Is “A” Bottom or “THE” Bottom? The Window is Open

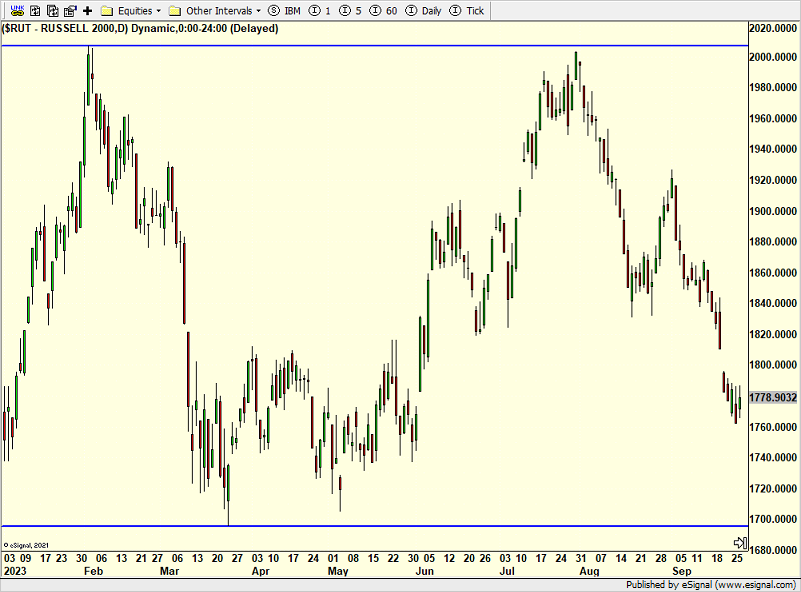

Monday was the first time in a month where some signs popped up of at least a short-term rally beginning. The bears waited all of one day to squash that notion as Tuesday was another win for the bears. Wednesday looked even better than Monday in terms of the market groping for a little low. We shall see what happens today. The most beaten down, ugliest indices, small and mid caps, have been hanging in this week. Here is the Russell small cap below for 2023. It doesn’t look that bad, does it?

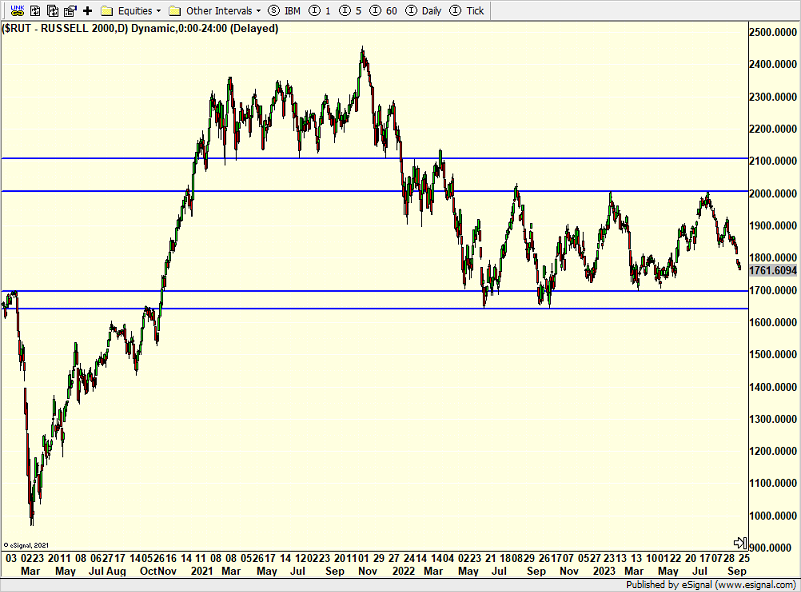

Now let’s pivot to a multi-year view below. That looks uglier and points lower still.

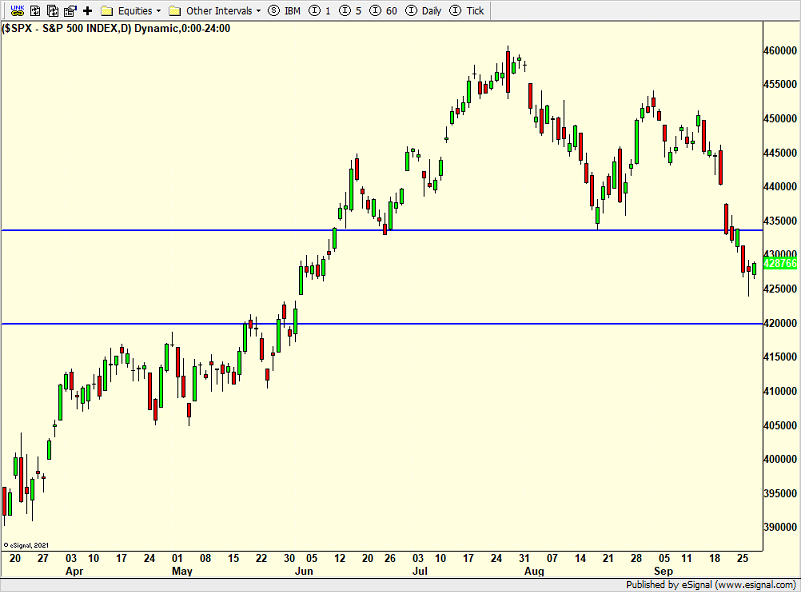

My thesis remains unchanged. The pullback I have been writing about for two months is now getting long in the tooth. The time window for a bottom opened this week. The price window for a bottom opened this week. The S&P 500 is down 7% from the July peak and it’s been more than 30 market days.

You can see the blue, horizontal lines below which show the range I expected the low to form. Price now sits squarely in the middle. The time window looks like it will remain open for a solid few weeks. The beginning for the makings of a bottom is here. We just need some more pieces to fit in place.

One of those pieces is the Volatility Index (VIX) which I discussed on Tuesday. I have been expecting the VIX to at least exceed 20 during the decline. Close but no cigar. Perhaps a little rally and one more move to new lows will do that. It is not an absolute ingredient but it does make it all cleaner.

Finally, in the very short-term, stocks look like they want to bounce into month and quarter-end and possibly early next week. Maybe 1-3%. That would square things up a bit.

Trying to anticipate questions, the answer is yes. It is possible that Wednesday was a low or the low. It’s just not the most likely scenario yet. The Big 7 stocks look like they need more work although some of the broader measures are already there.

On Tuesday we sold PHFNX.