Hated Set Up Playing Out As Volatility Rises Into Nvidia

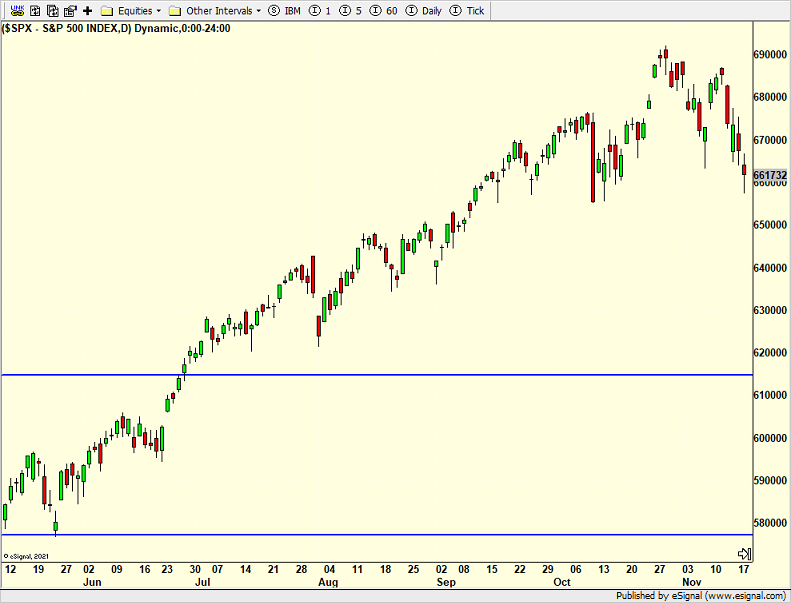

Let’s start with the pullback which is now back to 5% on the S&P 500, an area that usually holds in the strongest bull markets. It would be tidier if we saw a quick plunge below the October bottom that coincided with a spike in fear. That should set up the markets for a nice year-end rally.

The other day I wrote about a hated set up in the stock market that is playing out negatively as it often does. The good news is that the downside target has almost been reached.

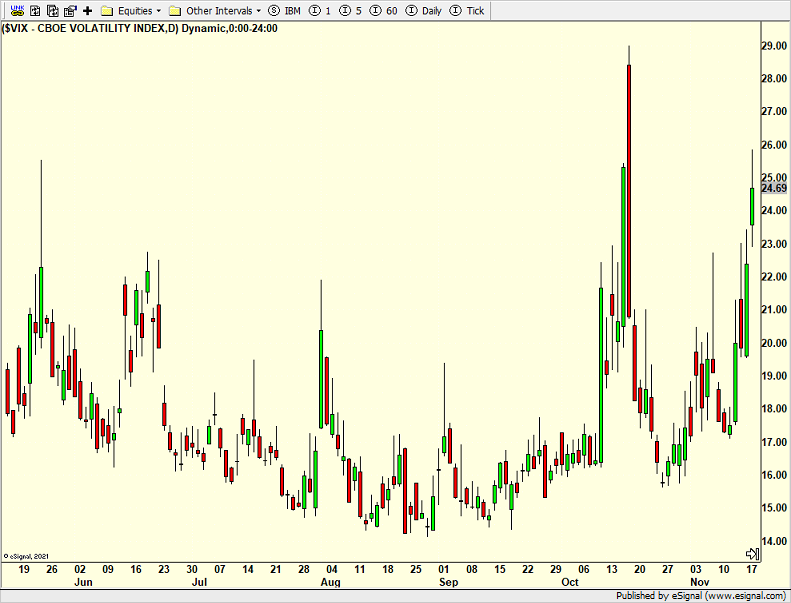

Is volatility spiking? Are folks getting worried? Panicky? Let’s consult my friend the Volatility Index (VIX) and see. The VIX jumped 50% into mid-October and is doing the same thing now. The VIX in the 20s often sees choppy markets, but tradeable ones.

Taking a longer view, we can see the tariff tantrum from 7 months ago where the VIX went from 15 to almost 60 in a few short days, so today’s move isn’t that crazy, at least not yet. And I do not believe it will get out of the 30s, worst case, this year.

Finally, the largest company in the country reports earnings tonight. That’s Nvidia. And the media should be out in full hyperbole force, letting us know that it’s the single most important report of the year or perhaps even ever. Just more nonsense.

You can see that it hasn’t been all rainbows and unicorns. The stock is supremely volatile and requires patience, if not an outright smaller position size. I would like to see the stock below $180 heading into earnings. That would likely price in a less than perfect report and set up a buying opp on the news. I also wouldn’t have minded new highs above $210 either. A jump higher would have set up a possible selling opp on the news. I fear I will not get either desire today.

If you told me you had the entire report ahead of time and you knew exactly what the revenue, expenses, earnings and growth rate would be, I still don’t think I would have high conviction on how the stock would trade. One thing we know for sure, we will all find out after the close today.

On Monday we bought SSO. We sold FDRR, PHM, RAIL, TQQQ, some XLRE, some DWAS, some SPHB, some CARR, some GOOG and some PINK. On Tuesday we sold EMB.