Fed Rate Cut Next Move – Bears Remain Embarrassingly Wrong

Let’s start with the model for the day. The S&P 500 is most likely to be plus or minus 0.50% until 2pm and then rally. However, because the stock market has rallied sharply into Fed day and closed so strongly on Tuesday, the post-2pm strength has been muted away to a coin flip. Post-Fed Day, stocks are supposed to pause or pull back very mildly before another assault higher. So, as we have done all year, continue to buy weakness. Again, these conclusions are based on data and not my opinion.

Turning to the meeting, Jay Powell et al are obviously not going to take any action today. And I would be super surprised if he indicated any substantive changes in his statement. For sure, he won’t be discussing a rate cut which I still view as premature.

Let’s not forget that the Fed was woefully wrong when the inflation genie got out of the bottle in Q3 2020. As I wrote during the second half of 2020, the Fed should have started jawboning the markets about a rate hike and then hike rates by 0.25% at every other meeting to gently warm the markets to higher rates.

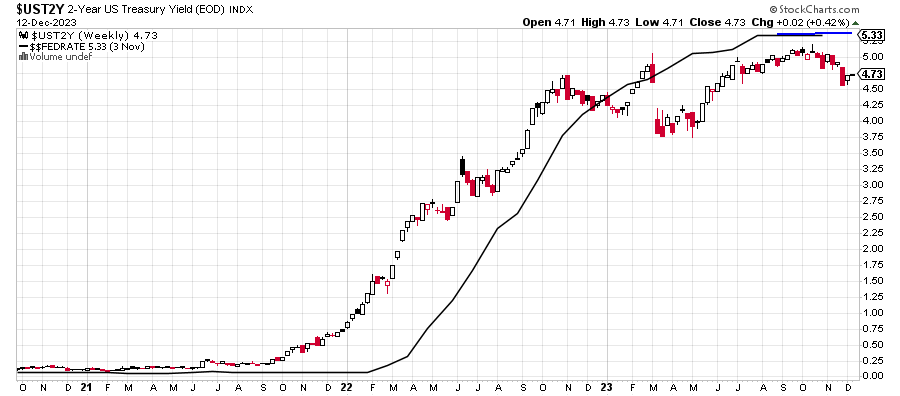

Regarding interest rates, let’s take a look at my favorite Fed chart which I always show around Fed meetings. The original concept courtesy of my friend, Tom McClellan, of McClellan Oscillator fame.

The solid line below is the Fed Funds Rate (FFR) which is the only interest rate the Federal Reserve controls in the public domain. It is currently 5.25%-5.50%. The other line is that of the 2-Year Treasury Note. The 2-Year has historically done a better job of controlling rates than the Fed. When it is well above the FFR, the Fed should be raising rates. And the opposite is also true. When the 2-Year crosses above or below the FFR after being on one side for an extended period, it says that the current rate cycle is long in the tooth and coming to the end.

We can see that as 2023 began, the FFR and the 2-Year were pretty much in equilibrium. After the little banking issues in March, the 2-Year has remained below the FFR, now by 0.50%. If you recall, my thesis for most of 2023 has been that these two lines would be close together with less Fed involvement as the rate hikes filtered through the economy. I thought it was preposterous that pundits were predicting multiple rate cuts in 2023. I just wanted the Fed to stop and leave everything alone for a while.

The casual observer might now ask why I am not advocating for a rate cut when the 2-Year is 0.50% below the FFR. While we are getting closer to lower rates, I still believe that a neutral stance is warranted and certainly until the 2-Year is under 4.50%. I also think that Powell & Company will do what they have said and stay higher for longer to not allow another bout of inflation to begin. I also think they are okay risking the downside in the economy.

Market-wise, y’all know where I stand. I was the biggest bull heading in to 2023, labeling it the Year of the Bull. I saw a summer peak for stocks and a Q3, mid-single digit pullback with three bottoms in August, September and October. That early Q4 action gave me pause for sure. I scratched my head a few times. But the bulls came back with avengeance and squeezed the bears unmercifully. What fun it has been as some of the major indices have already scored new highs for 2023 and even new 52-week highs. I see all-time highs in Q1 2024.

Some folks have observed that sentiment has become a bit giddy and stocks look a little tired. I can’t argue with that. With two plus weeks to year-end, that’s a good deal of time to remain in that state without a pause. And some post-fed trends point in the pause or mild pullback direction. However, let me reiterate that countless portfolio managers came into the year very defensive and fought the bull market the entire way up. Heck, some wrong way Willies doubled and tripled down in March and October.

And now the great portfolio performance chase is on to year-end which is why pullbacks haven’t lasted for more than a day. A great many people I speak with are and have been stuck. I believe their jobs are at stake come 2024 when they have little to show for themselves and no one will want to hear the “BUT BUT BUT, it’s only 7 stocks”.

It has been enjoyable to watch all the bears hate and disavow the new bull market all the way up. First, they said the economy was in recession and stocks would fall. Then they said that inflation wouldn’t come down and stocks would fall. Then rates were way too high and stocks would fall. Today, they are back to recession talk. Meanwhile, the S&P 500 is up 30% since the bull market began.

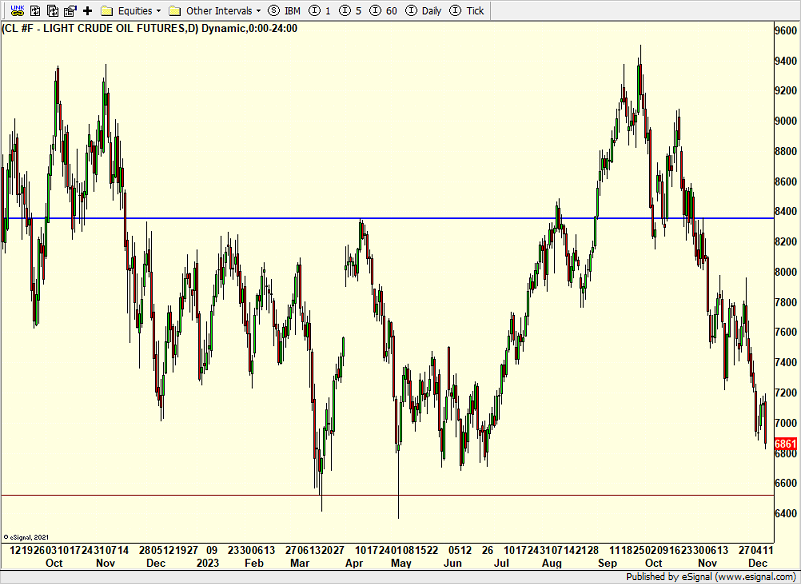

Finally, for those who usually ask, let’s look at the three musketeers of inflation where only the dollar has bounced so far. The 10-Year and crude oil remain under wraps.

On Monday we bought GDX. We sold EMB and some levered NDX. On Tuesday we bought TYL, EMB, levered inverse S&P 500 and more ERX. We sold GDX.