It’s P Day

A year ago at this time, Fed Chair Jay Powell gave a very short and direct speech at Jackson Hole. Most people were surprised at how short his comments were, but no one misunderstood his powerful message which he followed through on ever since. I do not expect Powell’s speech to be as short as 2022 nor as direct and sharp. I expect him to continue to be mildly hawkish and report that the Fed’s job is almost but not quite done, meaning another misguided rate hike left.

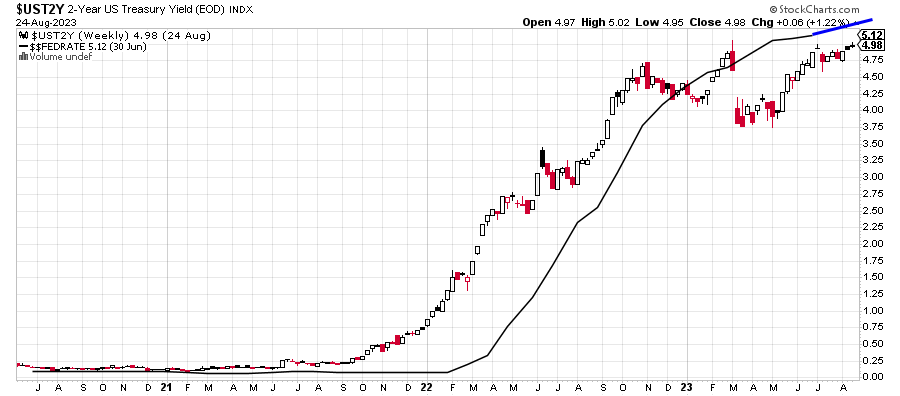

Looking below at the 2-Year Note and Fed Funds Rate we can see that the market (2-Year) which is in red, white and black remains below the Fed Funds Rate which finishes in blue. That means the market continues to be at equilibrium, best case, and expected an end to rate hikes, worst case. This has been the market’s position since the banking issues in Q1 when three non-systemically important institutions went bye bye.

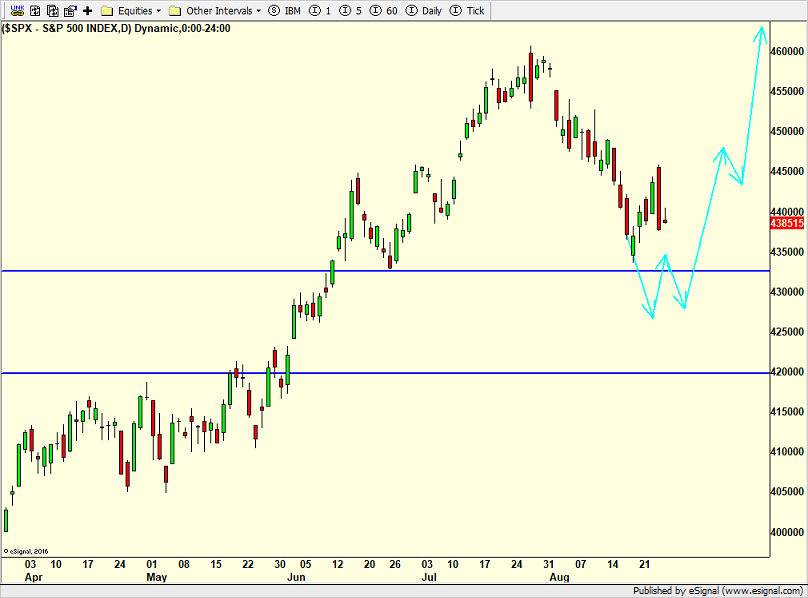

As you know, since late July, I have greatly tempered my enthusiasm for stocks and moved to the pullback camp. I thought a single digit decline would unfold in August and September that would lead to the final strong buying opportunity in 2023. That remains my working thesis. Last week the market got to the first line in the sand when the S&P 500 was down 5% from it speak. That’s where the strongest bull markets find buying interest and that’s where I became keenly interested in finding spots to commit risk capital.

As I also wrote about and mentioned in the recent video, my leash on new positions would tight. While I am willing to take a number of shots on the long side, I am not willing to accept larger losses when the indices haven’t confirmed a bottom. That’s why you may have noticed a number of positions bought and sold quickly. Early in my career I was taught that it’s always okay to be wrong. However, it’s not okay to stay wrong. I have sometimes tweaked that to state that I am okay with larger losses when I have high conviction.

In the chart above of the S&P 500 you can see that last week’s low occurred at down 5% from the peak. The bounce off that low was feeble and Thursday was another nasty reversal. That puts last week’s low in play to be breached in the next week or so if the bulls do not immediately step up. I was also looking at Powell’s Jackson Hole speech to act as a pivot point for stocks, meaning that whatever trend was in place into August 25th could be reversed. The market didn’t make it easy when it bottomed last week instead of now.

In short, the first leg of the pullback has ended. It’s questionable whether the bounce has also ended. If it has, we should not see Thursday’s high exceeded in the next week. However, if the bulls gather themselves quickly and close above Thursday’s high, then the bounce should live on into September. In either case, we should see more back and forth next month until the bulls are ready to rock n’ roll in Q4 and move to new highs for 2023.

While the middle of the country bakes (I think it was almost 100 when I flew home on Wednesday) New England is seeing its fair share of rain and cooler temps. I guess that’s okay during the week, especially for my recent fertilizer application. The weekend is looking up and I see BBQs with friends, swimming and maybe a little golf. Pre-season football ends so that means the NFL season is upon us! Of course, the Yankees still stink beyond comprehension.

On Wednesday we bought UBER ad DXHYX. On Thursday we bought PCY, EMB, SARK and more DXHYX. We sold IJK.