Looking For Downside Confirmation

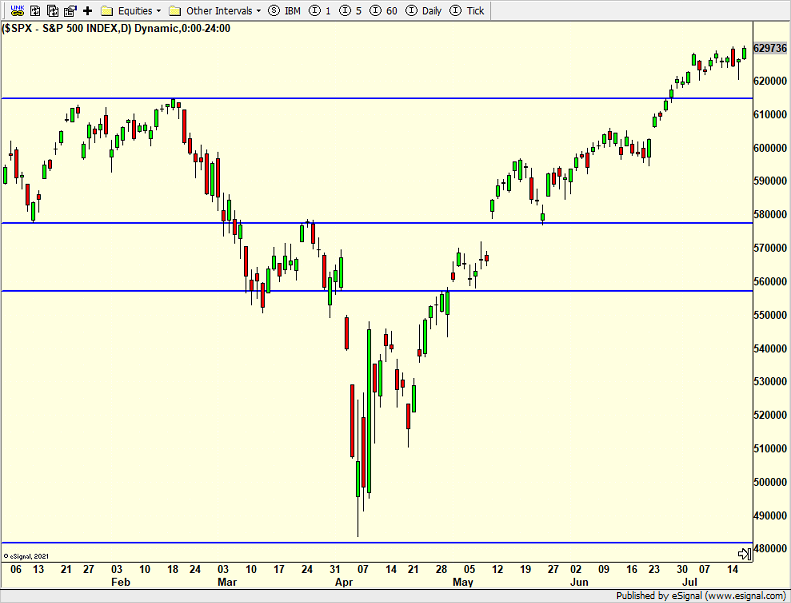

On Wednesday I wrote some of our models turning down on the stock market and that action would be forthcoming, which it was on our capital appreciation strategies. We jettisoned some laggards and losers and trimmed position sizes in some big winners. Our aggressive strategies remain solidly positive for now. When this happens our strategies usually higher turnover as they jockey around. However, we still need to see downside confirmation before taking more serious protective measures. That looks to be a close on the S&P 500 below 6200.

Today is monthly options expiration. I expect it to be quiet. Next week, if there is upside it should be muted.

Looking forward to a much needed break in humidity for Saturday. The British Open comes around 4am so it will be an early morning! I so love this tournament, especially after playing in the UK two years ago and getting ready to go over again.

Friends know that I typically drive my cars into the ground. My family often chirps me. I am the epitome of a creature of habit. However, with technology changing so quickly, I decided that my 7 year young SUV that needs thousands in work is in need of an upgrade. So, I will pick up a new SUV Saturday morning.

On Wednesday we bought EWY, NKE and RSPF. We sold SSO, KIE, KRE, COLO, PFF, PEY, IWN, SPLV, DIA, W, some COIN, some BA, some META, some SNOW, some LHX and some MSFT. On Thursday we bought XOP, XLC, MHK, QLD, more VGK and more HYG. We sold some IYT.