***Fed Update – Rates Going Up Today. More to Follow***

Stock Market Behavior Models for the Day

As with every Federal Open Market Committee (FOMC) statement day, there is a model for the stock market to follow pre and post announcement. Certain environments have very strong tendencies while others do not. Over the past few meetings, many of the strongest trends were muted and today looks a lot like the August 1 meeting day. I drew arrows below so you can see what the S&P 500 looked like heading into the Fed’s statement day which is today.

In both cases, stocks were just off of their highs. In August, stocks rallied and declined before beginning another leg higher. I wouldn’t be at all surprised if stocks saw a quick pullback this week followed by another rally attempt next week that ultimately fails.

As with most statement days, the model for the day calls for stocks to return plus or minus 0.50% until 2:00 PM. There is a 90% chance that occurs. If the stock market opens outside of that range which seems very unlikely today, there is a strong trend to see stocks move in the opposite direction until 2:00 PM. For example, if the Dow opens down 1%, the model says to buy at the open and hold until at least 2:00 PM. There is a strong trend in play for stocks to rally on statement day and especially after 2 PM.

Powell & Co. Set to Hike

After raising interest rates by 0.25% 6 weeks ago, Jay Powell and company will be at it again today by hiking rates another 0.25%. Markets have fully priced this in and have begun to price in another 0.25% at the last meeting of the year in December. This continues to fit perfectly within our forecast for 3.5 rates hikes in 2018 with the risk to the upside. All eyes and ears will be waiting for the Fed’s forecast of rate hikes in 2019 which now stands at two. Investors will also be parsing the statement and listening to the Powell Q& A session on the economic impact of tariffs and tax reform.

While I doubt there will be much if any mention of the Fed’s sale of assets purchased during the Quantitative Easing programs, it should be noted that the pace of sales increases next month. That’s another potential drag on liquidity in the system that may take the markets some time to adjust to.

Economically, things remain firm right now on the back of tax reform, reduced regulation and massive repatriation of corporate cash. We have strong Q2 GDP growth although Q3 will be much more challenging, record corporate profits, inflation back up in the zone and more jobs open than people to fill them. Consumer confidence and consumer sentiment are at or near record highs. Even wage growth is moving higher. Only the tariffs are holding back the economy and I think that may resolve itself favorably after the November elections.

In many ways, it doesn’t get much better than this. Reread that last sentence. That’s the one that concerns me a little bit, not so much for the next few quarters, but certainly as we get into the middle of 2019. If it can’t get much better than this, it only has one way to go although recessions do not begin with data like this. It takes time for bad behavior to permeate the system and confidence to become exuberance, but we are close!

They Just Don’t Get It

To reiterate what I have said for more than a year but a little more bluntly, the Fed is misguided, arrogant and in desperate need of help. NEVER before have they sold balance sheet holdings in the open market AND raised interest rates. In fact, I don’t think it’s ever been done in the world before. So why on earth do they believe they will so easily be successful? This grand experiment is going to end poorly and we are all going to suffer at the hands of the next recession which I stabbed in the dark as beginning between mid 2019 and mid 2020.

Yes, with banks holding $2.5 trillion on their balance sheets, the recession should be mild and look nothing like 2007-2009. And yes, this expansion will be more than 10 years old. And yes, there will be some external trigger like 9-11 or the S&L Crisis to push the economy over. This time, it could be tariffs or a European banking crisis. But the Fed will have greased the skids sufficiently for the economy to recess.

Let’s remember that the Fed was asleep at the wheel before the 1987 crash. In fact, Alan Greenspan, one of the worst Fed chairs of all-time, actually raised interest rates just before that fateful day, stepping on the throat of liquidity and turning a routine bull market correction into a 30% bear market and crash. In 1998 before Russia defaulted on her debt and Long Term Capital almost took down the entire financial system, the Fed was raising rates again. Just after the Dotcom Bubble burst in March 2000, ole Alan started hiking rates in May 2000. And let’s not even go to 2007 where Ben Bernanke whom I view as one of the greats, proclaimed that there would be no contagion from the sub prime mortgage collapse.

Yes. The Fed needs to stop.

Velocity of Money Most Important

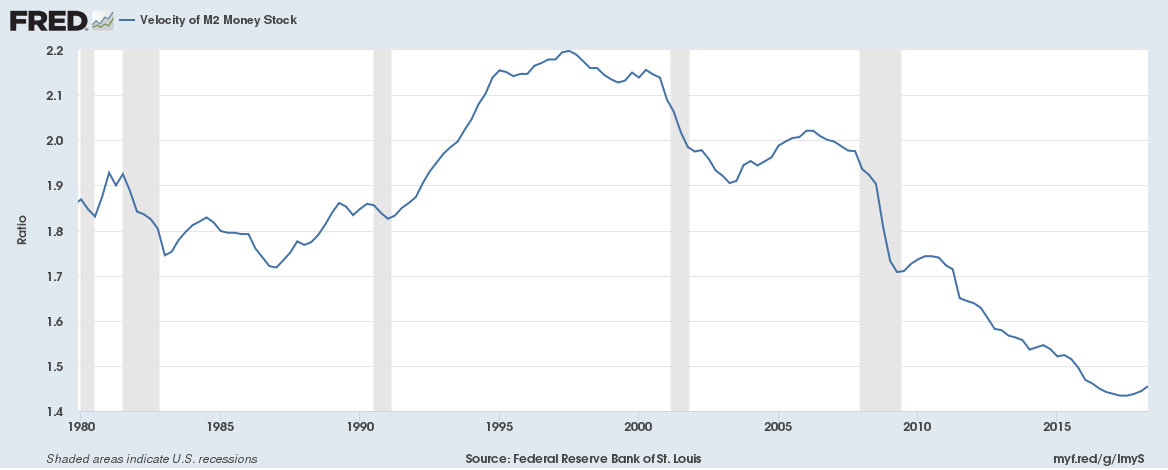

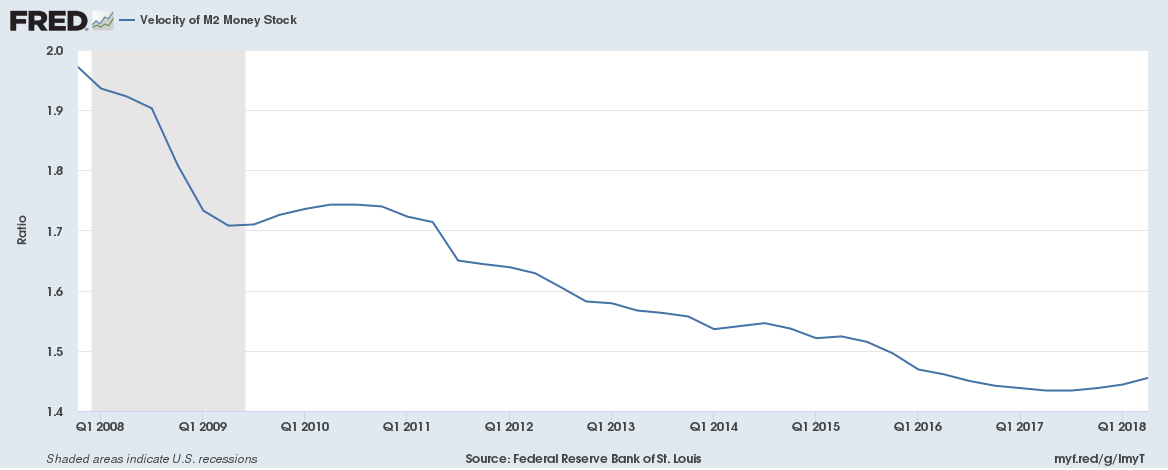

Below is a chart I have shown at least quarterly since 2008. With the exception of a brief period from mid 2009 to mid 2010, the velocity of money collapsed. It’s still too early to conclude, but it does look like it stopped going down in 2017 and might be just slightly starting to turn up as you can see on the second chart of M2V since 2008. If 2017 does turn out to be the bottom, this would also coincide with the bottom of the commodity cycle which I have discussed and should lead to a massive commodity boom over the coming decade, especially in the non-energy products.

In the easiest terms, M2V measures how many times one unit of currency is turned over a period of time in the economy. As you can see, it’s been in a disastrous bear market since 1998 which just so happens to be the year where the Internet starting becoming a real force in the economy. Although it did uptick during the housing boom as rates went up, it turned out to be just a bounce before the collapse continued right to the present.

These two charts definitely speak to some structural problems in the financial system. Money is not getting turned over and desperately needs to. The economy has been suffering for many years and will not fully recover and function normally until money velocity rallies. This is one chart the Fed should be focused on all of the time.

It would be interesting to see the impact if the Fed stopped paying banks for keeping reserves with the Fed. That could presumably force money out from the Fed and into loans or other performing assets. It continues to boggle my mind why no one called the Fed out on this and certainly not Powell so far at his quarterly press conferences.