I Didn’t See That Coming

While I was looking for the stock market to begin the bottoming process on Monday, I definitely did not think that stocks would literally rip to new highs in three days. That was a much less likely scenario and one that would bother me. To be exact here, the NASDAQ 100 is at new highs with the S&P 500 right there. The Dow, S&P 400 and Russell 2000 are not. We will see where they end up at week’s end.

As far as leadership goes, we need to see a better job. Right now, only discretionary is pulling its weight. I also want to see some of the defensive groups back off. Energy has been absolutely decimated this year and regardless of where it may bounce in the short-term, the sector does need time to repair the damage before it can begin a sustainable rally.

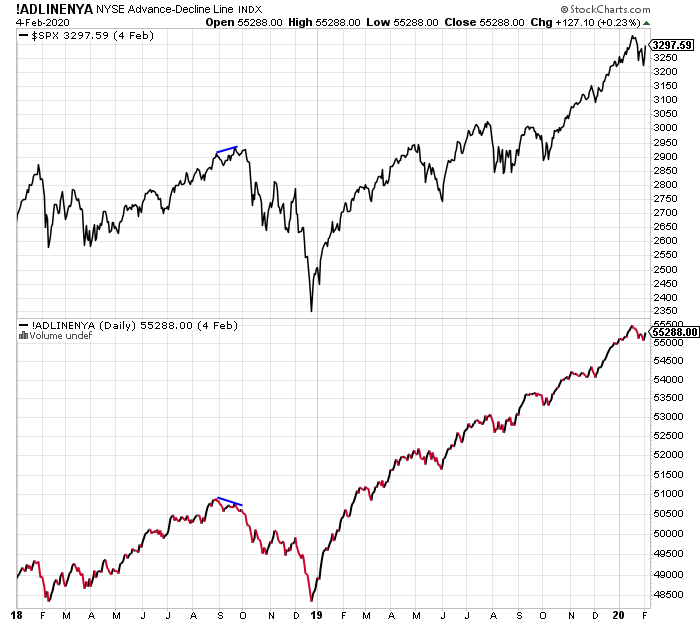

What may be taken as me being negative is buoyed by looking at high yield bonds and participation. The former is close to fresh highs and it’s very difficult to begin a serious decline with junk behaving well. The latter, measured by the NYSE A/D Line, is also acting strongly and should run to new highs soon.

Unless my short-term concerns are completely unfounded and stocks are set to explode higher, the case for a trading range still makes sense, at least to me. While I remain positive on the stock market over the intermediate-term, it wouldn’t be the worst thing to see some sideways activity this month.