FedEx Offering Many Market and Economic Clues

After one of the wilder stock market days on Thursday, stocks could not follow through on Friday after an up opening. While I wouldn’t say it is the end of the world, stocks absolutely, positively must hold above Thursday’s low. Otherwise, the bears take control yet again. This Friday is the expiration for October options. Seasonally, it is a strong period through Thursday’s close, so it will be telling if stocks stink it up.

What’s interesting as the new week begins is that by a geometric factor, I keep getting asked the same question about my thesis of a Q4 significant or major bottom. Nothing has changed. I am sticking by it. The markets should bottom in Q4 with October being the most likely month by a wide margin. And to repeat the most granular comment, week number two and three offer the best opportunity, historically. However, if the data change I will change and I promise to let you know. So far, the building block are there for a low and they continue to grow as pundits call for another 20%+ lower.

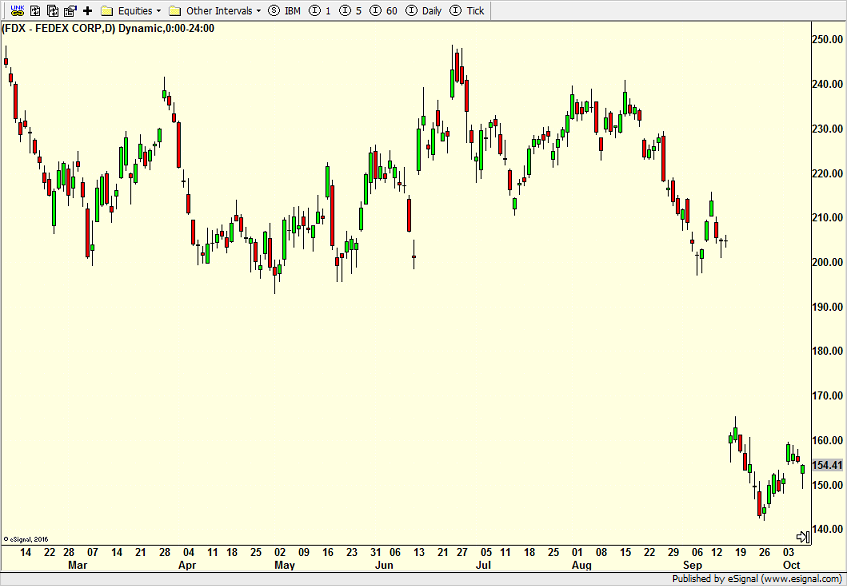

I don’t often devote a full blog to one stock, but today I will. One of the really key bellwether stocks in the market is FedEx which you can see below. The stock is certainly forecasting weak economic growth or outright recession.

On the right side of the chart below there is a very large price gap lower when they pre-announced bad news, both for the company and for the economy. Two Fridays ago they announced more weak news but in a poor market, the stock closed at the high of the day.

Then FedEx announced they were no longer giving monthly updates. This is so interesting. During less volatile times, they can’t wait to offer economic updates. They fancy themselves as doing a great service to investors. Now that times are much more challenging, they bail. Anyone sense anything?

Jason Goepfert from Sentimentrader.com tweeted that the last time FedEx did this was March 18, 2020. Stocks bottomed a few days later on March 23. Things that make you go “hmmmmmm”.

On Friday we sold some levered NDX.