Fed Has Cover For Rates Cuts But Inflation Not Giving Up

Today is FOMC statement day when their two-day meeting ends and Jay Powell gives his press conference after a statement is released keeping interest rates where they are, commenting on inflation and then letting everyone know that rate cuts are on the way later than sooner.

The stock market model for the day is plus or minus 0.50% until 2pm and then a big move or two.

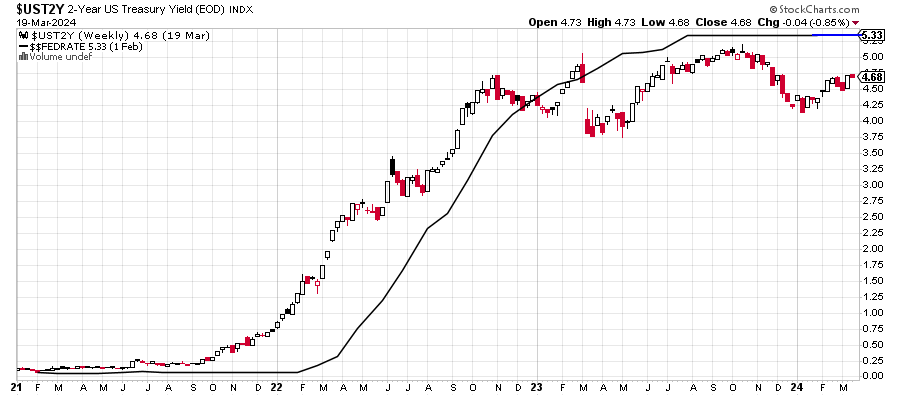

Since the outlier banking issues in March 2023, I have said that the landscape for interest rates has changed. That was the time when the 2-Year Note made a new high and reversed to close lower while breaking underneath the Fed Funds Rate which you can see below. I thought that was the clearest sign that the Fed rate hike cycle was coming to an end over the ensuing months.

The casual observer can see that the 2-Year has remained below the Fed Funds for the past year, meaning that the Fed not only finally caught up with the market, but overshot a bit.

While I thought the pundits were cognitively impaired when they were calling for 6-7 interest rate cuts in 2024, they somehow seem to have amnesia now. The masses have reduced their forecasts to 3-4 cuts. The market is now looking for 2-3 cuts which is where I was three months ago with the risk being less unless there was some extraneous shock to the system.

As I mentioned on Fox Business with Charles Payne last week, I think 3% inflation is the new 2%. That last 1% decline in inflation isn’t likely to happen without recession, just like the real estate market and mortgage rates will not get reset without recession. And neither will the jobs market. While I never root for recession and I am not now nor ever will, the financial system will not be fully repaired (a stretch) until recession hits and people get punished and feel pain.

Just watch the market and how it reacts to news. Remember, the most important thing is how markets react to news, not what the actual news is.

On Monday we bought more levered NDX. We sold TUR, ITB and some SSO. On Tuesday we bought EPOL, DWAS, XRT and more EPI and ARCH. We sold RYAZX.