High Yield Bonds Join The Party – FINALLY!

Until the last few weeks, I had been complaining about high yield’s lack of enthusiasm off the June lows. The sector had looked like death. I am sure part my bemoaning was that the fact that we have been legging into the high yield sector since June to get fully fully invested.

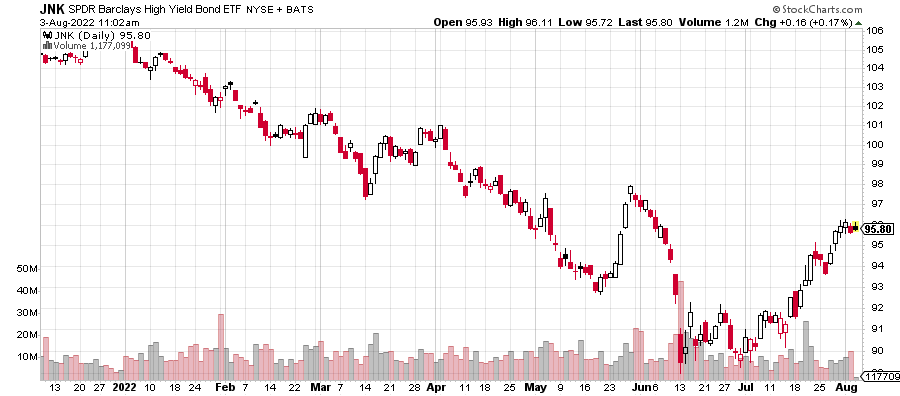

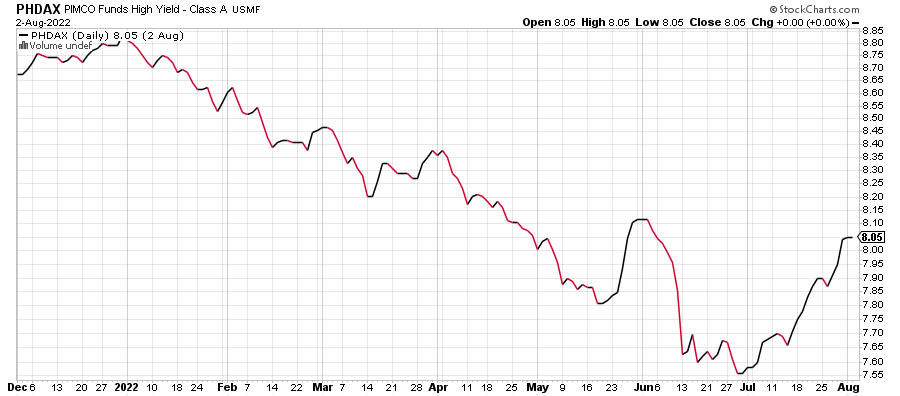

Below I show you two different ways to view junk bonds, through an ETF and a mutual fund, let me also say that because these bonds pay high interest rates to compensate for the credit risk in owning, looking at just a price chart doesn’t tell the whole picture. I would rather look at a total return chart which includes price gains/losses and interest.

In general, JNK in the first chart is more volatile and less linear than a plain vanilla mutual fund like PIMCO. But they both tell an accurate story. And that story has been one of strength over the past few weeks. Long time readers know that junk bonds are one of my favorite canaries in the coal mine for the markets as they are among the most sensitive to the tiniest ripples in the liquidity stream.

But they are not perfect and offered the single worst false sign in my 32 years in the business during the second half of May. That one hurt. High yield behaves better today but it’s till too early to say if the ultimate bottom is in for one of those multi-year runs. For the past few months I have said with high conviction that a double digit opportunity is coming this year.

On Monday we bought some preferred stock funds and more high yield. We sold FAS and some levered NDX. On Tuesday we bought more levered NDX. We sold levered inverse S&P 500, NUGT and some FUTY.