Houston, We Have Another Liftoff

Over the past few weeks I mentioned a number of opportunities in the markets as well as posting the trades we made to execute. I talked about gold bottoming at the end of June. I discussed some moves away from the big winners like the NASDAQ 100 and into lower risk areas like the Dow Industrials. It’s not rocket science. It’s prudent movement of funds to take advantage of solid risk/reward set ups. That doesn’t mean they will always end up profitable. Not even close.

One by one, investors have come calling in the various major stock market indices. First and for most of the year it has been in the NASDAQ 100. That’s been a lot of fun, especially listening to all the bears pound the table on why it should not be happening. Then they came for the S&P 500, Recently, the S&P 400 and Russell 2000 saw the love.

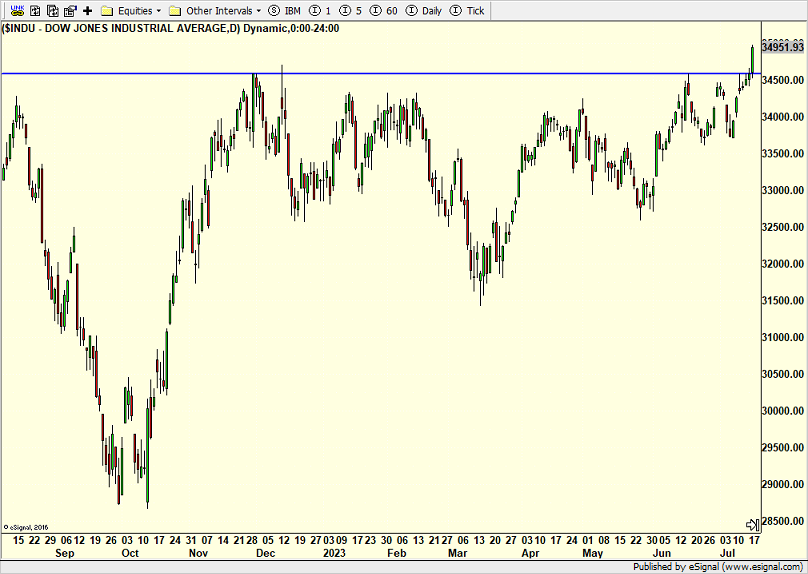

The old, stodgy Dow Industrials got my attention last month when all the media could talk about was AI and the melt up. That was also a time, I started to prune some of those holdings. The good ole Dow looked like it was in line for some affection from investors. And while the most recent rally started from 32,500 and 33,500, the index just got media notice yesterday when it broke out from its 7-month trading range and above 34,500. It won’t be a straight line nor as easy as the last few months have been, but the Dow should trend to new highs over the coming few quarters. I can’t even imagine what the bears will say then!

On Monday we bought IWO, BKPIX, more QQEW and more RYDHX. We sold IJJ, IJS and RYZAX. On Tuesday we bought more URA. We sold ENSG.