Hawkish Pause From The Fed? Market Not In Great Shape

The model for today’s Fed day is plus or minus 0.50% until 2pm and then a rally.

A high probability long trade was setting up nicely until yesterday’s rally. Now it’s just a coin flip.

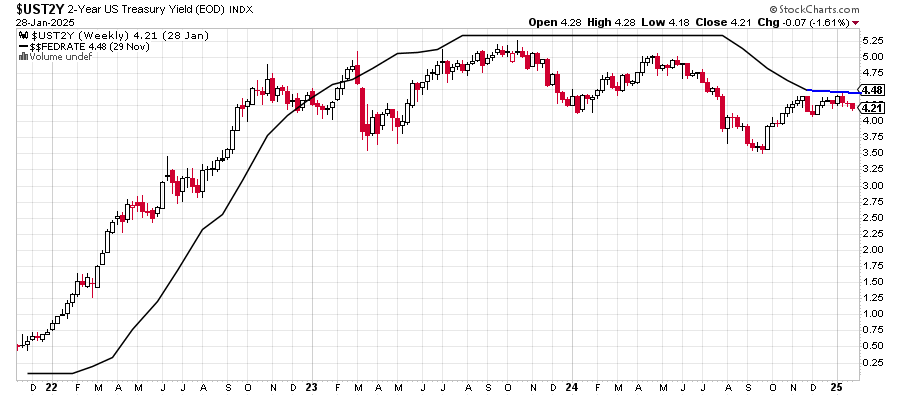

Jay Powell and the FOMC will take no action today although he may offer a hawkish pause where rates stay the same but his rhetoric is hawkish. The 2-Year Note currently sits at 4.21% with the Fed Funds Rate at 4.33%. That is as neutral as it gets.

While inflation has risen and should continue to slightly rise during the first half of the year, I do not see that being a problem overall. The economy is humming along. Employment is strong. I expect those to weaken as the year goes on. Another FOMC rate cut is coming, but it’s not today and unlikely to be in March either.

The stock market is a different story. The Dow Industrials have become the leader. That’s not what we typically see in a healthy market. AI and mega cap tech look broken. Nvidia is a “sell the rally” stock. I would rather own Apple if I had to make the choice. FYI, our Unloved Gems strategy owns both stocks but in very different sizes.

2025 and Q1 remain a trading range market. It’s not resolved. The NASDAQ 100 looks like it wants to revisit its 2025 low.

Better times are coming, but it’s not here.

On Monday we bought FJAN, SG and more MQQQ. We sold TQQQ. On Tuesday we bought KSPY. We sold FJUL, QMAR, FAPR, SSO and some MQQQ.