It’s ALL About the Banks

I know it was a big ask for both Huskies teams to make it to Texas, but the men came through and earned their first Final Four appearance since 2014.

Friday was another interesting day in the saga of Silicon Valley Bank, Signature and Credit Suisse. It was only a matter of time before the bears turned their focus to Deutsche Bank as I mentioned last week. The difference is that the German government is not going to allow DB to fail. Not on their watch. And while the Germans do not have the power of the U.S. Federal Reserve, I also would not want to be on the other side of that trade. Below is a chart of DB.

Below is a chart of the NASDAQ Bank Index. Friday was yet another day where bears hit the index to begin the day and the bulls firmed it up into the close. The bears will argue that it was just short-covering ahead of the weekend. The bulls say that the action was a sign of rejection and a rally is coming. It’s possible they are both correct although I lean with the bulls for now. What we really want to see is the Bank Index close above $85. Stay tuned. It won’t be today or this week.

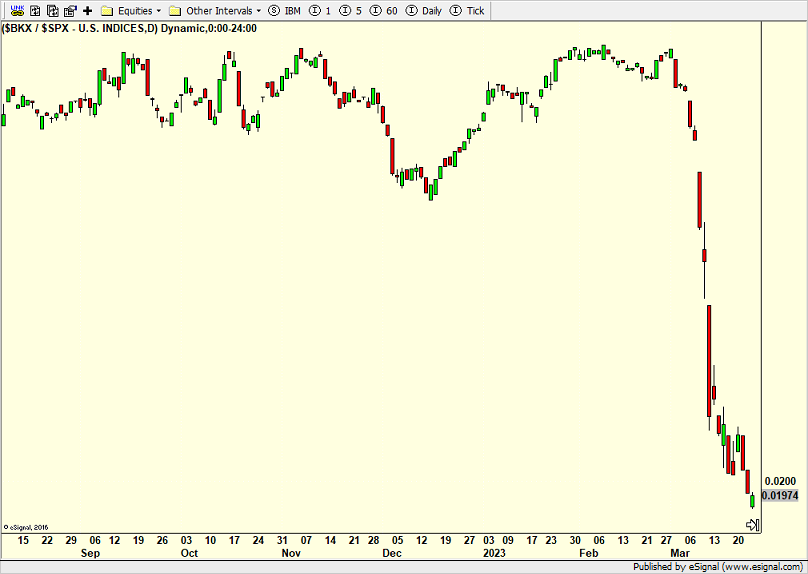

When I look at the banks against the S&P 500 below, it’s still quite ugly with lots of work to do. For the bull market to strongly reassert itself it needs the banks to rally and lead.

Lastly on the banks, let’s take a look at the regional banks, where the trouble began, versus the big banks. Of note, we see that the regional banks saw their peak of underperformance about 10 days ago. That runs counter to what we have been seeing and hearing in the news. We definitely want to see the regional banks outperform the rest of the sector along with the S&P 500. Stay tuned.

Finally, it is the last week of March and the end of Q1. Make no mistake about it. This is a strong seasonal period. The stock market is supposed to rally this week and into quarter-end.

On Friday we bought IWN and XLRE. We sold PIPR, some NVDA and some AMD.