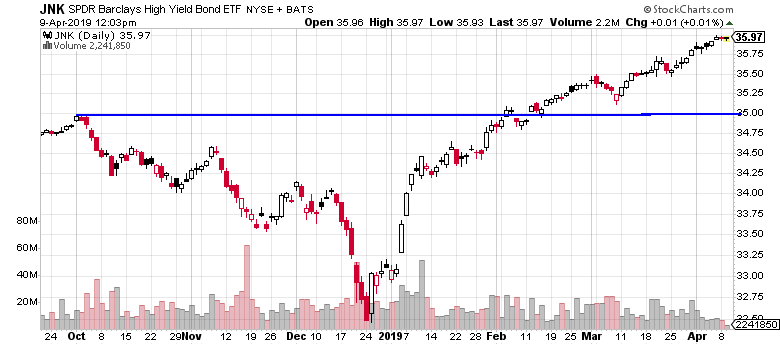

Junk Bonds Say Full Steam Ahead

It’s been a fairly quiet few days for stocks after the better than expected employment numbers were released on Friday. The economy created 196,000 new jobs versus the 175,000 expected. As I wrote about then, I was expecting a strong number with a sharply higher revised number for February. While the former happened, the latter certainly didn’t as February was only revised higher from 20,000 to 33,000.

There’s nothing wrong the major indices. All looks fine. The four key sectors are split with semis and discretionary rocking and rolling, but banks struggling and transports looking like they want to burst higher. High yield bonds continue to quietly shock and surprise at all-time highs. I’ve been saying this for years, but certainly of late, bull markets do NOT end with behavior like this. Junk bonds usually top out long before the stock market. Risk on remains in place. The bears are and have been wrong.