Goldilocks Is In The House – And The Banks Are Loving It

Boy is it great to be home! Three trips piled into one long 8 days on the road. Nothing better than walking off the plane at midnight and being greeted by this sign in Hartford.

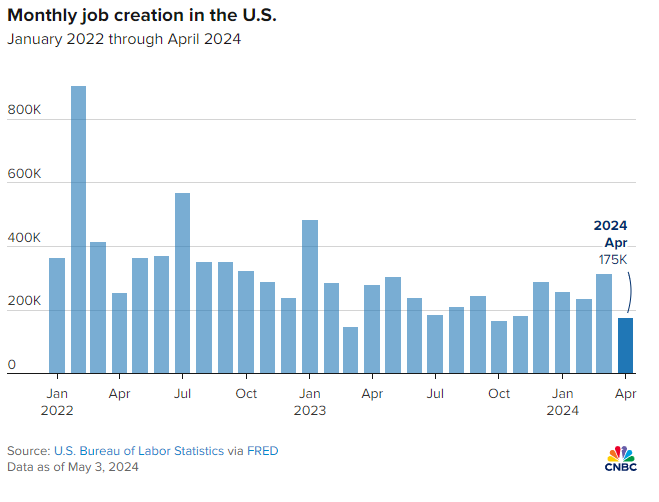

A new week begins after last week ended with a bang. If Apple’s earnings and epic share buyback weren’t enough, the jobs report on Friday gave a Goldilocks gift of not too hot and not too cold. 175,000 new jobs were created versus the 240,000 anticipated. While the number of jobs created was below expectations it was still a very solid number.

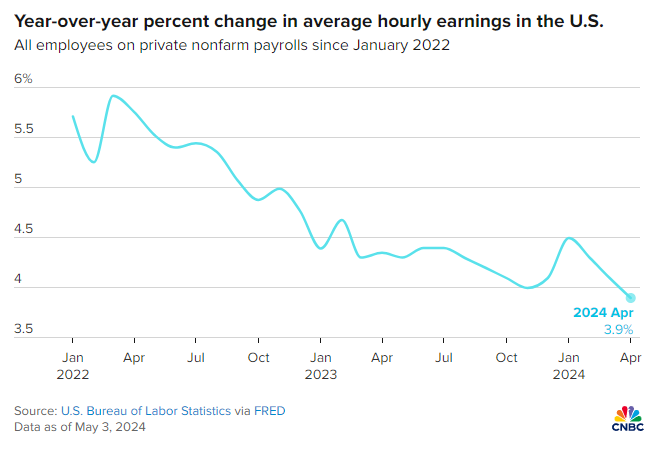

The unemployment rate ticked up to 3.9% which is getting closer to my 4% line in the sand. Wage gains also moderated which is helpful on the inflation side.

As you would expect when bonds rally and the dollar falls with lukewarm data, stocks roared higher. And we now have a series of higher highs since the April low and higher lows as you can see below on the S&P 500 and NASDAQ 100. That is the classic definition of an uptrend. We will look at the other indices on Wednesday.

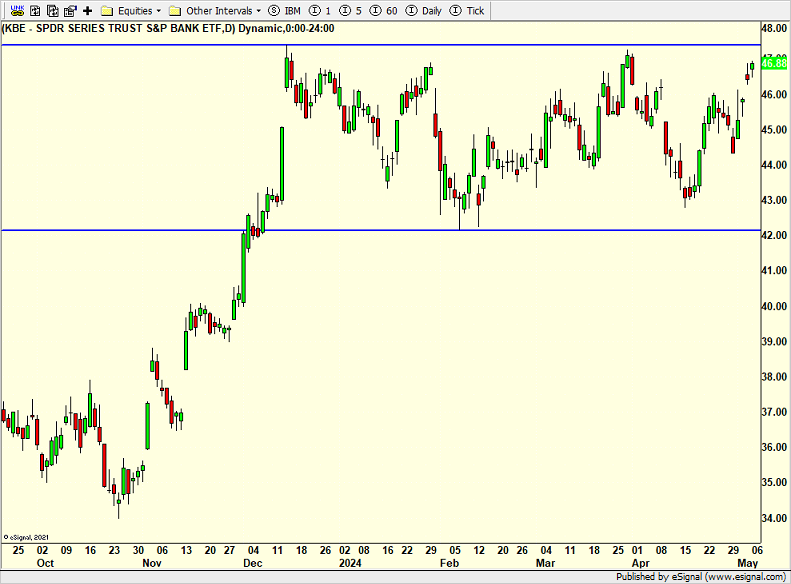

Ya know what has been quietly acting great? The big banks. Here is the KBE ETF below. One of the most important groups in the stock market, this ETF looks like it is going much higher.

I received a few questions about the “sell in May” trend which I will answer on Wednesday. We’ve also quietly had some major portfolio shifts.

On Friday we bought CYRLX and more levered Russell 2000. We sold HELE and some FREL.