HOLY GEEZ!

Thursday was a day for the ages. It was one of those days that you only see a few times in your lifetime. Yes, your entire lifetime! In mathematical terms it was supposedly a 6 sigma event, meaning that it should only happen once in a million to billion years. I added the word “supposedly” because in my 35-year career I have seen enough 6 sigma events to know that what is supposed to happen mathematically and what does happen in real life are often different.

So what happened on a day when the casual investor saw the Dow Industrials up by 30 points?

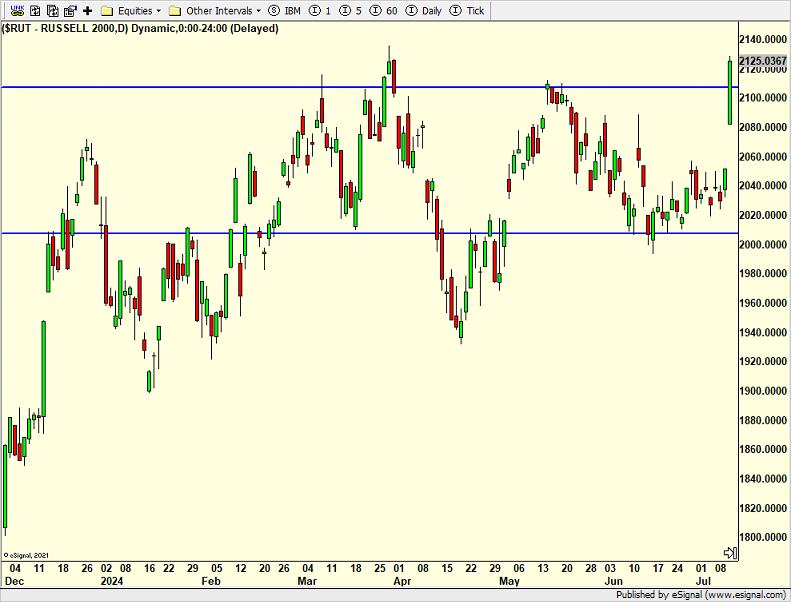

The Russell 2000 Index of small caps closed up more than 3.50%. OK. I mean, that’s a huge jump, but it’s not that unusual. Well, the S&P 500 closed down almost 1%, something that happens routinely. The Russell is below.

The 6 sigma event happened when you combine both of those together to see a spread of 4.5% in one single day. The last time we saw that was supposed to be when dinosaurs roamed the earth. The last time we really saw that was October 2008 during the crisis.

You know what else I speculate happened? A major hedge fund or pension fund did a monstrous portfolio re-allocation that forced the hands of others.

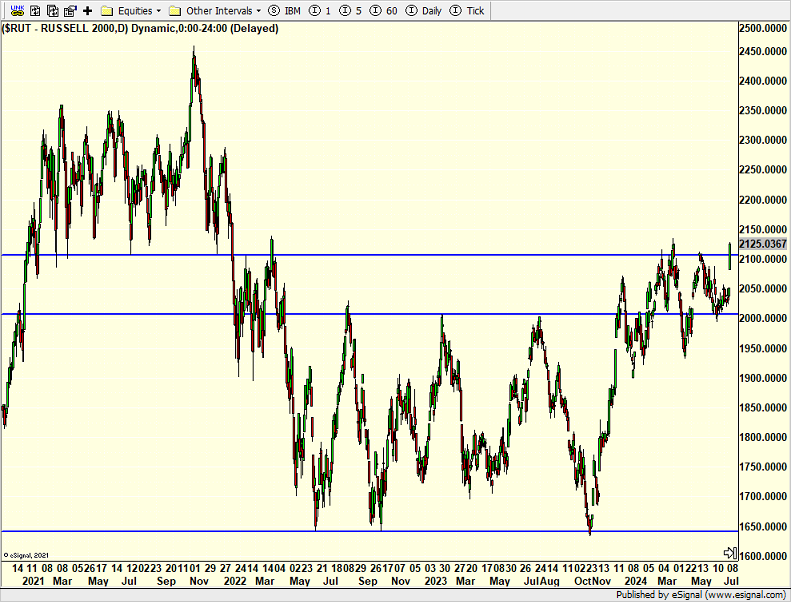

Getting back to the Russell, it has been so frustrating to own that index or its cousins. Brutal is the best way to describe it. The chart above doesn’t really tell the whole story. Let’s zoom out and look below.

The 2021 peak was a major one. The bear market that ensued was painful. The 2000 level was a real hurdle. Once that cleared the index should have traded better, but it didn’t. Yesterday may have finally cleared the deck. Or, it could be just yet another disappointment for the momentum bulls. Given the data, I think it’s the former.

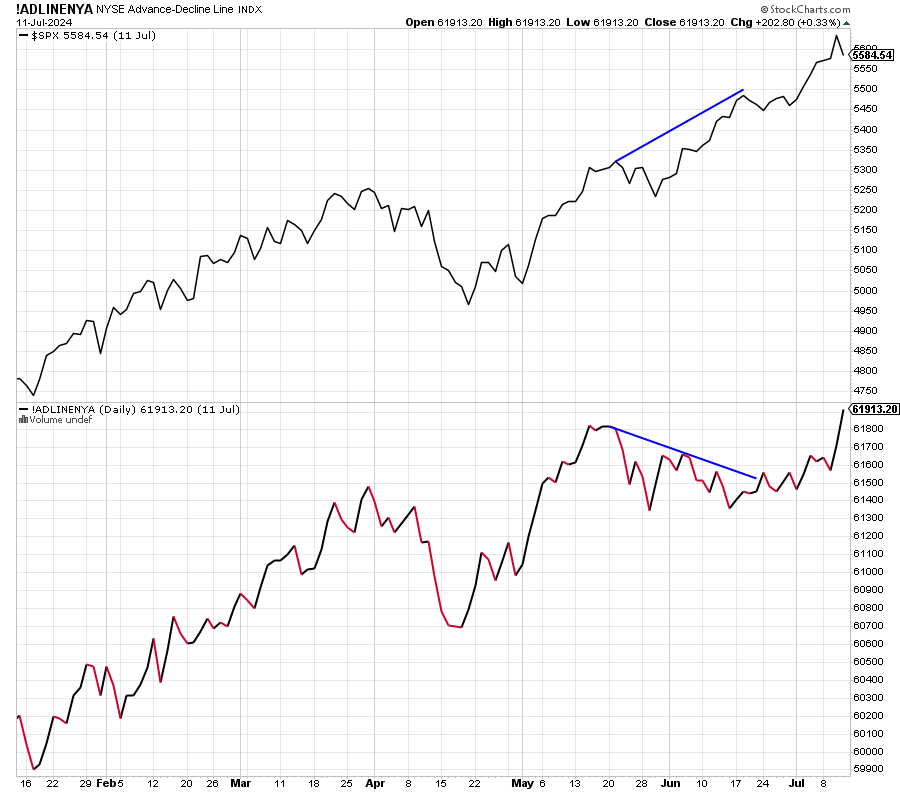

Thursday wasn’t only about the 6 sigma event and the Russell surging. We saw a breathtaking surge in, well, market breadth, meaning the number of stocks going up and down. There were 2000 (TWO THOUSAND) more stocks that closed than down on the NYSE. That’s a big number. It’s an insane number when the S&P 500 closed down. Those 10 AI stocks got hammered but 490 didn’t. On the NASDAQ it was even more pronounced. Almost 2200 more stocks going up than down with the index closing down. The NASDAQ 100 was down more than 2% which is obviously dominated by the handful of AI stocks.

Thursday was a truly generational day. We may not see another like this for years and years to come. I am sure the computers were chaotic as relationships like these are difficult for AI to handle.

Just the other day, I downgraded my view of the stock market over the next 1-3 months. A number of things concerned me including the lower chart below. In just a day, that one piece of concern has moderated. While others remain, I will not ignore the data as it comes in next week. Although we haven’t taken any significant portfolio action yet, I won’t hesitate to do so when the time is right.

The string of weekends with rain will grow tomorrow in CT. BOO! My hope is to find a few breaks to let my shoulder float around the pool for a while, see some friends and annoy my kids.

On Wednesday we bought RYEIX and ENPIX. We sold RYMIX. On Thursday we bought EPI and levered S&P 500. We sold EWT and levered inverse S&P 500.