Job Growth Meh, Inflation Dead, Cover To Cut, Market Breather

As I mentioned last week, I am traveling to the Sunshine State this week although the weather looks more like my alma mater, Rochester, with gray skies, damp and windy. However, it’s still 80 where Rochester is probably 18. My schedule is off which is why I missed yesterday as I was trying to finish up my 2026 Fearless Forecast. The more research I did, the less negative I became. More on that later this week.

Let’s start with my first five-day trade update which was all in on small caps for the first five days of 2026. If you’re keeping score at home, the Russell 2000 gained 4.92%. I wish this system happened more often or I found others with such a high hit rate.

On Friday, the BLS released the December employment report. While job growth was a bit weaker than expected the unemployment rate and under-employed rate fell. More Americans left the job force. Not quite Goldilocks, but it was okay for now. The report is very supportive of more Fed rate cuts which I have long argued are coming this year.

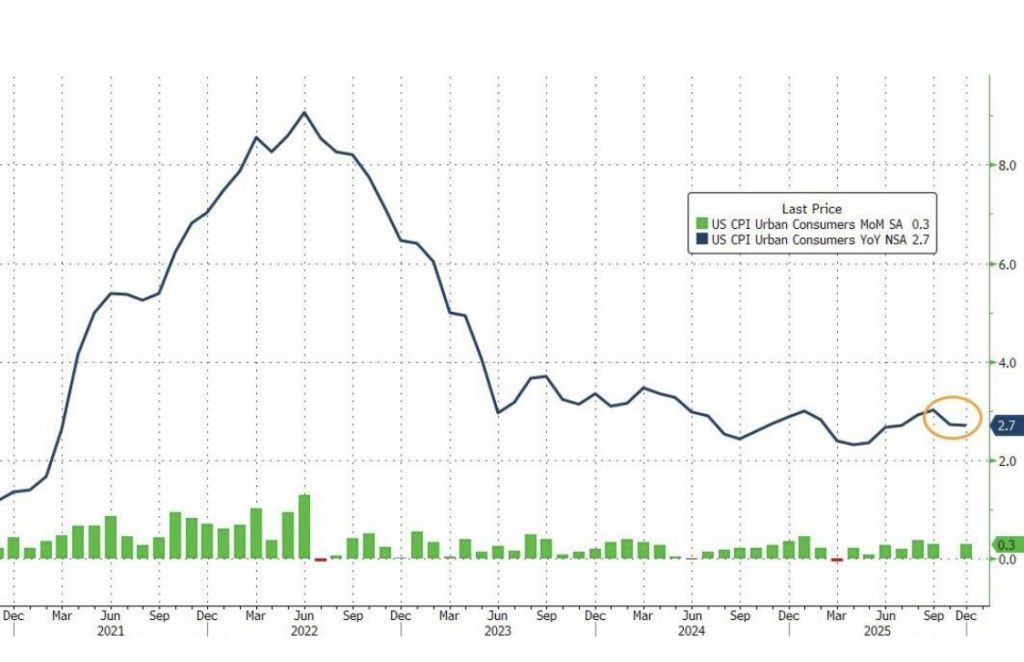

This morning the government released December inflation at the consumer level, CPI. Once again, it came in as expected on the top line and cooler than expected at the core. At the risk of annoying you again, for two years I have stated very loudly and often that the upward trajectory for inflation was dead. The Fed has been and is fighting the wrong battle. Inflation has not been a problem since 2023, yet folks continue to invoke it.

Below is chart I copied from Zerohedge. That’s CPI since 2020. No narrative. No spin. It is what it is. I have long said that 3% is the new 2%.

Stocks have run nicely to begin 2026. They should take a breather, but do not need one. Until proven otherwise, weakness should be bought. If small caps do not lead lower then I would contemplate buying even more which would be tough because our position size is so large.

On Friday we bought TQQQ, IBIT, EMB, IVE, more NVDA and more PG. We sold SSO, IVW and some XLU . On Monday we bought more MQQQ. We sold EMB.