Inflation Data Benign – Strong & Weak Indices

After a benign CPI report, the PPI report was even more tame, continuing to support my longstanding theme of inflation moderation. This has been an amazing story as we now have 9 straight months of lower month over month inflation. I can’t find a similar streak over the past 50 years and I saw on Twitter you have to go back to the 1930s to see, not exactly a valid comp. Of course and obviously, it is difficult to see such a prolonged downtrend in inflation had it not had such a prolonged uptrend. Suffice it to say that the inflation Genie is dead for this cycle. We can pick up the topic again once we get through the next recession.

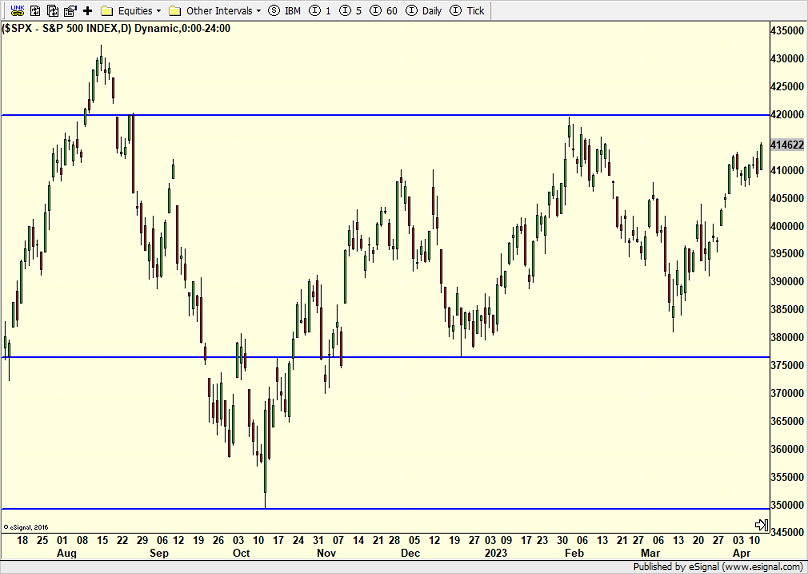

Looking at the S&P 500 below we can see that the index in approaching the highs for 2023. I have already stated that I expect price to make new highs for 2023 this quarter and possibly this month. The real fun comes if and when the August highs come into play.

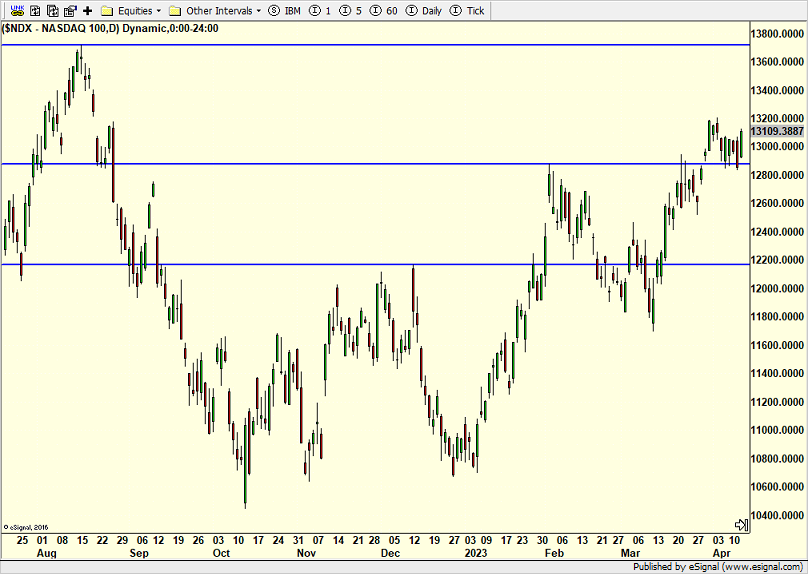

The NASDAQ 100 looks even stronger, having made a new high for 2023 two weeks ago. I expect the index to challenge its August 2022 levels before July 4th which is another 11% higher from here.

Not to be accused of cherry picking, below is the Russell 2000 which is the weakest index and one of the things on my concern list. It has fallen hard since its February peak and has a lot of repair work to do. Again, it doesn’t matter whether this index is falling because of the banking issue or recession risk. I don’t care. It just matters that along with the S&P 400, there are problems out there.

Between good news on the CPI and PPI front and the beginning of Q1 earnings season with the banks today, there is a lot for the markets to digest. Let’s take a look at the last three days together on Monday.

Happy July 4th! Or at least that’s how the weather has been in CT for the past few days. It was 92 as I drove on I95 on Thursday afternoon and supposed to be almost 90 today. But remember, if you don’t like the weather in New England, just wait an hour. It is bound to change. From the 90s, it looks like the 60s all next week with the 30s and 40s at night. Note to self. Turn off the A/C. Switch back to heat. Whatever your plans, it’s spring so hopefully you can get outside and enjoy the weekend!

On Wednesday we bought SARK and levered S&P 500. We sold ITB, some SPYD and some QQQ. On Thursday we bought PEY and EMR. We sold levered S&P 500.