For All The Negative Fanfare, Stocks Remain a Whisker From ATHs

Let’s take a step back and get away from the media’s hyperbole and hysteria regarding the two inflation reports last week. Essentially consumer prices were a little hotter and producer prices were a little cooler. That’s really it in a nutshell. The market was pricing in up to 7 rates cuts in 2024 which I have viewed as insanely absurd. As I mentioned on FOX61 the other day, if the Fed has to cut anywhere near 7 times, we will an economic catastrophe that warrants that. I would bet heavily on the under folks.

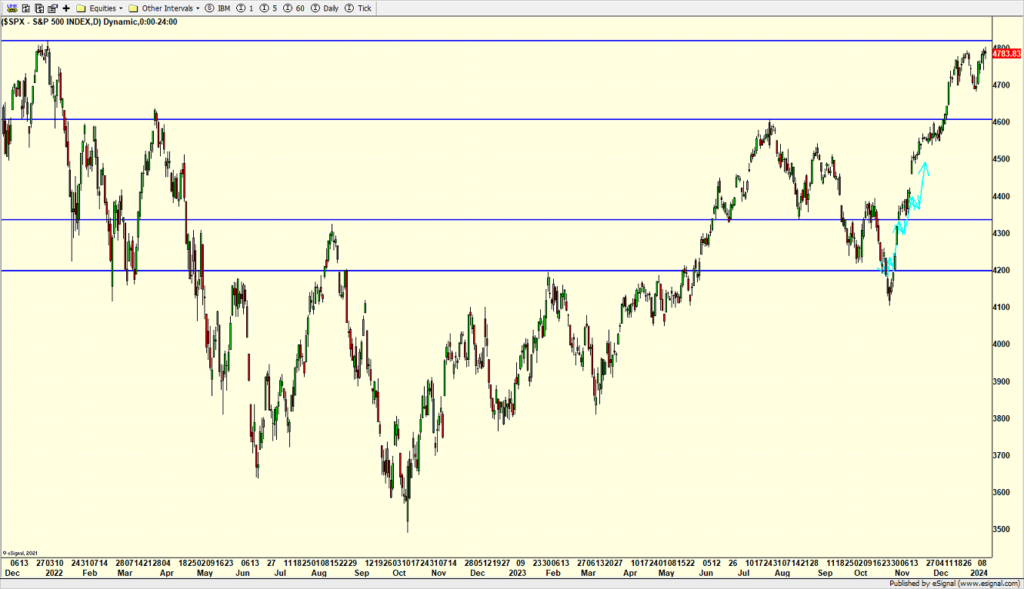

And for all the fire and brimstone the S&P 500 remains just one good day away from new, all-time highs. That’s it. Santa Claus may not have called and the first 5 days of the year were down, but the bulls continue to hang in and perhaps work towards the mid-January peak scenario I have been watching.

Earnings season has begun with the high profile banks starting to report last week. So far, it has been mixed with JP Morgan, Citi, Wells and Bank of America. After this pullback ends, I expect banks and financials to see another significant rally.

Here we go again. After some beautiful snow a week ago, Mother Nature delivered some precipitation of the non-frozen variety with more on the way along with major winds. A big sigh in eastern ski country. At least we have 6 NFL playoff games on the docket along with countless college hoops. Let’s go Boys. Let’s go Huskies.

On Monday we bought XME. We sold levered S&P 500. On Wednesday we sold XME, MOS and some levered NDX. On Thursday we bought PCY, EMB, SSO and more levered NDX.