Looking For More Downside

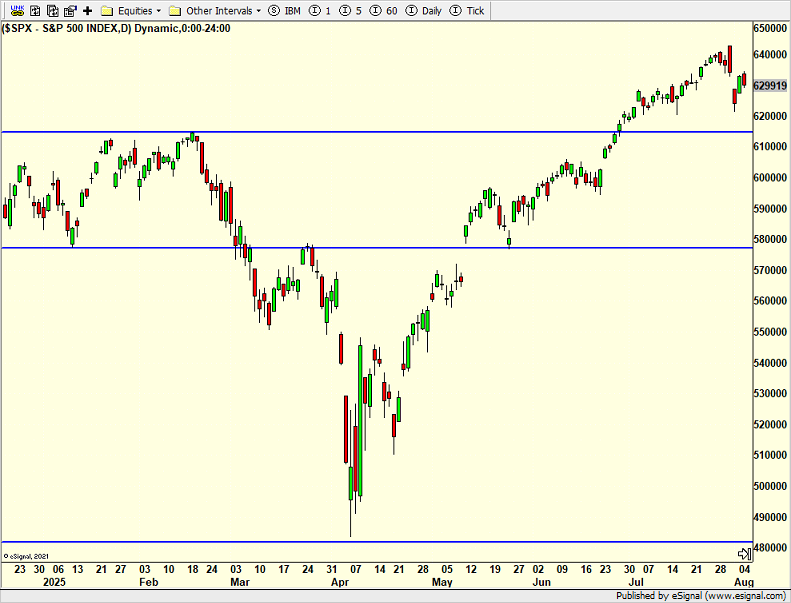

The major stock market indices saw sharp reversals last Thursday. And there was a whole single day of follow through on Friday. So far, that’s been it. We are currently seeing a bounce from that little pullback. I still think there should be more downside this quarter, but I am certainly not going to die on that hill. In a perfect world, the bounce ends this week and then we see a move below last week’s low.

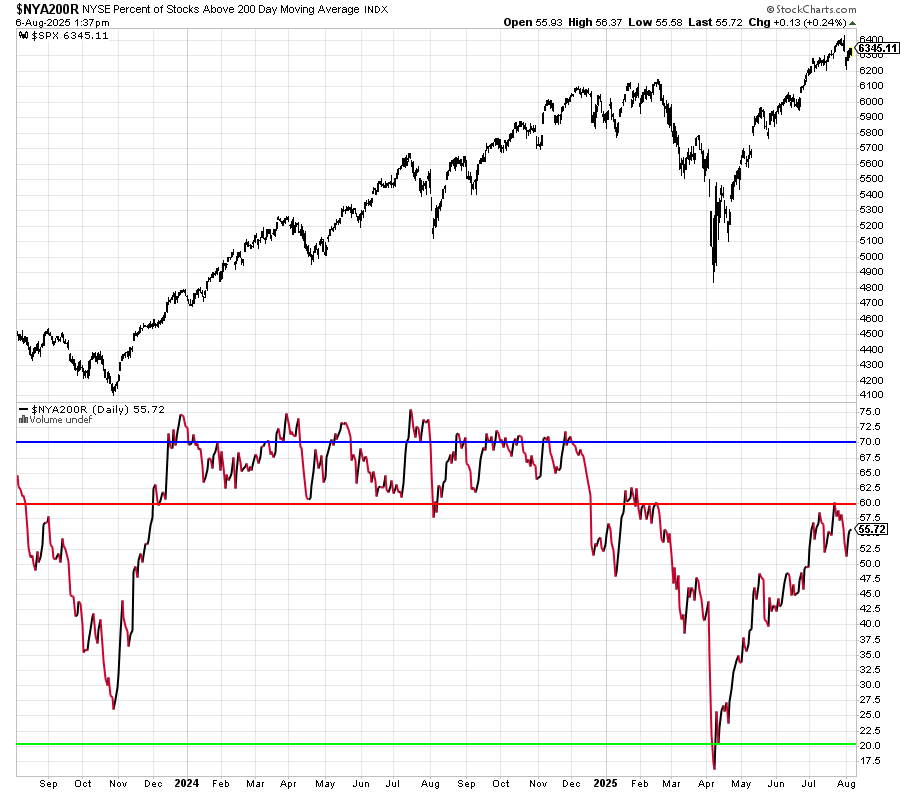

Looking at the percent of NYSE stocks in uptrends, we see it’s at 56%. That number should be above 60%.

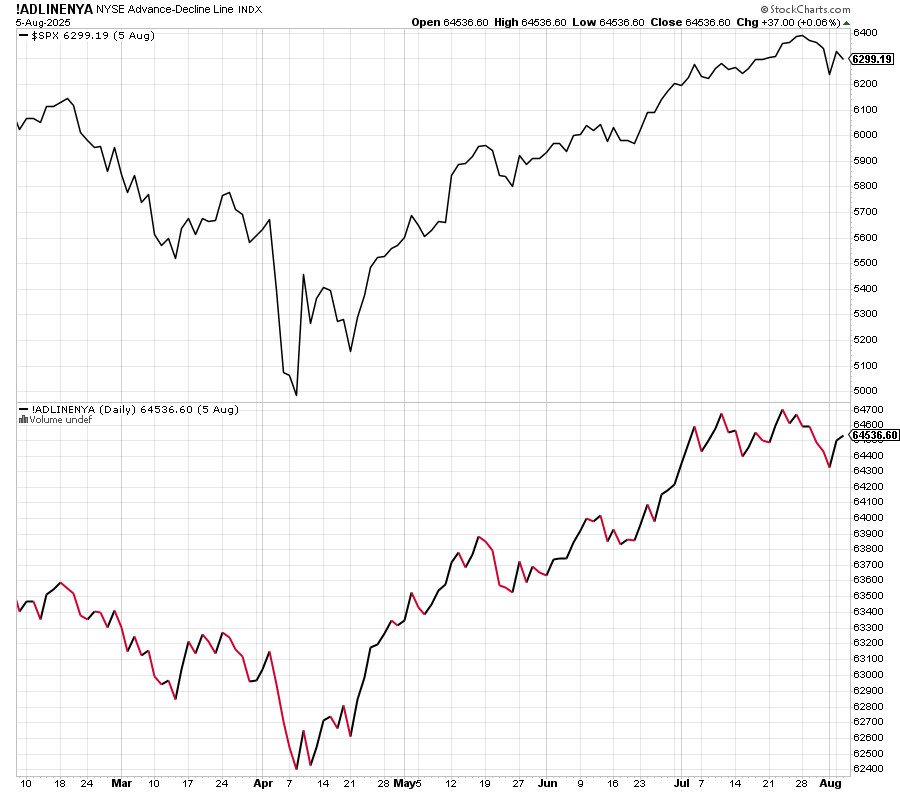

The NYSE A/D Line below looks healthy, basically following the S&P 500. Bear markets rarely begin with so much participation. For all the media’s nonsense about only a few stocks leading, this indicator refutes that.

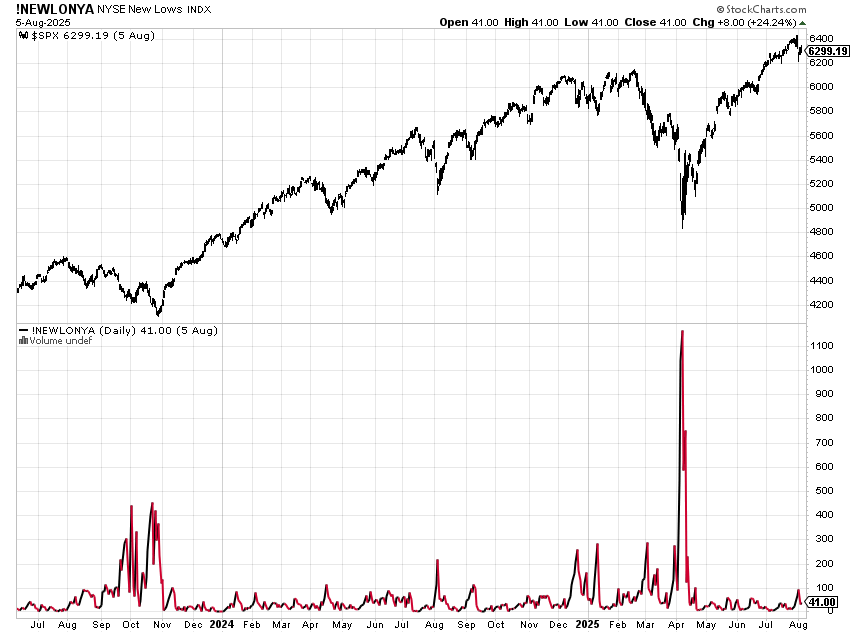

Finally, let’s take a look at the number of NYSE stocks making new 52-week lows. It got to 100 last week which is not nothing for a market at all-time highs, but it’s also not a flashing red light.

All in all, the markets behave well. The 2-5% Q3 pullback looks to be shaping up. It is buyable. There are just too many investors still sitting on the outside wishing they were inside. All those people who panic sold during the tariff tantrum in April. And while it’s only early August, the longer the stock market goes without a meaningful pullback, the more likely a performance chase will ensue in Q4. Lots of jobs in jeopardy.