Looking At Other Similar Crashes As Stocks Target All-Time Highs In Less Than A Year

The stock market bounced as expected from both a time and price standpoint. A pullback is next. I do not believe stocks will breach or come close to the lowest levels we have seen in April, at least not yet. Ideally, I would like to see the S&P 500 get to at least 5550over the coming few weeks. My thesis remains that a wide, 15% trading range is likely in place for the next 4-8 weeks and the final bottom from which stocks go up and don’t look back will follow.

I have done a lot of studies over the past few weeks and more than 80% of them point to the S&P 500 rallying to 6100 – 7300 by April 2026. That puts new, all-time highs in place by Q1 2026. The other 20% show much more muted gains or small losses.

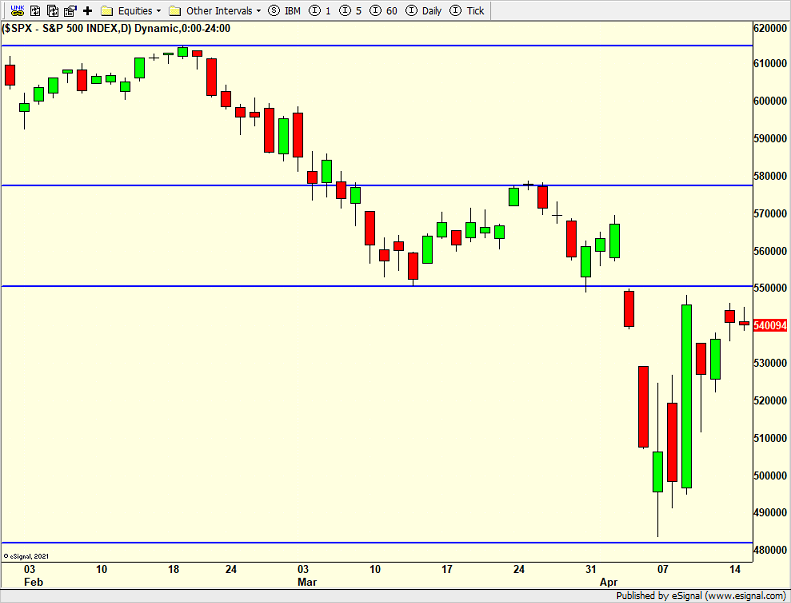

I have had a number of questions about what this market most compares to. I have many answers and I will start with the few in the modern era where we saw two-day crashes of at least 10%. The current market is below.

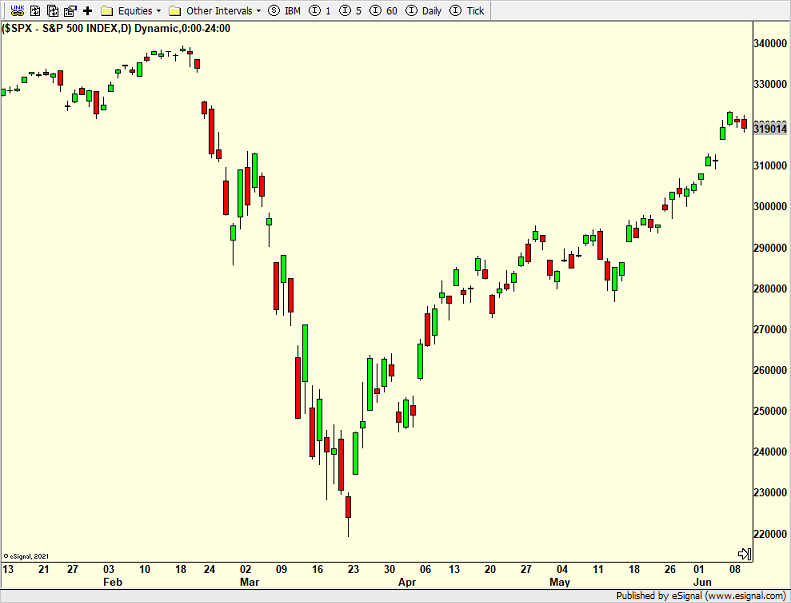

Before that, we had the COVID Crash in March 2020. Notice the “V” shaped bottom as the Fed quickly pivoted, dropping nuclear bombs on the markets by April 6. Everything went vertical from there and never looked back. I do not believe this will happen today.

2008 is below and that looks absolutely nothing like today except for the two-day crash action. Today, banks have fortress balance sheets and consumers are in much better financial shape. Throw this out as a valid comparison.

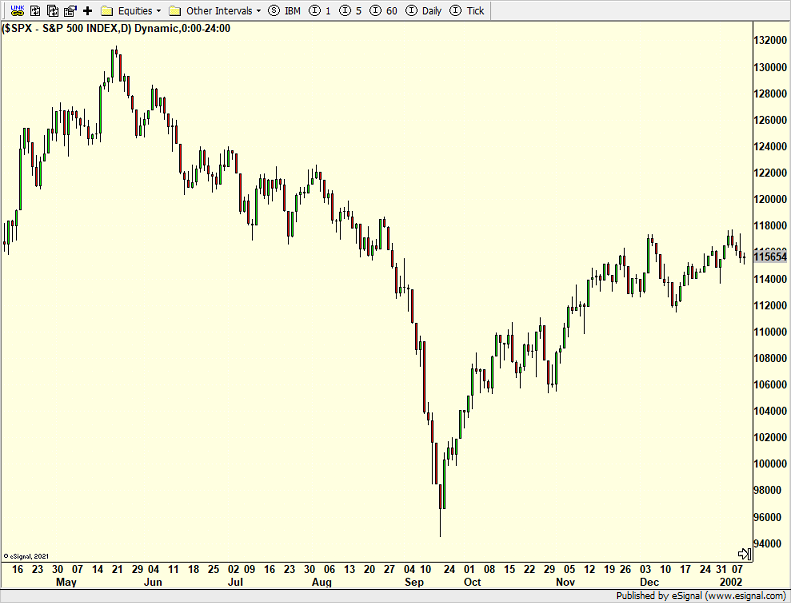

9-11 is next. That period has similarities to 2020, both in term of magnitude and Fed response. You can see the “V” shaped bottom as well. The rally was fierce, but it only lasted a few months and just about 25% before rolling over to new lows in 2002.

Finally, old timers like myself still remember the crash of 1987. At that time, I owned one single stock, a company that made toilets. I always thought that even if the world ended, people will still need toilets and probably more of them. My stock still fell 50% and I learned a valuable lesson about bear markets. Almost everything goes down.

I think this may be the most comparable to today although newly appointed Fed chair, Alan Greenspan, did slash interest rates after Black Monday. Notice the bottom the market went up from was on December 4th, some 6 weeks after the crash. That fits in with my thesis about the 4-8 week window.

While I absolutely do not think the Fed is going to pivot like they did in other crashes, if they somehow do, then I will adjust my thesis. Jay Powell and the Fed are late, yet again. They should have cut rates 1/4% in March and then again in early May. Markets do not see a cut until mid-June, that is unless market breach the levels we saw in April which remains possible.

With or without tariffs, the economy was weakening coming into 2025. Inflation was dying. The Fed should cut rates by 3/4% to 1% the rest of the year. The sooner the better for the markets and economy. Interestingly, President Trump has set up Powell and the Fed to take the hit for any recession. Trump has been loudly calling for rate cuts and for Jay Powell to be replaced. Trump has a scapegoat teed up.

On Monday we bought PCY and QID. We sold UWM, QLD and MQQQ. On Tuesday we bought EMB. We sold SDS.