I Was Wrong – We Have a Problem

I was wrong.

Last week, I left you with my opinion that April’s well below expected employment report was just an anomaly or aberration. And that a big upward revision was coming along with a strong May report. Well folks, May was weaker by more than 100,000 new jobs. Thankfully, the unemployment rate came in as expected.

Two months is now a nascent trend and there is something structurally wrong with the economy. You know my trifecta. Vaccines + Massive Fed Support ($9T) + Gargantuan Fiscal Stimulus ($5T) should equal generational job growth.

Houston, we have a problem. Err, the economy has a problem.

Could it be all this free money sloshing around and be given out in return for nothing? Yes. However, with 29 states now opting out of COVID unemployment, if that was the case, the jobs market should begin to improve over the summer. The supply chain disruptions could also be adding to the issue.

Stay tuned…

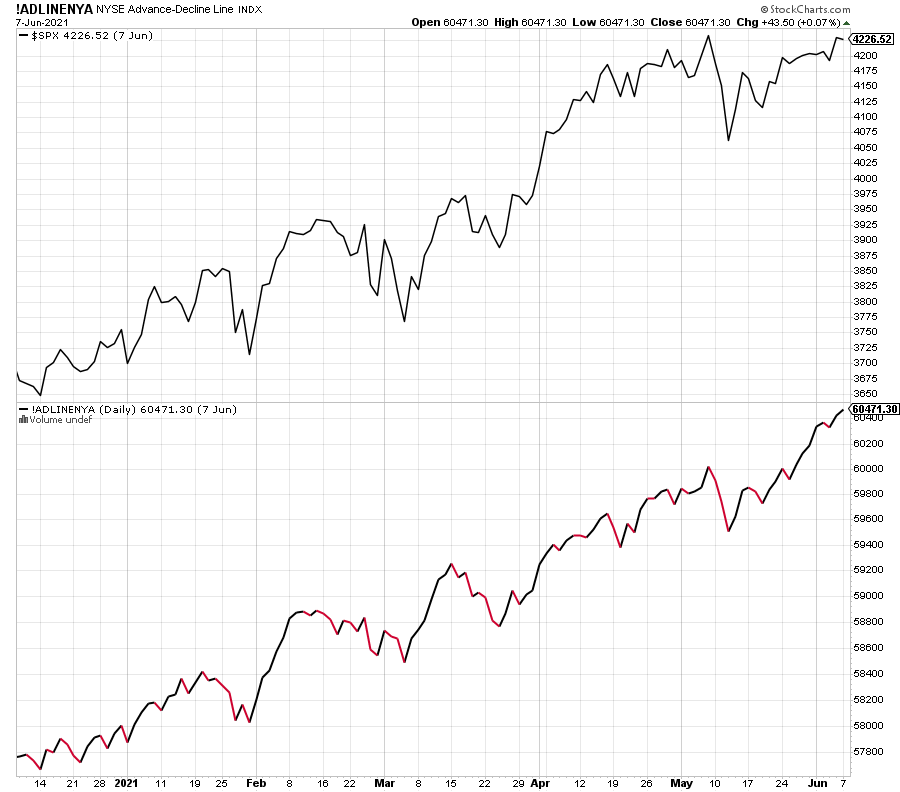

The markets continue to be quiet. The stock market remains mired in the same trading range I have been discussing for over a month. And that’s fine. As you know I do not believe the bull market is over after just 14 months. However, as I have written about many times, I have been targeting the May 1 through September 1 period to see a more meaningful peak in stock prices. The market is in that window, but showing no signs of imminent danger.

Just take a look at the NYSE A/D Line below which measures participation. The S&P 500 is on top and just below its peak while the NYSE A/D is at all-time highs. Bull markets do not end with this configuration and large declines do not begin like this. However, we could certainly see a 10% correction without any warning here.