Hard to Find Places to Hide

Stocks are through with most of earnings season and you know what? The major stock market indices haven’t gone anywhere and I don’t not believe they are set up to explode higher just yet. My tempered enthusiasm remains. Besides the big picture, short-term challenges, I am really having trouble finding things I want to own, regardless of my market take. I thought low volatility ETFs like SPLV would get some love along with utilities and staples, but the plunge in bond prices has put a damper on that trade.

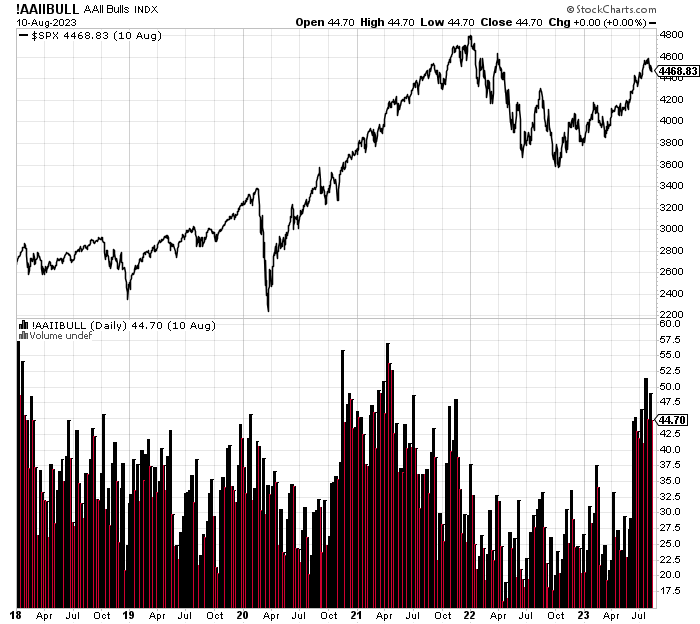

Lots of folks have been talking about how the individual investor has become too bullish. The American Association of Individual Investors puts out a survey each week and the chart is below. First, it’s an incredibly volatile survey. You can see on the far right how bullishness was recently over 50%, leading to the bears screaming about irrational exuberance and a bubble. Nothing could be farther from the truth.

Early in new bull markets, sentiment does in fact become bullish. After all, someone has to buy. And as we know, sentiment works great at extremes, not so much in between. Sure, people got too happy too quickly and a pause or mild pullback was in order as I have written about. Let’s not carried away beyond that.

I have also heard people scream about the “super secret, all powerful” (sarcasm) average price of the last 50 days, aka, the 50 day moving average. It’s in red on the chart below. I always laugh when pundits assign power to an average price as if it has some mystical power. Truth be told, the computer algorithms can try to move prices to the popular averages to entice people to make a trade and then pull the rug out from beneath them.

Look at how many times the S&P 500 knifed above and below the red line. Today, we hear that price is coming down to test the 50 day average. My strong sense is that buying at that level will not be the bottom of the pullback. Sure, stocks may quickly bounce, but I doubt that price holds. I think the market needs more time before attempting a low. One window I am watching is the Fed’s Jackson Hole meeting in two weeks.

It’s good to be back home and in my own bed although I am not getting my usual steady sleep throughout the night. I think I need to stop falling asleep on the couch while binging Shark Week shows. Maybe I’ll try Deadliest Catch tonight.

Here is my caddy walking ever so close to the beach and North Sea, not exactly position A off the tee, but he did find my ball.

Pictures of the Scottish coast just don’t it justice. So many holes right on the water. Never got tired of seeing it. I did become intimately familiar with the fescue, heather and gorse during our stay. Next time, I hope to hit it straighter instead of learning how to get out of it.

On Wednesday we bought PCY and more TSLA. We sold TQQQ and some ARKK. On Thursday we bought HYG and DXHYX. We sold SPY, IWN, IJS, XLB and some PDBC.