Horrible Market Action BUT BUT BUT Bears Carried Out On a Stretcher

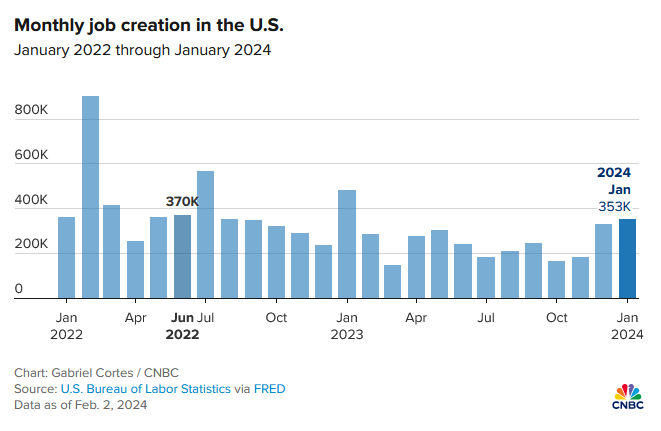

On Friday we saw what I would consider to be a powerful jobs report showing that the economy created more than 350,000 new jobs in January. That was well above the forecast of 185,000. While I am sure someone in pundit got somewhat close, the masses were largely looking for a disappointing report. The “BUT BUT BUT” crowd was out in loud fashion qualifying why this was bunk. And then the political conspiracy crowd was parading around claiming government manipulation.

The truth is the since Q3 2020, the economy has been creating an insane number of jobs which is something to celebrate. The chart below shows the last two years.

You know how I feel about numbers. I take them at face value and don’t try to qualify them. Will this number be revised lower? I think so, but I have also thought so with other numbers, both up and down. The Goldilocks economy that so many predicted for 2024 seems to be a bit hotter right now. In other words, no soft landing and certainly no hard landing. In fact, right now, no landing at all.

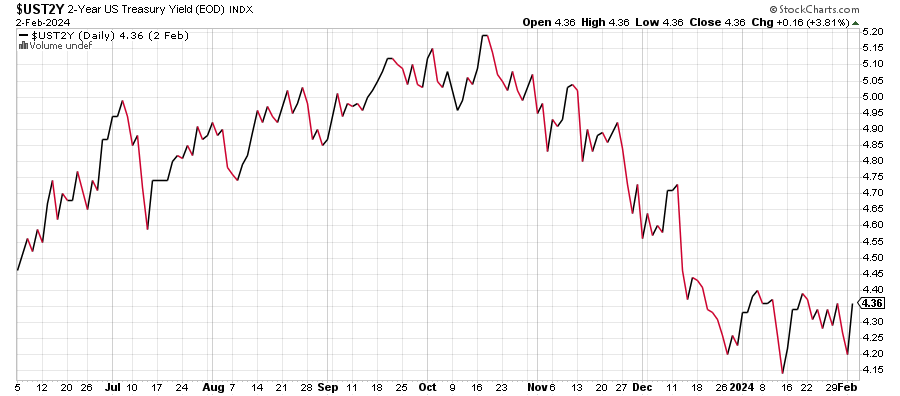

Coming in to 2024, I thought people were on drugs who forecast 6-7 rate cuts in 2024 with March being the first one. As I keep saying, if the FOMC has to cut 6-7 times, there were be an economic catastrophe and some exogenous event. I don’t think so. The Fed could cut a few times for sure, but not the way the landscape is right now. No chance.

And take a look at the 2-Year Treasury Note below. From 5.2% to 4.15% and now at 4.36%. To me, it looks like it’s bottoming and wants to rally to at least 4.5% to 4.6%. I think two years at 4.5% guaranteed by the full faith and credit of the U.S. government for those who are totally risk averse sounds pretty good if it gets there.

Friday’s stock market action brought yet another chorus of “BUT BUT BUT” from the bears who cried about the lack of broad participation. “More than half the rally came from just a few stocks”, I heard. “The small caps were down”, cried another. Perhaps my favorite was “The average down fell on the day”. You know what I say? So what! If the bears were short the S&P 500 or NASDAQ 100, they were carried off the field on a stretcher.

The bottom line is this. The market hasn’t look so good beneath the surface this year, a song we have sung a fair amount in 2023. I am sorry for those who don’t own the winning stocks. It must be frustrating. No one ever prevented folks from owning the mega cap tech stocks. Several times, I tried owning small caps, only to be disappointed. That doesn’t mean I will stop trying, but when I do own them, I do not load up because it’s a laggard play.

And while I agree with the bears on some points, you know one of my favorite lines. Price is the final arbiter. I am glad we reduced exposure below 100% in all but our most aggressive strategies. That’s one of the things I am paid to do. Buy when no one else wants to. And sell when no one else wants to. Prune and plant.

On Friday we bought ZTS. We sold PMPIX and RYPMX.