Goldilocks Remains In The House – Bears Decimated

It’s the end of a holiday-shortened week. I love these weeks. Today should be on the quiet side with many folks taking off early or the whole day or the entire week. As you would imagine so much of the geopolitical complaints has totally calmed down. New, all-time highs will do that to folks. My Twitter feed stopped crying about 401Ks turning into 201Ks.

As I continue to write, I beg and implore folks to ignore geopolitics when it comes to investing. It’s a fool’s errand and loser’s game reacting to all of the nonsense. Iran, Russia, China, Gaza, Congress. It’s always enough to make your head spin. Follow data. Analyze data. Take action on data.

Just as I was finishing up this piece, the June employment report was released showing that the economy created 147,000 new jobs, higher than the 110,000 forecast. May and April only saw small revisions which is always good to see. The unemployment rate fell to 4.1% versus the 4.3% forecast. That makes it slightly more challenging for the Fed to cut rates as I have been imploring them to do. Even the U-6 or underemployed rate fell to 7.7% which was also better than forecast. This was definitely a Goldilocks report.

The markets have been strong as you know. And we are in a seasonally positive period for another week. Sentiment has become a little giddy and greedy. Some folks who reached out to me in early April asking for help after they liquidated their portfolios are now back asking how to invest. This is clearly concerning as the emotional investors are usually woefully wrong.

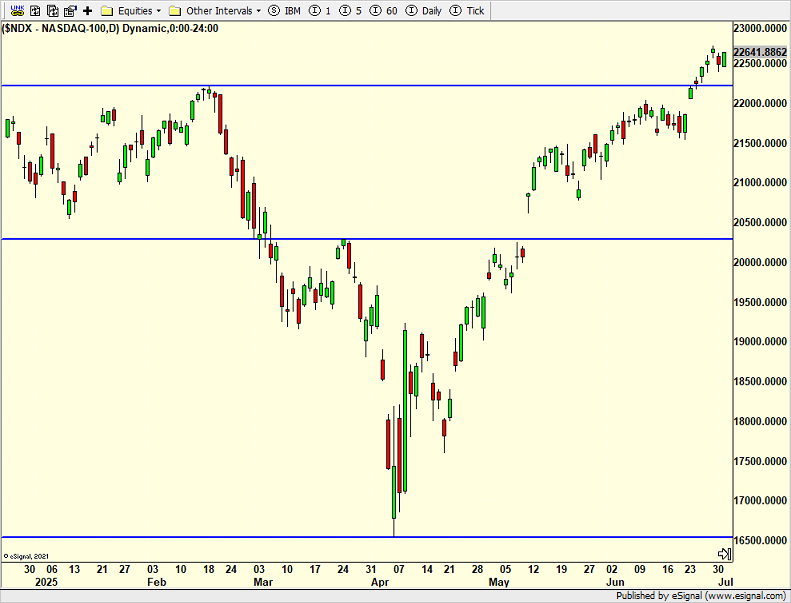

The S&P 500 and NASDAQ 100 are below. I dare the bears to find something wrong with either. Maybe they have come very far and very fast?

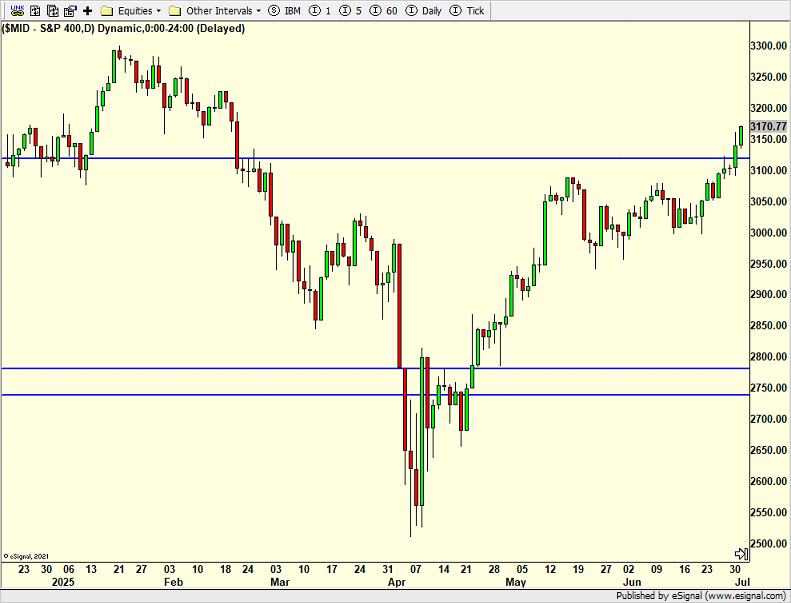

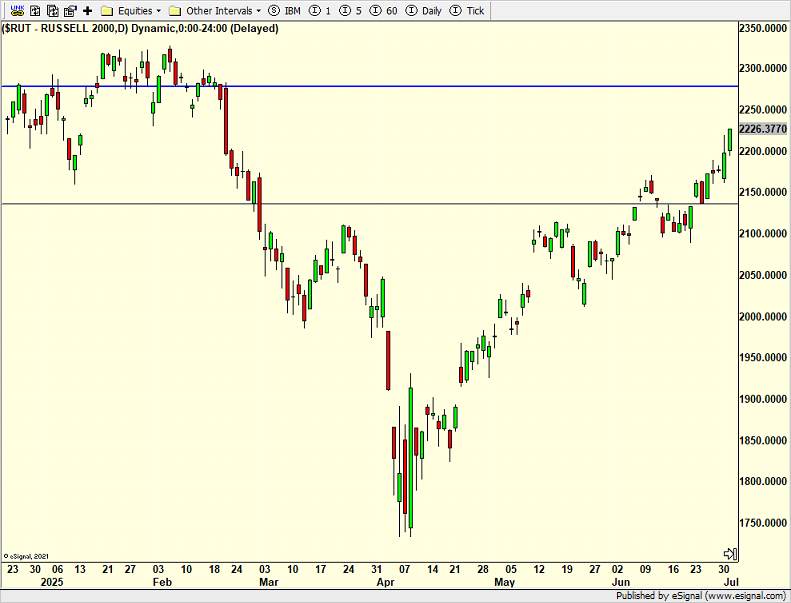

If the naysayers want to point to areas of caution, they could say that the S&P 400 and Russell 2000 below are not yet at new highs which would be a divergence or non-confirmation. And they would be correct.

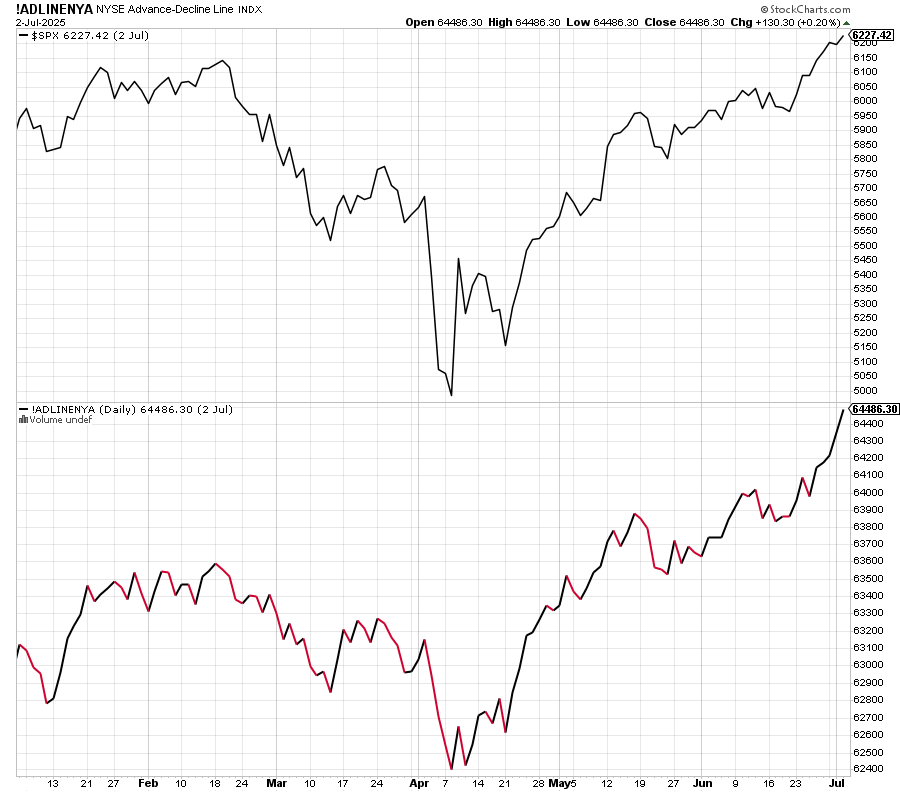

However, when we look at participation in the rally as evidenced by the chart below, we see that the bears have tough row to hoe. The upper panel is the S&P 500 while the lower panel is a cumulative line of the number of stocks going up and down on the New York Stock Exchange. It has soared into new high territory where bear markets and large declines rarely begin.

The bears remain decimated and impaled. I am still shocked at just how many investors pulled the ripcord in early April right near the bottom. And they hated and disavowed the rally throughout April and May. Slowly, some capitulated in June and have been chasing ever since. Smart money added money in April. They added risk. They did ROTH conversions. They certainly didn’t sell and get hung up on the headlines.

A beautiful summer weekend lies ahead in CT. Half day in the office on Friday. There will definitely be golf in the forecast. And some swimming and napping. Some nameless person in my house put too many plans on the calendar for Thursday through Sunday. I hope I don’t have any sudden migraines. Whatever you do, Happy Independence Day weekend. I hope it’s full of fun and family.

On Tuesday we bought more PCY and EMB. We sold QLD, SRPT, some ETFOX and some HYG. On Wednesday we bought QLD, more HYG and more BRK.b. We sold some MQQQ and UWM.