Fed to Stand Pat – Still Operating on Powell’s Dramatic Change

What to Expect Today

The Federal Open Market Committee (FOMC) is going to do absolutely nothing today at 2:00pm regarding interest rates. The market is expecting nothing and nothing it will get. Any other action would be a total and complete shocker. In fact, at this point, the market isn’t pricing in any FOMC action until the very end of 2020 where a rate cut is expected. Keep in mind that market expectations even a quarter out don’t amount to much, let alone a full year out.

With stocks so close to all-time highs, this continues to be reminiscent of 1995 when the Fed came from an overly restrictive monetary policy in 1994 to realizing they screwed up and quickly played catch up. Stocks had long understood and priced this in with 1995 being one of the all-time great investing years in modern history.

Right after the Fed announces their decision,the usual parsing of every single word and change from the last statement on October 30 will take place. In this regard, I do not expect much in the way of market moving news.

Invoking Paul Volcker

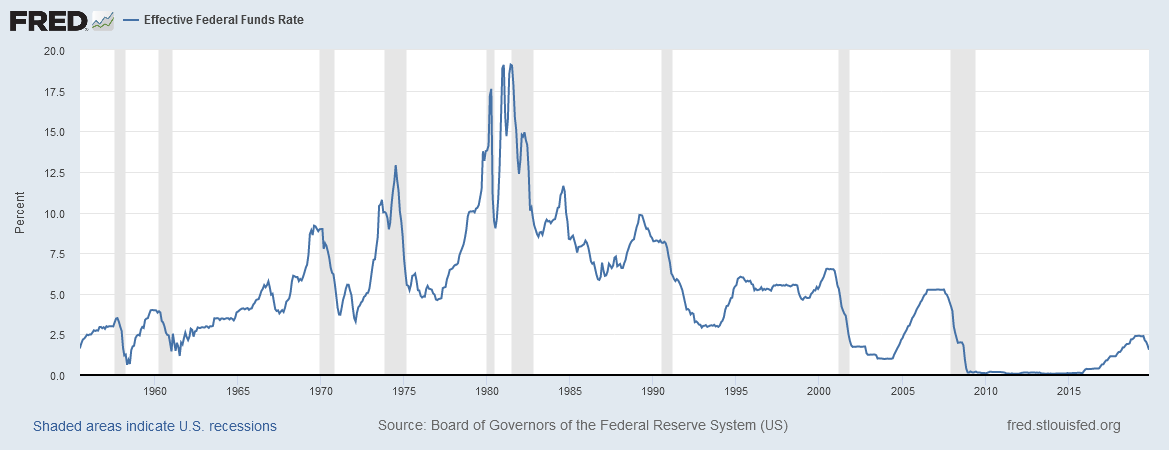

On October 30, Powell & Co. basically said that they were not going to raise rates again until inflation at least met their 2% target. Moreover, they opened the door for inflation to exceed their target before they took action. In other words, the Fed is now okay with inflation running a little “hot”. How almost ironic that in the period that the FOMC not only begs for inflation, but wants it “hot”, former Fed Chair Paul Volcker passes away. Many will remember Volcker as the Fed savior in the 1980s who kept raising and raising interest rates to combat what had been very troublesome inflation. Some will remember those W.I.N. buttons which stood for Whip Inflation Now. Short-term interest rates rose to almost 20%. I personally remember money market rates in the teens as I first invested my bar mitzvah gifts before moving to stocks. You can look at the chart below to see the history of short-term interest rates controlled by the Fed.

I remember my grandfather buying a lot of triple tax free New York City municipal bonds in the late 1970s and early 1980s which were yielding more than 25% as the city was on the verge of bankruptcy. He told the family one holiday that the United States would never, ever allow the most powerful and prominent city on earth to default. I had no idea what it meant at the time, but he was certainly right. As the years went on, he would see bond after bond be called away and/or finally mature in what he always said was the investment of a lifetime. Until he passed in 1999, he would often complain about the paltry single digit yields from newer muni bonds although he ended up buying Mobil with its fat dividend yield with some of the proceeds.

Model for the Day

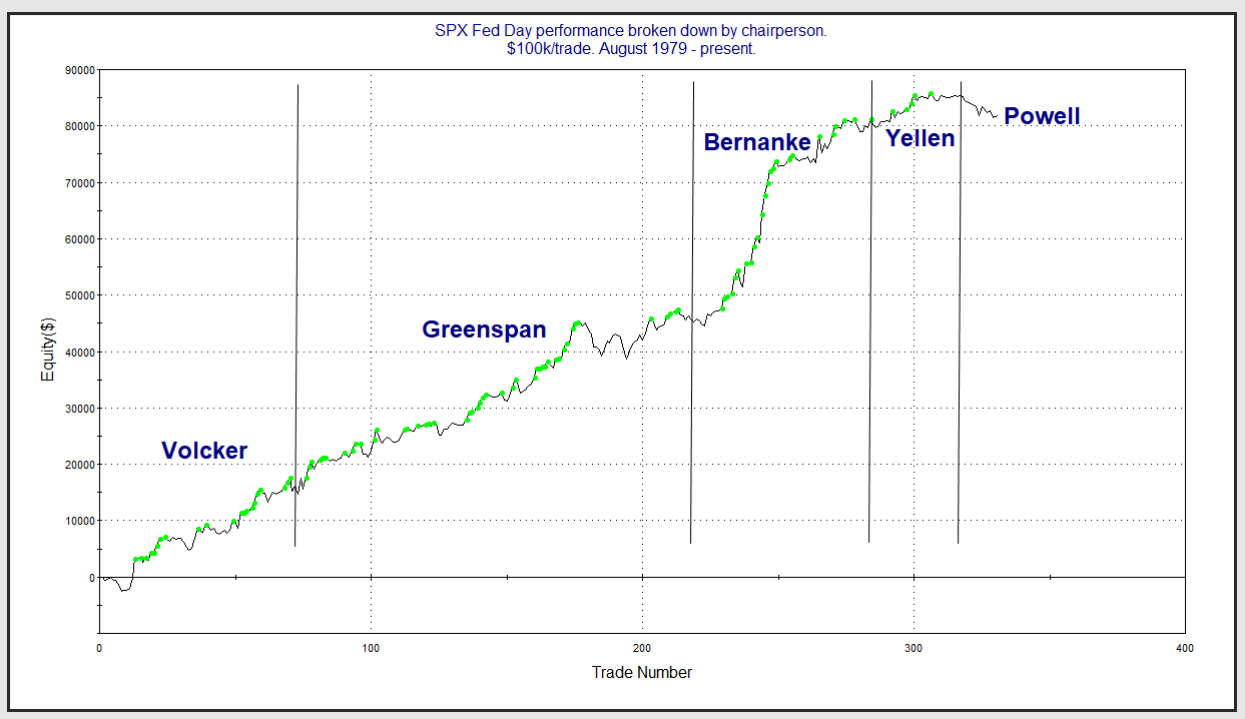

As with every Fed statement day, 90% of the time stocks stay in a plus or minus .50% range until 2pm before the fireworks take place. I fully expect that to be the case today. Besides that, there is also a strong long-term trend for stocks to close the day higher, although that is not as strong as it used to be. Additionally, with stocks near all-time highs and significant upside progress over the past month, the bulls have even less dry powder than normal, not to mention how poorly stocks have done under Jay Powell on Fed day. In his short tenure as Fed chair, Powell already has the weakest stock market performance of any Fed chair in history on Fed day although stocks did rally on October 30th.

Below is a wonderful chart courtesy of the great Rob Hanna from Quantifiable Edges @quantedges which shows just Fed day stock market performance by Fed Chair. While Powell’s tenure is young, it is not enviable for the bulls.

Countdown to a Trump Tweet

It’s certainly no secret that the President isn’t the biggest fan of Jay Powell, even though Donald Trump appointed Powell as Fed chief. Trump has been as misguided as Powell when it comes to interest rates. The President has been publicly trying to shame the Fed into copying the failing and disastrous European model for negative interest rates, something I hope and pray never, ever happens in the U.S. Low or negative interest rates are certainly not an economic panacea.

On the other hand, whether intentional or by accident, President Trump has been ingenious in creating a natural scapegoat for any potential economic weakness before the election. If the economy strengthens over the coming quarters, Trump will certainly take credit for it, in spite of his perception that the Fed had been working against him. If the economy weakens from here, the President will obviously blame Powell & Company as Trump has been publicly campaigning for more aggressive action by the Fed. In either case, Trump likely wins in the court of public opinion.

The Fed – Savior of the Financial Markets

Now, you can argue that it’s not the Fed’s job to appease the financial markets and you would technically be correct. The Fed has a dual mandate from Congress. Price stability (inflation) and maximum employment. However, the Fed, for the most part, usually follows what the markets want and have priced in. I say “usually” because there have been a few times when the Fed has gone off book.

Jay Powell began his term as Fed chief by essentially saying that enough was enough and he wasn’t going to be beholden to the markets. And to his credit, he did live up to that statement all the way to January 2019 when his famous or infamous 170 degree turn took place after stocks saw that very minor decline of “only 20%” in short order. Then, much to his supporters chagrin, Jay Powell turned into Janet Yellen, Ben Bernanke and good ole Al Greenspan all wrapped up into one. He waved the white flag, much to President Trump’s delight, and declared that he was simply going to give the market what it wanted going forward. The last part is an exaggeration, but that’s effectively what he did.

Something must happen when one becomes the most powerful central banker on earth. The term “not on my watch” is taken to a new level. No one wants to be the one who kills the golden goose of a rising stock market, extended business cycle if you can even use that term anymore and general prosperity. And this all happens with the quiet understanding of “whatever it takes”. So many of us have poked fun and criticized former European Central Bank Chair Mario Draghi for essentially saying the exact same thing when it came to saving the Euro currency. At least he had the gumption to overtly state it.

The Fed doesn’t want to upset the financial markets. And that’s understandable. These markets are absolutely vital the U.S. and global economies. And despite what you may hear from Lizzie Warren and Bernie Sanders, a healthy and vibrant Wall Street community is an absolute necessity to a growing economy, even though that same group is prone to bouts of greed and bad behavior which can have a periodic and significant detrimental impact on the economy (see chapter on how the financial crisis began in 2007 and 1929).

When politicians from both sides talk about how Wall Street “wrecked” the economy, they always forget how many direct and indirect jobs were created from Wall Street’s work. The problem is that we (the U.S.) always seems to reward bad behavior and don’t punish it. And so many politicians continue to pat themselves on the back for the Dodd-Frank piece of legislation which did good by increasing capital standards but failed miserably by declaring victory that the days of Wall Street bailouts were over. Not a chance.

When push comes to shove, the political will is never there to let a Morgan Stanley or a Goldman potentially take down the economy. In real time in 2008, my thesis was that AIG should not have been saved which would have sent Goldman down with it. I thought letting more institutions be punished would have caused more short-term pain, but the free market would picked up the slack and the economy would have seen a much, much better recovery than it did. A topic for a different day.

Dual Mandate

As I already mentioned above, the fed has a dual mandate from Congress. Regardless of what President Trump believes or wants, the Fed’s instructions are from Congress. When we look at the Fed’s dual mandate, Congress essentially directs the Fed to keep inflation manageable and seek to have the country fully employed.

Right now, unemployment is at or near record lows with minority unemployment also at or near the lowest levels since records began. That is maximum employment, a point where the Fed would normally worry about a labor shortage and a spike in wages. While wages are finally rising, we are not seeing a squeeze and nothing like McDonalds paying signing bonuses like we saw years ago. With half of the Fed’s mandate pointing towards a rate hike, it’s makes me wonder.

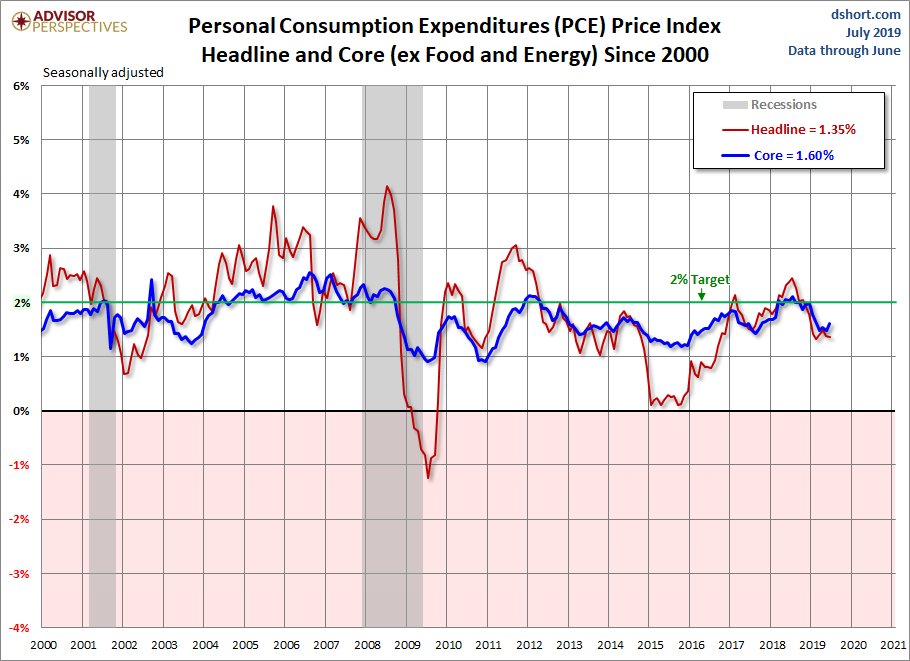

Looking at price stability (inflation), we see the same trend that has been in place for more than a decade; inflation cannot seem to get going. While many people are familiar with the Consumer Price Index, the chart below is a much better gauge and you can Google if you want more info about it. The blue line excludes food and energy and this CENTURY you can’t find a single year of 3%. The very random Fed target of 2% has barely been met since the financial crisis.