Fed Stands Pat – Stocks Should Rally

It’s Fed day and an uneventful one at that. Interest rates will not be going up today. That’s what everyone expects and what we will hear at 2pm. Before that the model says plus or minus 0.50% in the stock market and then the usual bigger moves after the Fed news breaks. With the recent weakness, the model says the bulls have the upper hand today.

I also do not think the Fed will say anything about a pause for more than this one meeting. They are not going to pivot to neutral and they certainly aren’t going to take a victory lap on killing inflation which I have said looks to be bottoming. But remember, they have an enormous amount of damage over the past two years and much of their rate hikes are just starting to hit an economy dealing with a major auto strike, the highest mortgages rates this century and a record amount of credit card debt that will eventually turn to higher delinquencies.

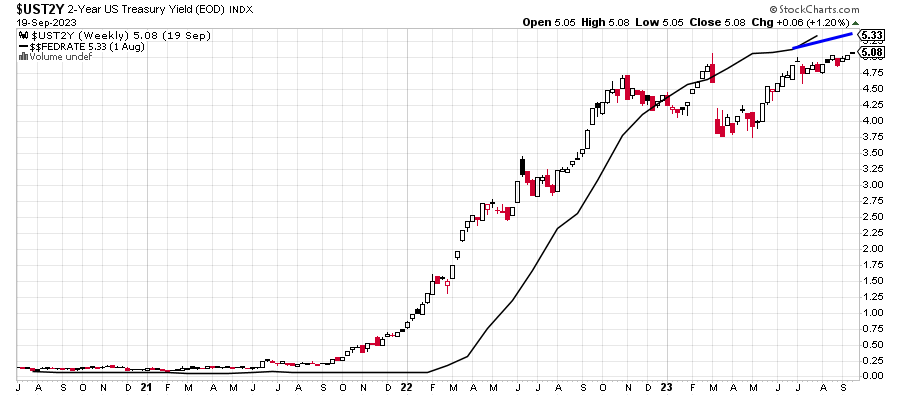

Below is my favorite chart for Fed day. You can see the 2-Year Note in black, white and red alongside the Fed Funds Rate which is the solid line. The 2-Year Note is what the Fed most closely follows and what the market sets. For most of 2023 the 2-Year has been below Fed Funds. That tells us the market no longer views the Fed as behind the rate rise curve. Because the two rates are so close together, I view this as somewhat equilibrium with the nod going slightly to the market that the Fed has gone too far.

The rate hike cycle is kicking and screaming but at the end. However, even when the Fed moves to neutral, I do not believe any quick rate cuts are close unless the stock market collapses. Rather, a hawkishly neutral Fed is the most likely next regime.

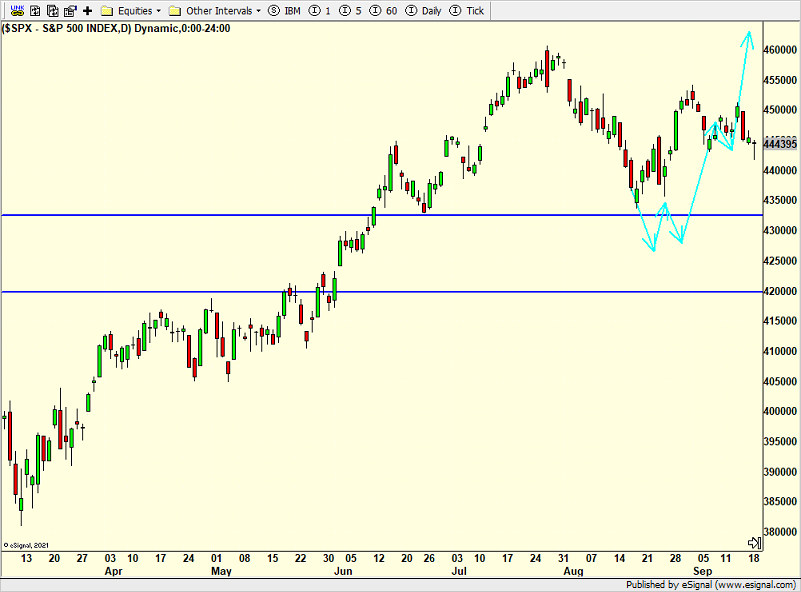

The stock market has sold off into the Fed meeting. While I would have liked a weaker close, the trend says that it is supposed to rally today and perhaps a little further. As you from other posts, this is at odds with the seasonals which show this week is the weakest week in the weakest month. They never make it easy. The market continues to be in pullback mode with the lines in the sand clearly drawn by the August highs and September lows. In between as we have been in almost all month, it’s just a big chop fest.

On Monday we bought more levered NDX. On Tuesday we sold NUGT, mid cap value, some URA and some QDEF.