Looking at Yields Again

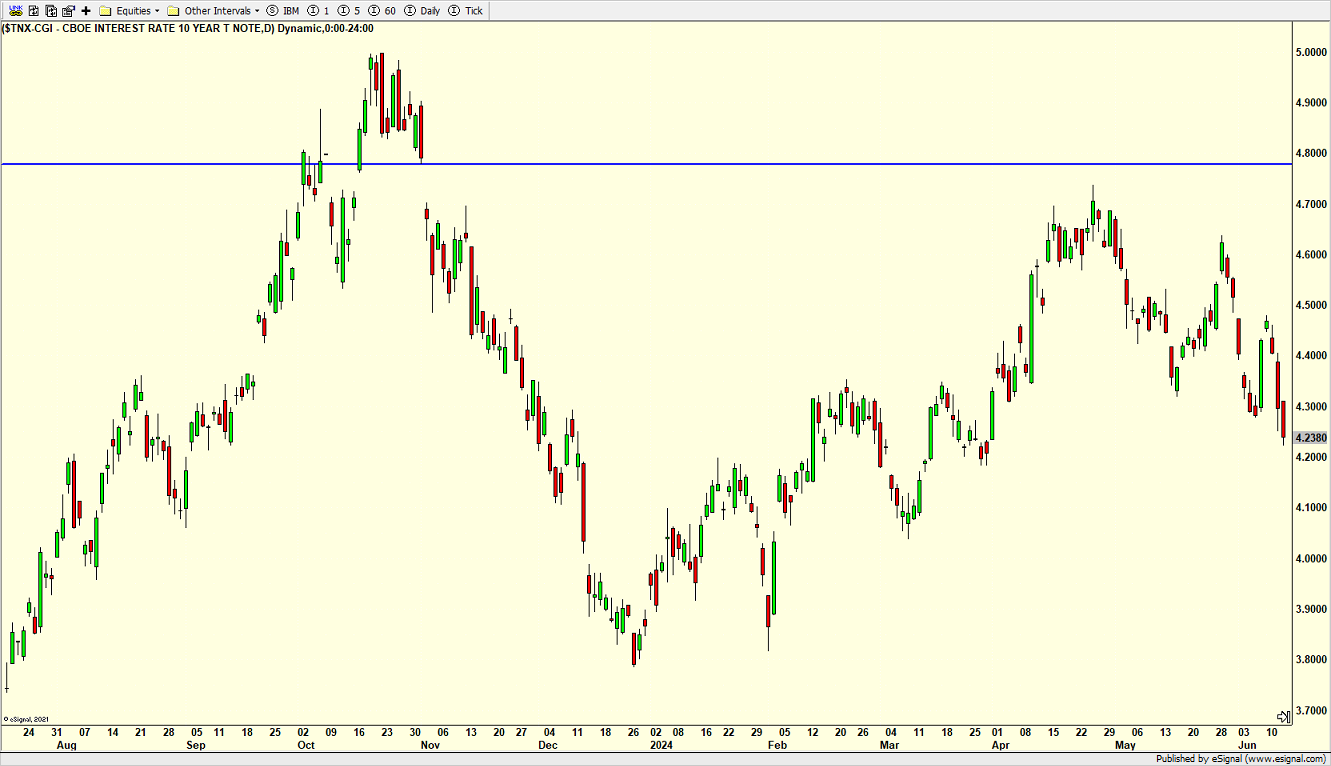

Between the cooler inflation numbers and the FOMC meeting this week, yields on bonds have come down in a rather large way. As you know, the 10-Year yield in the long-term benchmark and most heavily traded. Let’s look at the 10-Year using two different time frames.

Below are treasury yields over the past year. 5% was the high profile peak last October with 3.75% being the low in December. I had thought yields would have visited 4.8% before they saw 4%. While yields have risen in 2024 they have certainly come down in Q2.

Zooming out to mid-2021, we see a totally different picture. It looks like a strong bull market in yields where pullbacks should be bought. In other words, we have a solid bear market in bonds. Remember when bond prices rise, yields fall and vice versa.

The $64 billion question is whether that 5% peak last year is a multi-year, durable peak. I do not have high conviction, but the longer it holds, the more likely it is. If that’s the case then 0% GDP growth or even a modest recession would be on the table over the coming 6-18 months.

A beautiful Father’s Day weekend is in store for CT with the U.S. Open at famed Pinehurst #2 and travel ball for the Schatz boys. While I love my kids to the end of the earth I can’t say I am excited to drive to and from West Hartford on Friday night, to and from the middle of Rhode Island on Saturday and to and from eastern CT on Sunday. The things we do for our kids that I miss terribly when it’s all over.

Sending Father’s Day wishes to all the dads out there! May you be surrounded by your loved ones.

On Wednesday we bought PMPIX and DXHYX. We sold some RYEIX and some RYCIX. On Thursday we bought PCY, EMB, FUTY, DXHYX and levered inverse S&P 500. We sold RYSPX, PMPIX and some FDEV.