Fed to Hike by 1/4% – Balance Sheet Balloons Again!

Today, the FOMC (Fed) concludes their regularly scheduled two-day meeting. And for the first time in years, there are two outcomes being discussed by market participants which makes today all the more interesting.

The stock market model for the day is plus or minus 0.50% and then a rally into the close post-2pm. However, we should realize that the stock market has rallied smartly into the announcement, taking some firepower away. In my view what usually is an 80% certainty has been reduced to a coin flip. Furthermore, I do not see the potential upside magnitude for today that I did last week.

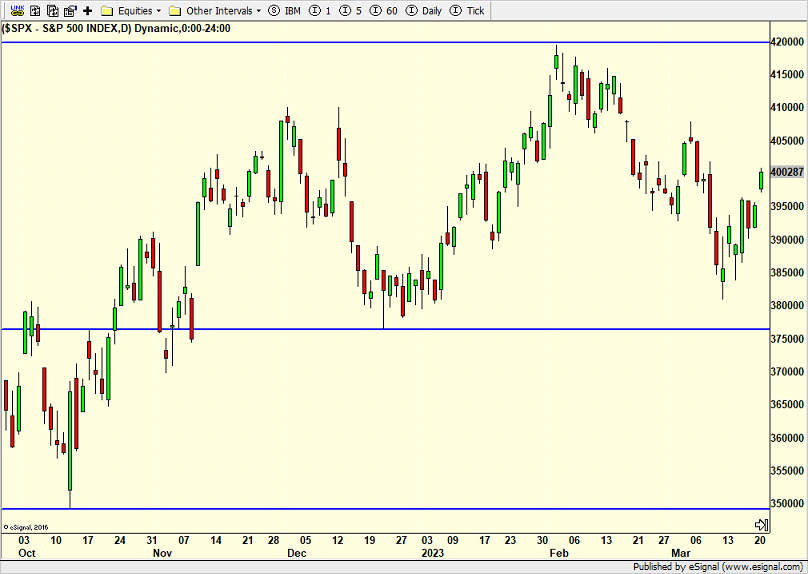

While I hate to be part of the masses, the truth is that the stock market is mired in a trading range. The S&P 500 above epitomizes it while the NASDAQ 100 is stronger and leading. The S&P 400 and Russell 2000 are weaker and trailing. We want to see the S&P 500 and NASDAQ 100 score new highs for 2023. The rest will take some time. I don’t like to see the more “risk on” indices lagging so badly, but it makes sense given their need for capital and the banking issues.

Regarding the Fed’s action today, I am firmly in the 1/4% rate hike camp. While I have argued that rate hikes should have paused already, I think Powell and Company will hike today and leave open the possibility for one more in May before pivoting to neutral. I think not following through today will cause investors to worry that the banking situation is far worse than currently priced, a situation exacerbated by the Fed’s incompetence.

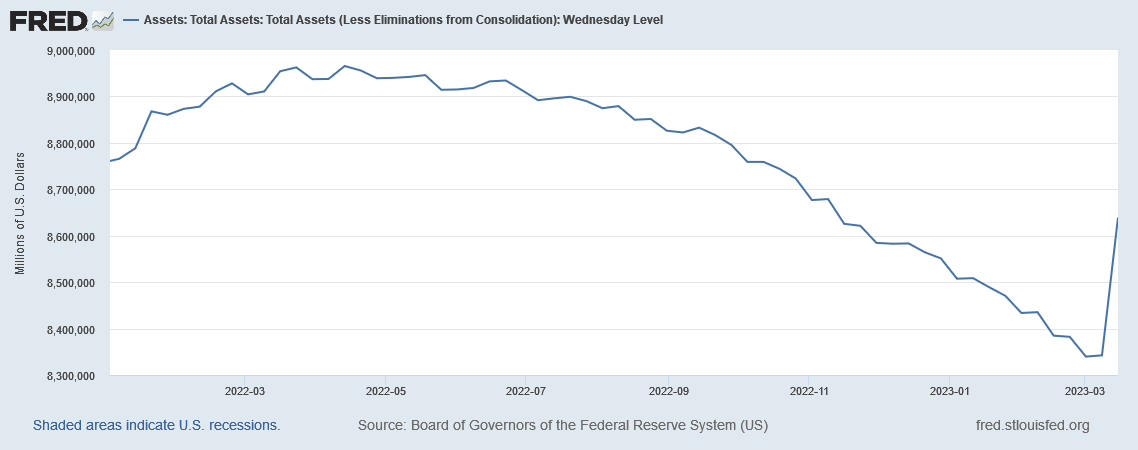

I have read and heard lots of nonsense regarding the chart below, the Fed’s balance sheet. Specifically, the far right of the chart. As everyone knows, the Fed has been selling assets from its balance sheet for the past year. An almost $9 trillion balance sheet was absurdly insane.

Down roughly $600 billion you can see a surge in assets on the far right. Contrary to the uninformed, the Fed was not starting the printing presses and another round of quantitative easing. Rather, banks have used the discount window on an emergency basis to borrow from the Fed. In other words, banks want to ensure they can meet the cash needs of depositors and stave off a bank run.

I have already written several time regarding the bank runs at Silicon Valley and Signature. Between crypto and bad decisions, these were outlier cases and not the norm. Nonetheless, they exposed the system to a new kind of bank run where depositors don’t line up at branches, but rather electronically in an instant. The system isn’t designed to combat this, but rules and regulations will certainly change in the coming weeks and months.

I think most people do not understand the actual FDIC rules regarding insured deposits. It is not clear and easy to understand. I had to read the FDIC website and parse through. Please feel free to reach out to me directly if I can help you understand your exposure.

Furthermore, cavalierly raising the insured limit from $250,000 to $500,000 or $1M or higher sounds easier said than done. But some entity has to actually pay for that insurance which means the banks. And don’t think for a second that they wouldn’t pass through at least some of that cost in higher or added fees to customers.

Others have argued for a tiered system where all deposits are not treated equally. Perhaps a checking account is different from a payroll account which is different from a CD account. Do we have too many small banks? Lots of things to consider. I have high conviction that the Fed and Treasury will not let this problem spread throughout the system. No way.

While there won’t be an clear sign, like white smoke at the Vatican signaling a new Pope, you can simply watch the regional bank ETF, KRE. If and when that instrument gets back into the mid $50s from it’s current price of $46, volatility should have calmed and the meat of the crisis behind us.

On Monday we bought DIA and levered inverse S&P 500. We sold EMB. On Tuesday we bought BMRN. We sold ENSG, SRPT and levered inverse S&P 500.