Stock Market Behavior Models for the Day

As with every Federal Open Market Committee (FOMC) statement day, there is a model for the stock market to follow pre and post announcement. Certain environments have very strong tendencies while others do not. Over the past few meetings, many of the strongest trends immediately before and after were muted except for a moderate post FOMC trend last meeting which called for mild weakness.The S&P 500 gained fractionally over that period.

Today, as with most statement days, the first model calls for stocks to return plus or minus 0.50% until 2:00 PM. There is a 90% chance that occurs. If the stock market opens outside of that range, there is a strong trend to see stocks move in the opposite direction until 2:00 PM. For example, if the Dow opens down 1%, the model says to buy at the open and hold until at least 2:00 PM.

The next model calls for stocks to close higher today and rally after 2:00 PM. That is usually a very strong trend, 80%+, however with the Dow sitting at all-time highs with barely a hiccup in four months, the bulls exhausted a lot of energy, similar to what we saw at the last two Fed meeting 6 and 12 weeks ago. That trend’s power has been muted significantly to less than 50% which is not exactly the kind of trend worth trading.

Finally, assuming stocks close higher today, there is a trend setting up for a post statement day decline, although the seasonal strength of December puts a little damper on that.

Rate Hike Certain & Balance Sheet Reduction Update

Janet Yellen & Company are certain to raise the Federal Funds Rate by .25% today. It’s the worst kept secret and the markets are fully prepared. I also expect an update on the Fed’s progress in trimming its $4 trillion balance sheet although I do not believe they will make any changes.

All the Wrong Moves for Yellen & Co.

Remember the Tom Cruise movie, “All the Right Moves”? It was a football movie set in steel country PA with Cruise having to make a number of life decisions. Well, if the Fed’s plan was a movie, I would title it “All the Wrong Moves”. Their academic arrogance has sprung up again and it will not end well for our economy.

I want to stop for a moment and rehash an old, but still troubling theme. I am absolutely against the Fed hiking interest rates AND reducing the size of its balance sheet at the same time. It’s an unprecedented experiment and the Fed doesn’t have a good track record in this department. Pick one or the other. Stop worrying about ammunition for the next crisis. Given that the Fed has induced or accelerated almost every single recession of the modern era, I have no doubt that the recession coming in late 2018 or 2019 will certainly have the Fed’s fingerprints on it with their too tight monetary policy experiment.

Let’s remember that the Fed was asleep at the wheel before the 1987 crash. In fact, Alan Greenspan, one of the worst Fed chairs of all-time, actually raised interest rates just before that fateful day. In 1998 before Russia defaulted on her debt and Long Term Capital almost took down the entire financial system, the Fed was raising rates again. Just after the Dotcom Bubble burst in March 2000, ole Alan started hiking rates in May 2000. And let’s not even go to 2007 where Ben Bernanke whom I view as one of the greats, proclaimed that there would be no contagion from the sub prime mortgage collapse.

Yes. The Fed needs to stop.

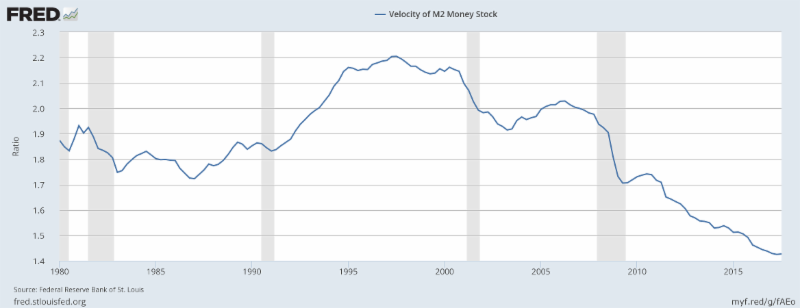

Velocity of Money Still Collapsing

Below is a chart I have shown at least quarterly since 2008. With the exception of a brief period from mid 2009 to mid 2010, the velocity of money was, is and will continue collapsing. In the easiest terms, M2V measures how many times one unit of currency is turned over a period of time in the economy. As you can see, it’s been in a disastrous bear market since 1998 which just so happens to be the year where the Internet starting becoming a real force in the economy. Although it did uptick during the housing boom as rates went up, it turned out to be just a bounce before the collapse continued right to the present.

This single chart definitely speaks to some structural problems in the financial system. Money is not getting turned over and desperately needs to. The economy has been suffering for many years and will not fully recover and function normally until money velocity rallies. Without this chart turning up, I do not believe the Fed will sustainable inflation at 2% or above.

It would be interesting to see the impact if the Fed stopped paying banks for keeping reserves with the Fed. That could presumably force money out from the Fed and into loans or other performing assets. It continues to boggle my mind why no one calls the Fed out on this and certainly not Yellen at her quarterly press conference. Being her last presser today, let’s hope that someone in the media steps up!

If you would like to be notified by email when a new post is made here, please sign up HERE