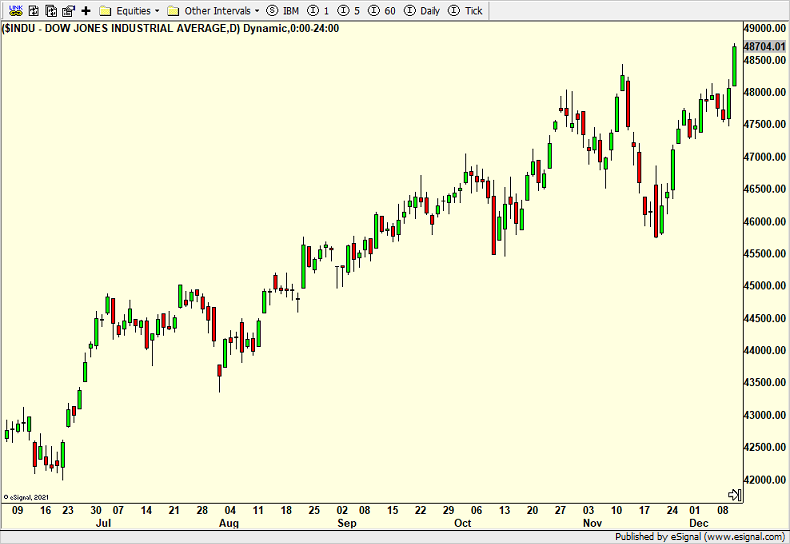

The Dow Industrials hit new highs.

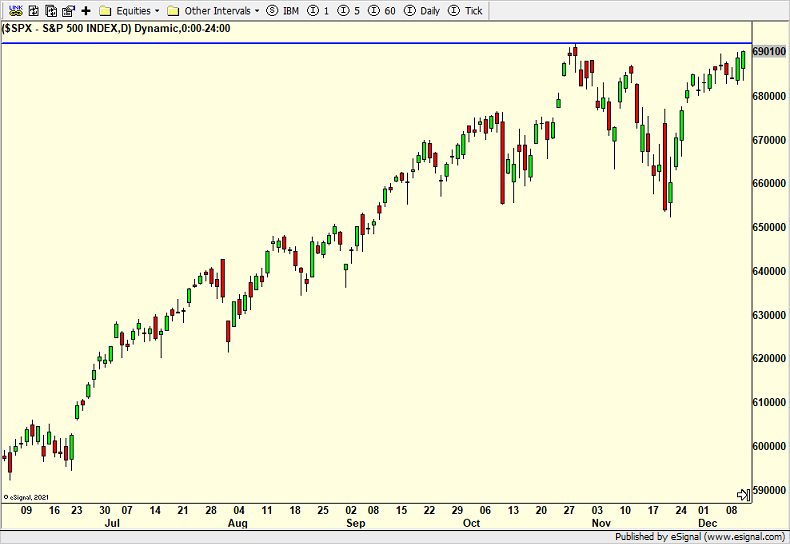

The S&P 500 hit a new closing high but not a new intra-day high.

The S&P 400 hit a new closing high but not a fresh intra-day high.

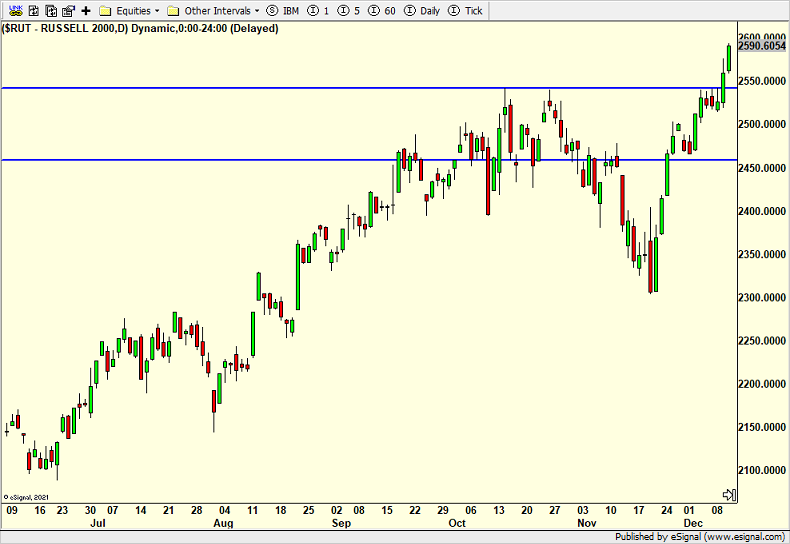

The Russell 2000 scored fresh highs on both counts.

The NASDAQ 100 failed so far which is an area of concern. The sexy, loved and over-owned AI stocks are being sold and punished. I do not want to see that index close below this week’s low. I do think the index and the AI stocks will offer another buying opportunity sooner than later although early January should see some tax related selling for a few days.

The lay of the land for the indices is solid. The rally has broadened significantly as evidenced by leadership in the S&P 400 mid caps and Russell 2000 small caps. Look below at the S&P 500 against the equal-weighted S&P. The equal weighted ETF is finally leading which means a broadening of the rally. The zillion dollar question is if this is yet another bounce that leads to more downside or the start of something brand new as I thought about the small caps in April. It is also a funky time of year with tax loss selling ending, window dressing of portfolios and a lack of catalysts for large moves. The market will tell us shortly.

This polar vortex in New England is real and really cold. But it’s also making for great skiing. After the UCONN game in Hartford, I am going to drag myself up north to ski tomorrow and then race back for a dinner with friends that we purchased at a charity auction. Hanukah starts on Sunday so Happy Hanukah to all those who celebrate!

On Wednesday we bought ARKK, more QLD and more IHI. We sold SSO.