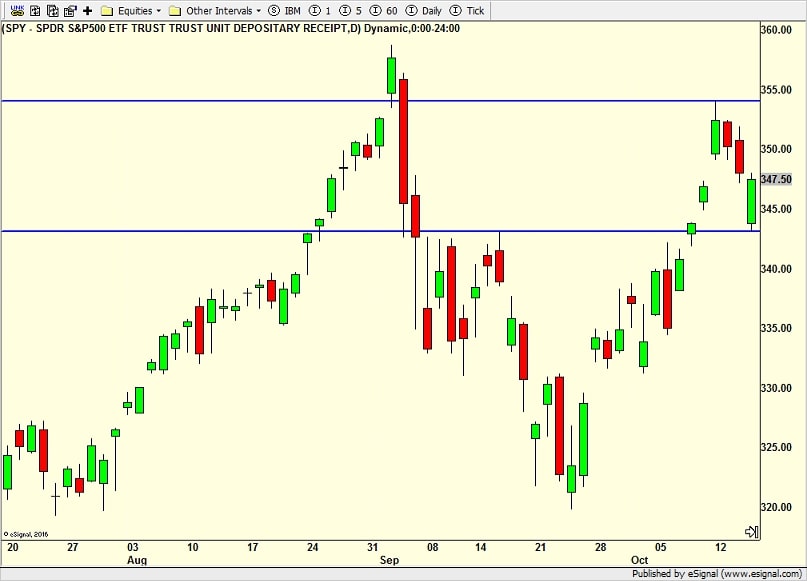

Lines in the Sand – Semis Strong

After opening down more than 1% on Thursday, the bulls stepped up as the perceived “value” was too much to ignore after a few straight down days for stocks. We now have two very nice and tidy, short-term lines in the sand. They are bound by this week’s low and high. It’s that simple. Closing above or below those prices should induce more movement in that direction. For now, the bulls are supposed to run prices to the upper blue line.

As I continue to cherry pick from my favorite canaries in the coal mine, like high yield bonds and the NYSE A/D Line, I want to share what has been my top sector pick for several years and one of four key sectors. That is semiconductors. I believe we have owned them since 2017 in varying position sizes.

You can see below that after collapsing in March, they roared back to life with the work from home theme and easing of tensions with China. When they fell hard in early September for three days, I viewed that as a buying opportunity. I continue to watch them closely for signs that the tide is turning. For now, they remain buys into weakness until proven otherwise and do not signal an end to the bull market anytime soon.