Historic Selling Wave Ended

As I have been writing about for more than a week, I had high conviction that a low of some sort was forming. Dozens of stars were lining up and even if this was 2008 (it’s not), prices should still rebound 7-15%. And the bulls did what I said they were supposed to do. Step up and squeeze the bears.

Prices are back to the peak from Fed day this month where the last plunge began. The bulls should surpass those levels before stopping, especially in the more “risk on” indices like the Russell 2000 and S&P 400. And investors have started moving off the uber bearish bent of “sell everything” and all news is just the most awful ever.

I am not going to sit and say with high conviction that THE bottom is in and the stock market has started another run to all-time highs. Because of the magnitude of the decline, I just don’t know right here. Let’s see how far this rally goes, what the internals look like and how people feel. I hope that we soon hear a chorus of “sell the rally”! That would give it legs. We don’t want to hear that a new bull market has started and I don’t think we will.

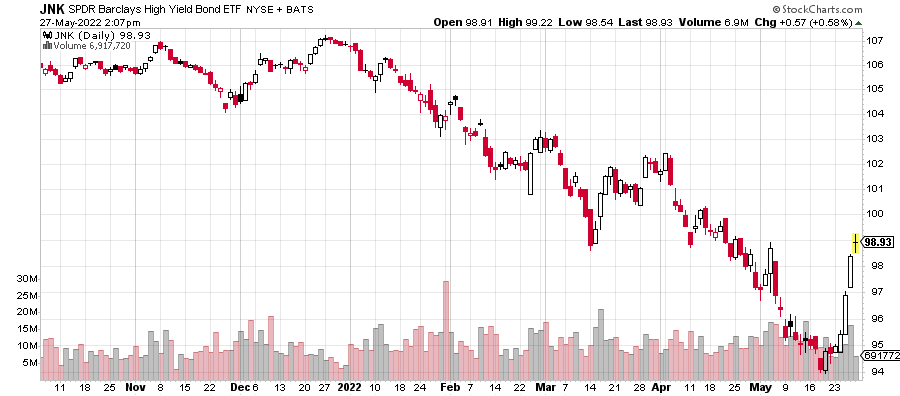

Ya know what started to rally hard this week?

High yield bonds. That has been the missing ingredient all along. I sense the masses were heavily short this sector and now they are getting squeezed. We bought the sector as well.

You know what else moved a lot this week?

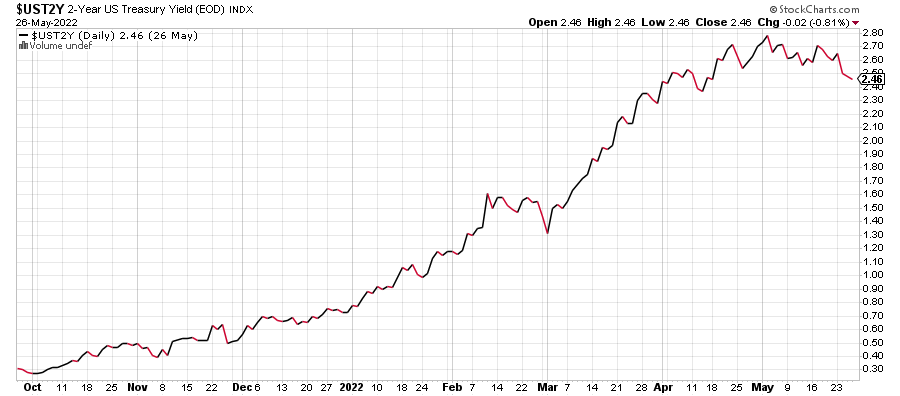

The two-year treasury note has quietly fallen from 2.80% to 2.46%. You know what follows the note? The Fed Funds Rate.I have said all year that the Fed does not have the intestinal fortitude to raise rates to 4%, 5% or higher. I am sticking by that. 3% is the absolute cap. this year.

I turned wildly bullish on bonds a few weeks ago and I am not wavering. They are the trade for the rest of the year on a risk adjusted basis.

On Wednesday we bought EWZ and more ECH. We sold levered inverse S&P 500. On Thursday we bought levered inverse Russell 2000 and NDX along with VGK, JNK more IP. We sold levered Russell 2000 and NDX along with GDX, VOXX some FREL.

I survived the heat and humidity of Newburgh NY last weekend for D’s baseball tourney. They didn’t fare well, but they did have a great time all hanging out at the pool on Saturday night. The long weekend where traditional summer begins awaits. Another baseball tourney in New London. And I plan on hitting a few golf balls since my surgeon said I can putt and chip. I mean, if I can chip I can hit light wedge shots. And while I am there, I might as well work on my iron game, right? Yes, I know. I am not a great listener when it comes to taking it easy. I figure I will have plenty of time to do that when I pass away, hopefully a long way from today.

Be safe, have fun and enjoy the long weekend. I am hoping to find a party, BBQ or two myself!