Powell Delivers – Indices Diverge – Mega Cap Tech Lagging

Fed Chair Powell did not disappoint. He was brief and clearly confirmed that rate cuts were coming without offering the cadence. I was a bit surprised that markets hadn’t already priced that in since 95% of participants expected it. With the 2-Year under 4% and short-term rates above 5% there is plenty of room into 2025 for the Fed to juice the economy. The billion dollar question will be if it’s too late or more ammunition for the soft landing. So far, it’s the latter.

After Thursday’s decline, Friday was a strong bounce, but the major stock market indices were not in sync. The Dow, S&P 400 and Russell 2000 all made new highs for the week and post-August 5th bounce. And they all saw sizable rallies on Friday.

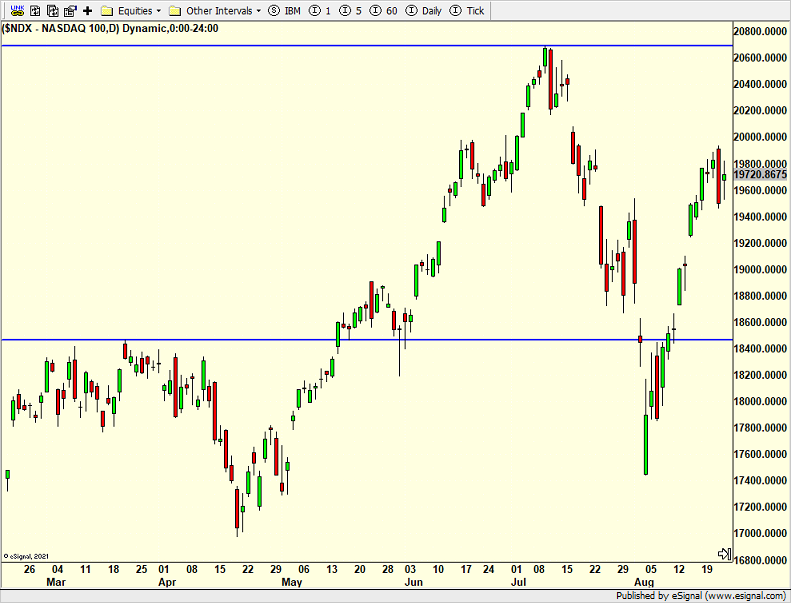

The S&P 500 and NASDAQ 100 which are below saw more muted rallies. And of course, more strength this week could repair the divergence. However, it is a sign that mega cap technology is no longer leading.

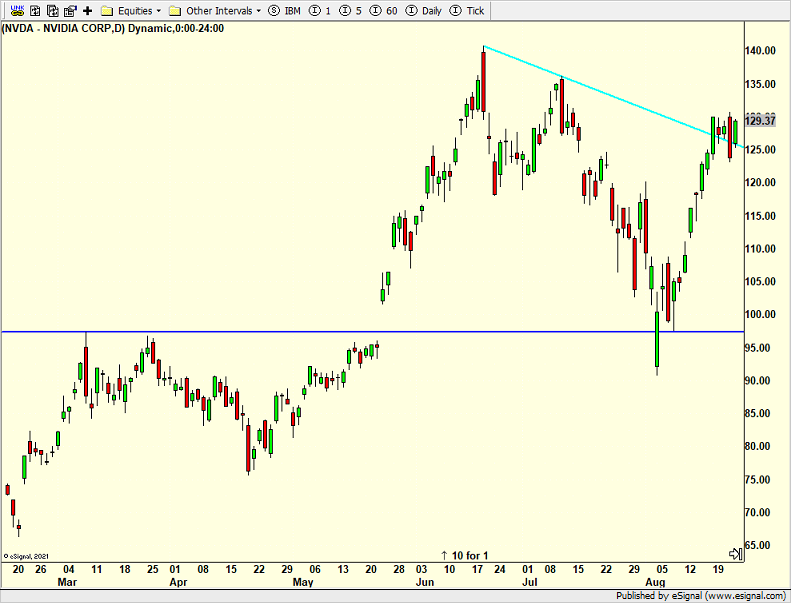

And speaking of mega cap tech, Nvidia reports earnings on Wednesday. The company is now the “most important stock” according to the pundits so everyone will be keenly watching. If the stock gets above $130 right here, I think the earnings report could spike it to new highs where I would strongly consider selling what we bought on that August 5th spike low. I would be surprised if the bears make much headway below $120 before earnings.

On Friday we bought FSTA and more levered NDX. We sold levered inverse NDX.