It MUST Be a Bear Market

For the past 14 months, I have pounded the table that the bear market ended in October 2022. To be 100% accurate I started this thesis in late September 2022 and it’s all in the blog archives, the good, the bad and the ugly. It’s also in the media section. I have watched so many people turn bearish from June through August 2022 after stocks had already seen the vast majority of their bear market damage. And those folks largely remain negative today.

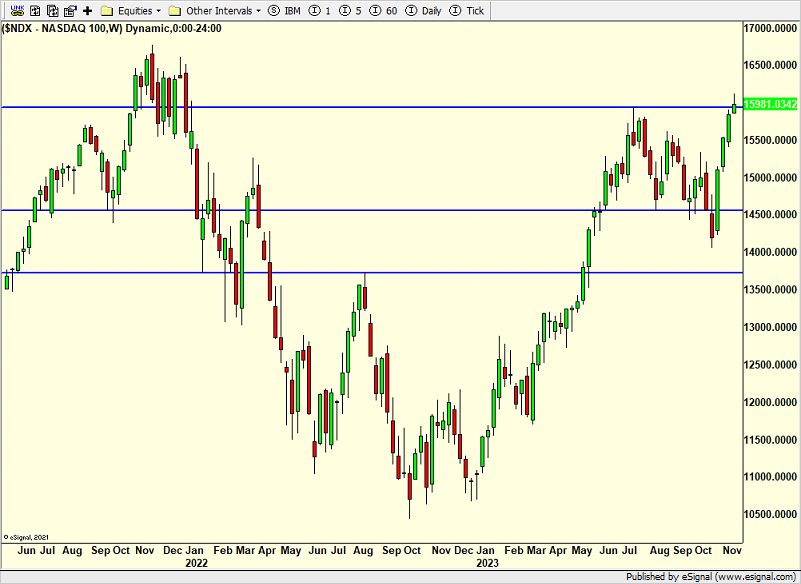

Below is a chart of the NASDAQ 100, which is dominated by the Elite 8 stocks. Can you see where it sits this week? At its highest level in 21 months. and within striking distance of all-time highs. It is also 50% off the bear market lows. Seriously, how can anyone proclaim with a straight face that this is a bear market? I think it’s more of a hope and prayer for people who have sat out the bull market that began in October 2022.

I speak to many industry folks. We act as sounding boards, cheerleaders and psychologists for each other. I cannot get over how many people have spun the bearish narrative all year and now are in trouble with year-end so close. There is a mad dash to chase performance. That’s never good. The market gave us a good opportunity to load up in March. It gave us an equally good opp to buy in August, September and October. There’s no excuse really.

In the short-term, we do have an overbought stock market and some options traders have become a little too giddy. A pause to refresh or mild pullback is certainly logical and possible. Today, the day before Thanksgiving, is one of the most seasonally positive days of the year. The day after Thanksgiving used to be, but not so much in recent years. The Monday after Thanksgiving is one of the weakest days of the year. Lots going on in the markets, but not much that for that is really actionable unless we see an explosion higher this week.

Wishing you and your family a Happy and Meaningful Thanksgiving! I hope it’s full of family, fun and football! Let’s go ‘Boys!!

On Monday we bought more FVD and ITB. On Tuesday we bought levered S&P 500. We sold levered inverse S&P 500.