Harvesting Some Acorns & Reducing Risk

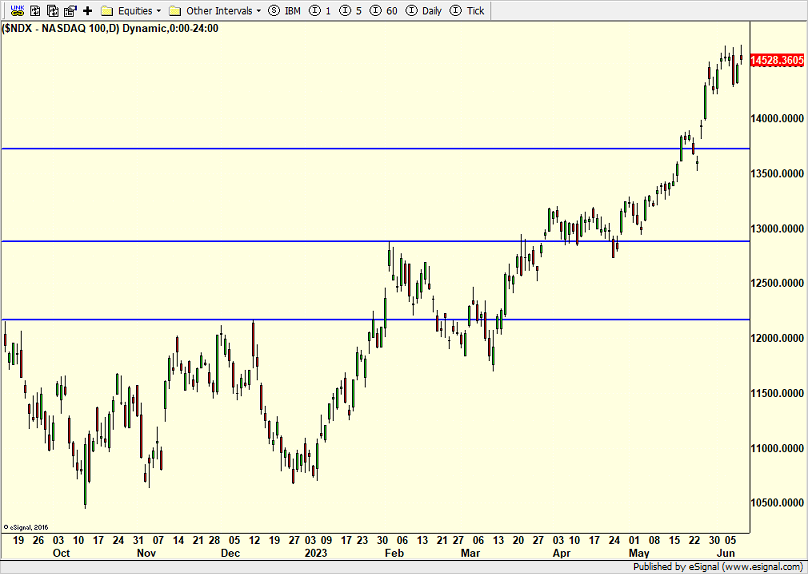

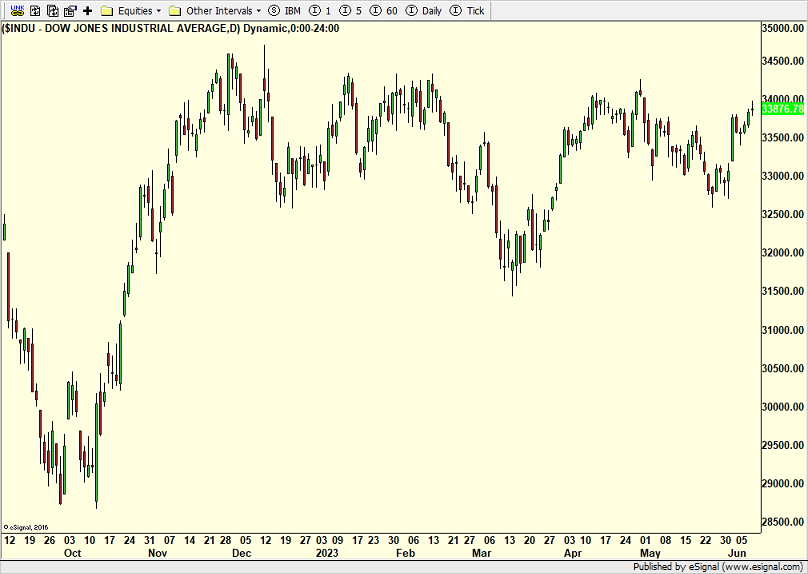

It has been a quiet few days, but certainly not an opportunity-less few days. The major stock market indices have been bullishly digesting some very sizable recent gains. Gold and bonds have not. During the week, I used some of the continued abnormally strong action in the NASDAQ 100 to lower risk by rotating into the Dow Industrials.

This comes at a time when I sense lots of investors recognizing what my readers have known since October; this is a new bull market and one I have written about over and over and over. I don’t know why it is getting all the chatter this week, but I certainly feel like lots of very wrong pundits are qualifying their bearishness. Almost every single pundits on CNBC and FOX Business came into the year pounding the table on more and bigger declines, especially in the first half of 2023. They have hated on and disavowed the entire rally from the October 2022 bottom. That hasn’t worked out so well and their fighting for their jobs and portfolios.

While investors are never, ever happy losing, they can somewhat tolerate it when everyone else is too. In 2023 these Chicken Littles have positioned so defensively that it has been very difficult to even show a return in the black, even though the most popular stocks have soared 25%, 50%, 100% and even 200%.

The bears have a huge dilemma. Do they dig in their heels and hope and pray the markets reverse lower? Or, throw in the towel and chase performance? I don’t know the answer although I am harvesting some acorns. We did sell our internet sector stake along with our position in gold and silver stocks. But I did buy some much lower volatility position in pharma. And as I looked at our sector holdings last night, very quickly, we now own defensive positions in pharma, staples and utilities along with banks, biotech and tech.

I saw a blue sky coming to the office this morning. A real, genuine blue baby. What a change from the recent haze and smoke which has really impacted CT with cool temps as well. I played golf in Rye, NY on Wednesday. I saw club staff wearing masks so I asked if they had a COVID outbreak. Well, DUH! It was because of the picture below. On some holes it was so dark I could not see with my sunglasses on. Breathing that smoke was definitely not good, even though my buddy who is a doc told me not to worry. I hope the smoke doesn’t return anytime soon. Looking forward to what is forecast to be a nice weekend in the mid to upper 70s.

On Wednesday we bought levered S&P 500. We sold PMPIX, RYPMX and some levered NDX. On Thursday we bought EEM, USHY, PJP, RSYYX and more levered NDX. We sold TLT, SPY, levered S&P 500 and some FDN.