Inflation Soars At The Producer Level – Stocks & Bonds Don’t Crash

While inflation at the consumer level was tame in July, it soared at the producer level to numbers not seen since 2022. Pundits and the media had exaggerated initial reactions with all kinds of narratives being spun. I was suspicious. That kind of spike did not add up for me. While I have been saying that a warmer month or two was to be expected, July was hot. I also wanted to see how bad the markets reacted. With that kind of number, stocks and bonds should have plummeted. By the time stocks opened, I read some of the details about the report. The amateur economist in me saw the culprit as an aberration in the services sector, not on the hard goods side from tariffs. Beyond that we will need to see the next few reports.

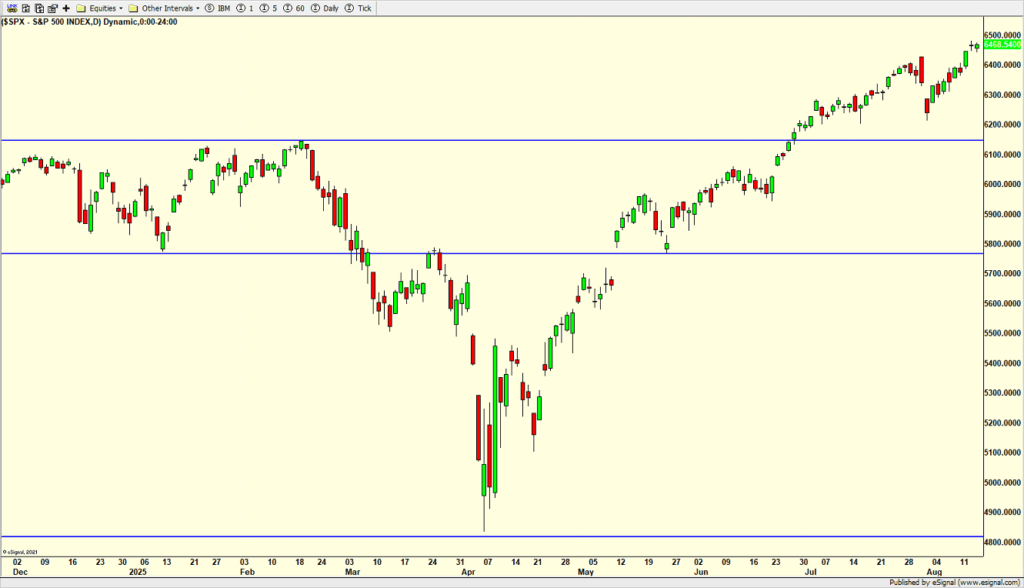

So what did the markets do with all that air beneath the epic rally from the tariff tantrum lows?

The stock market barely budged, basically closing at new highs. How can that be with soaring inflation? The market knows better and is looking past July.

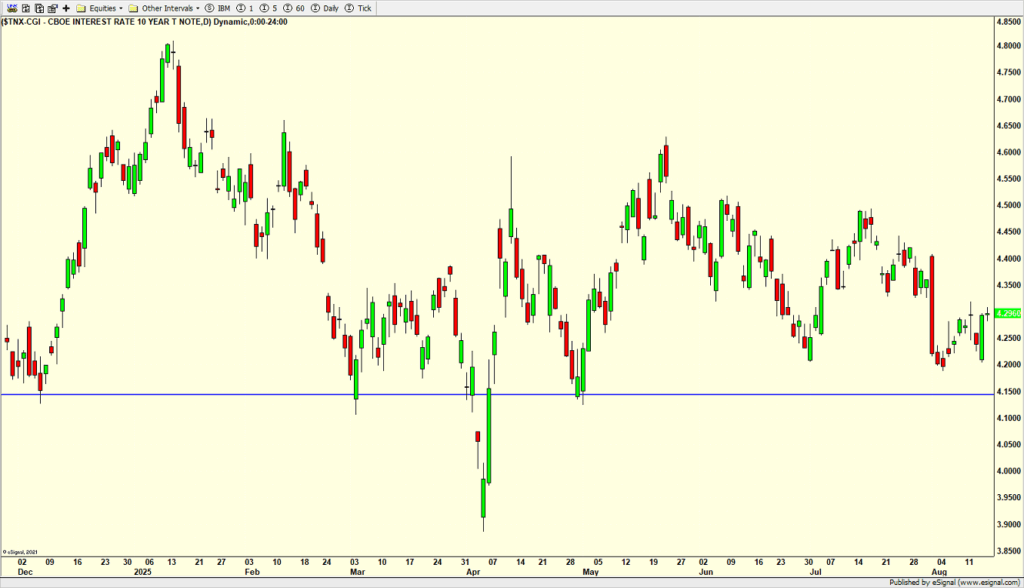

And bonds, what did they do? Yields reversed higher, but are at the same level as earlier this week and remain in the context of a wide range.

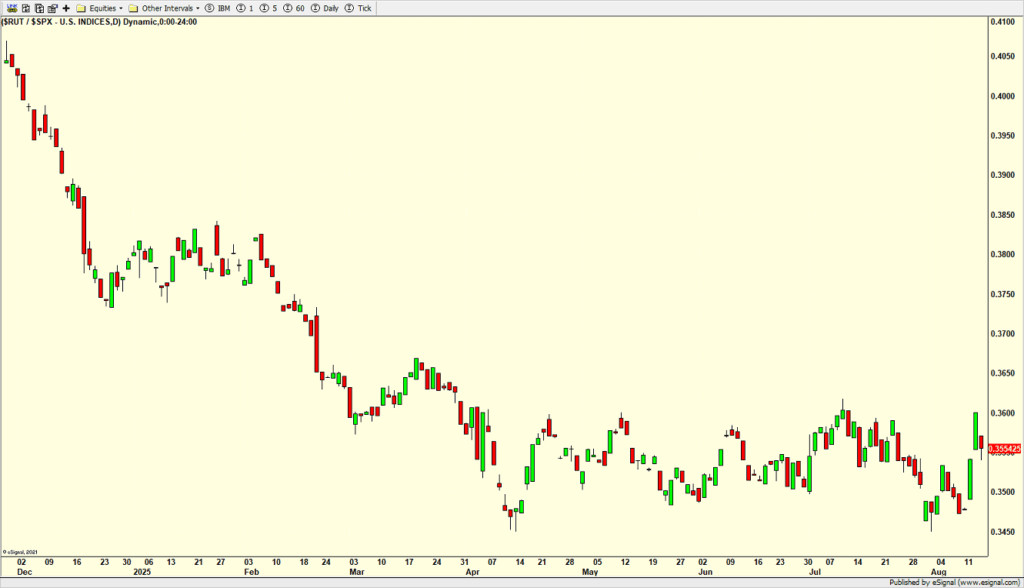

We have also seen the long, long-awaited beginning of a rotation into small caps. However, we have seen this movie many times before with a few strong days of the Russell 2000 beating up on the S&P 500 only to see that relationship revert back, leaving the chasers holding the bag. Is this time different? I have some optimism, but I also have the road rash scars from playing this over the years.

Another hot August weekend is on tap in CT. It such a bummer that so many trees are losing their leaves with the drought. I can’t recall seeing so many leaves on the ground in mid-summer. Fall foliage isn’t shaping up to be anything special.

On Tuesday we bought IGV, more QLD, more PFF, more XLRE and more EWY. We sold GDX and some SSO. On Wednesday we bought more XLRE, more OTIS and more FDLO. We sold some MTUM. On Thursday we PCY, IJS, OLED, more CF, more OTIS, more XHB, more HYG and more EWY. We sold IJT and some QLD.