Inflation Peaking

Markets have been super quiet over the past few days. We have seen the pause and mild pullback I wrote about, but there should be more to it. Sentiment is back in the greedy, euphoric stage, but let’s remember that frothiness usually needs some structural damage before we see real weakness. Economic and earnings data continue to support my theme that the economy is re-accelerating strongly.

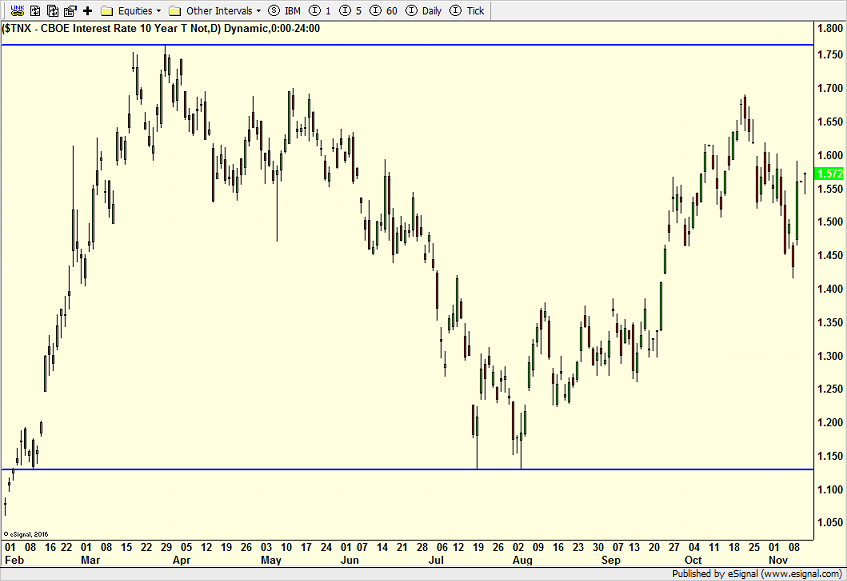

Inflation data is the hottest in 31 years which also is right in line with my forecast that it is in the process of peaking. For all those who argue that I am wrong on inflation, please let me know why the yield on the 10-year note has been stuck in a range and not skyrocketing with 6% inflation. In fact, if you use the inflation calculation from 1980, according to Shadow Stats, the inflation rate is close to 15%. Why is the 2-year note under 1% if inflation is perceived to be long-lasting?

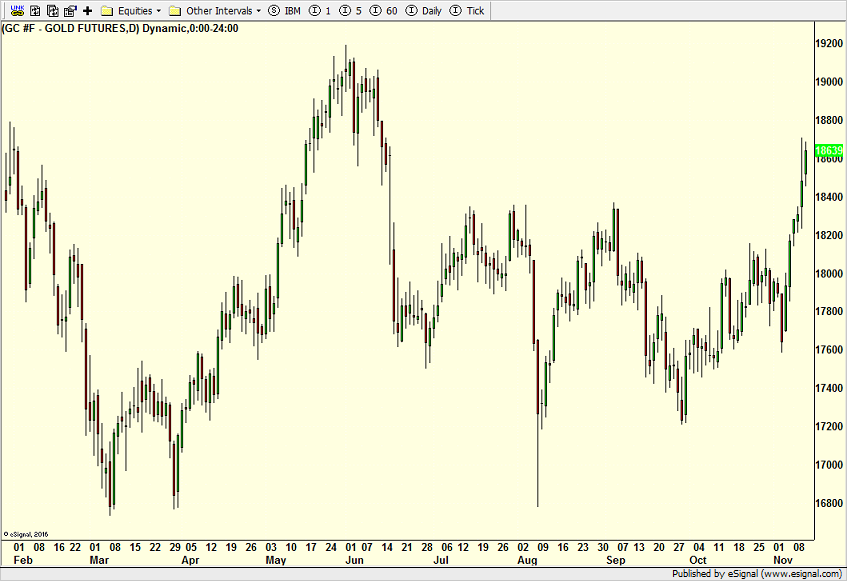

Gold has finally gotten off the mat, at least for a week or so. However, real interest rates remain at historically extreme negative levels, making it challenging for the metal to mount a rally of major significance. In the best of best cases, I think gold could run towards $2000-$2100 although this decade I still see $3000 and maybe $5000.

We sold part of our sub-sector position in internet, not the best of executions, and we are holding some dry powder as I watch biotechs and large pharma.

A yucky fall day in CT with rain and wind should yield a better weekend. There’s still so many leaves left on the trees and it’s mid-November. Killington is open for skiing and it won’t be long before the rest of Vermont joins the party.