***Fed Rate Hike Cycle Over – Early Signs of Recession Growing***

Let’s start this Fed update with the trends. The model for the day should be familiar by now. Look for the stock market to be plus or minus 0.50% until 2pm and then a big move. Had stocks not rallied smartly over the past two days, it would have been one of those rare, all in days where the trend’s accuracy is over 90%. Still, the post-2pm move favors the bulls into the close.

The FOMC is not going to raise interest rates at 2pm today. In fact there is a high likelihood that the long, sharp and aggressive rate hike cycle is now over. Chair Jay Powell will not be telling us that in his statement or his press conference, but market participants certainly feel that way. My guess is that they will label this another “pause” while offering some hawkish statements. After all, they are caught up in the string GDP report and labor market.

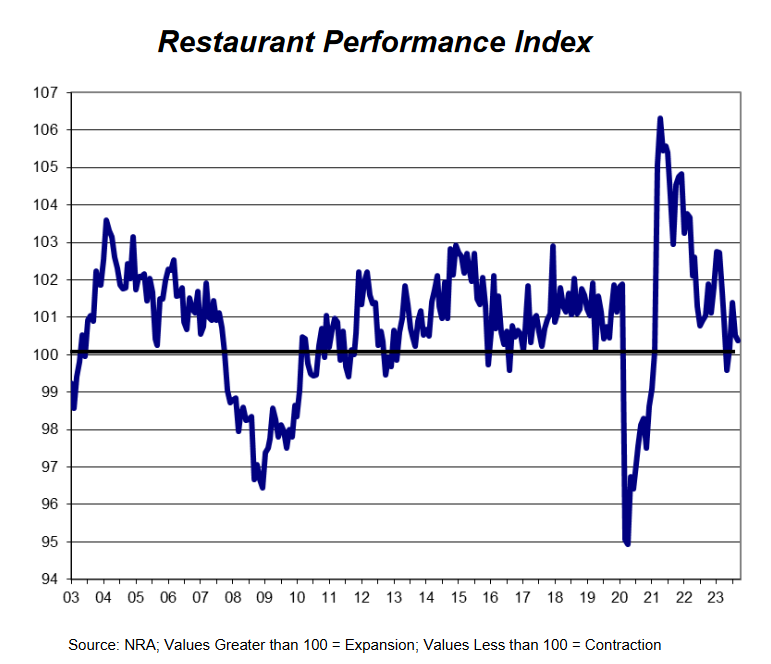

Below is a somewhat esoteric indicator I often quote when I think recession is on the horizon. As with many other indicators, COVID really screwed it up. Dining out is one of those things that is considered a luxury and one of the first things to cut during a belt tightening phase. You can see how the index completely collapsed in Q2 and Q2 2020 and went vertical through 2021 as the economy shut down and then the government flooded the system with free money and vaccines.

On the far right of the chart you can see that the index slightly rebounded but is close to the 100 level of being neutral. Below 100 is usually where recessions or strains on the consumer occur. I expect to see this indicator fall below 100 in early 2024.

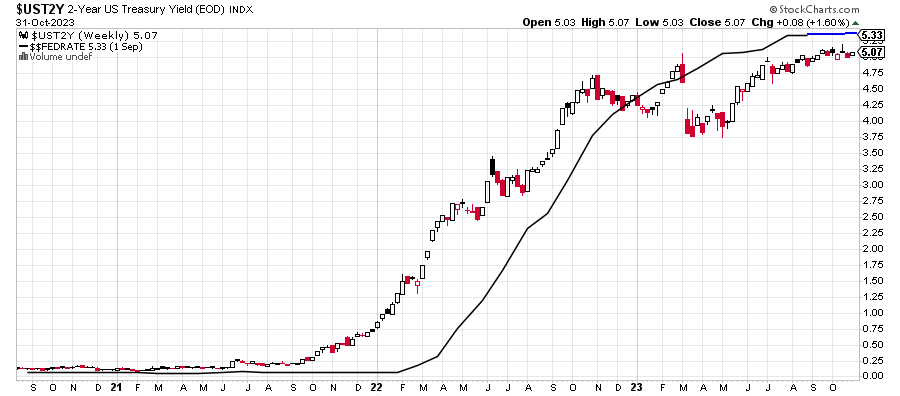

Next is my favorite Fed indicator (h/t Tom McClellan), showing the 2-Year Note against the Fed Funds Rate. Remember, the Fed usually follows the market. The market does not usually follow the Fed. The 2-Year was going up, up, up in 2021 and 2022 when the Fed was woefully behind the curve. After the banking issue in March, the 2-Year fell beneath the Fed and has been there ever since. The 2-Year thinks the Fed should go to neutral for a while. I am waiting for the 2-Year to recede which is probably a Q1 2024 story.

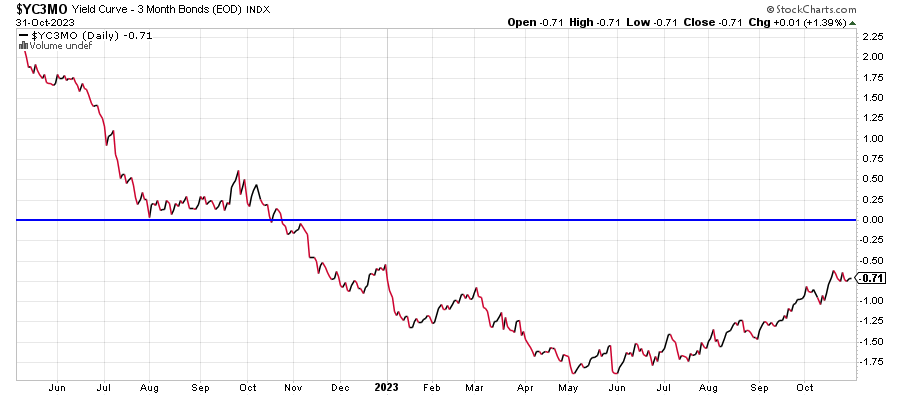

Finally, here is one yield curve and one of my favorites. It is simply the 10-Year minus the 90-Day interest rate. In the best of times the line is increasing higher and higher from lower left to upper right. When it is falling the other way and below zero, it’s “Houston, we have a problem”. That’s an inversion and a great predictor of recession. You can see below that this yield curve has been negative for the past year. Other yield curves like the 10-Year and 2-Year have been negative even longer.

Recession is coming, but this is not a timely predictor. I will become more concerned when the line below zero gets back to zero or above zero. That indicates clear and present economic danger. Stand by in 2024. Auto loan delinquencies are rising. Credit card debt topped $1 trillion for the first time ever. The savings rate is falling. Interest rates and cramping consumer lifestyles and inflation may be decelerating, but it’s still challenging and very noticeable.

On Monday we bought SSO and levered inverse S&P 500. On Tuesday we bought more SOXL and more levered NDX.