Lots Going On Beneath The Surface Of The Pullback

Happy Friday. Let’s talk pullback and what to glean from it. So far here is what has occurred.

Dow Industrials -3%

S&P 500 -4%

S&P 400 -4%

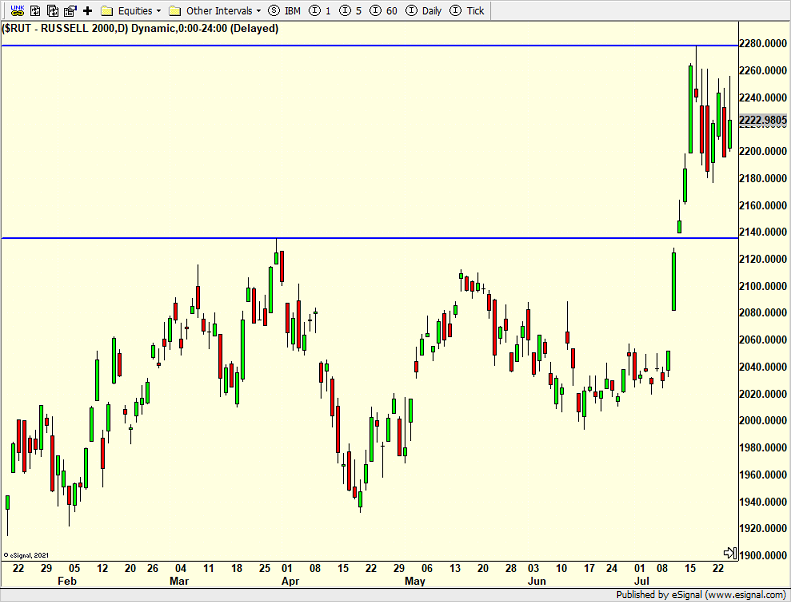

Russell 2000 -3.5%

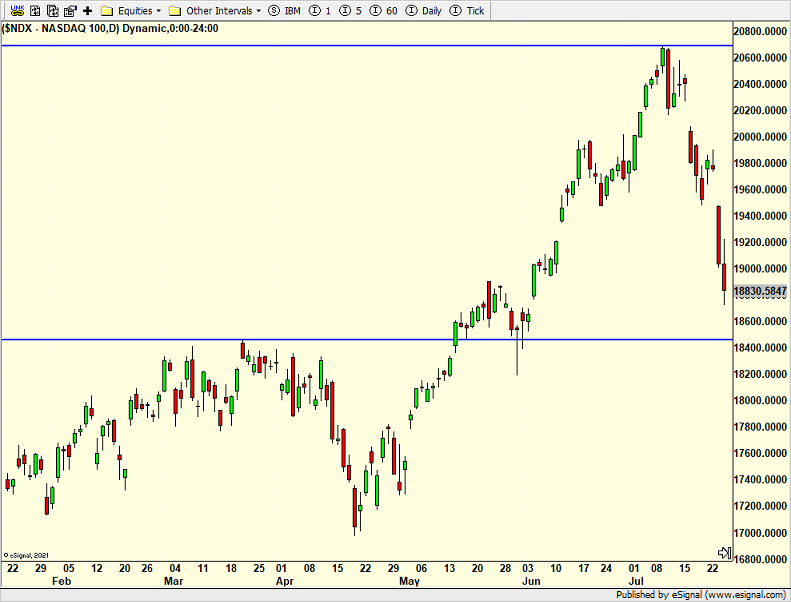

NASDAQ 100 -9%

On the surface you may conclude that the pullback is basically even except for the NASDAQ 100. But you would be wrong. There is something important beneath the surface that the raw numbers do not show. First, all indices did not peak on the same day. The highs have been July 10, 16, 17 and 18. What peaks last is usually what’s leading. In this case it is small caps followed by mid caps.

Additionally, on down days, the NASDAQ 100 has underperformed or lagged while the small caps have lead. On bounce day, the small caps (Russell 2000) have lead or outperformed while the NASDAQ has lagged.

Stocks are due for a bounce and that’s what is shaping up pre-market. The odds don’t favor this being the final low, but the key takeaway is that new leadership is emerging or has emerged since that epic day on July 11th.

A beautiful summer weekend is here. Folks have asked what I do since I still can’t play golf or be active. Well, not much. I go to the office. I float around the pool. I socialize. The little guy is pitching tomorrow so that’s much of the day. Can’t wait to get back to normal. Well, most would say that I have never been normal, so maybe back to myself.

On Wednesday we bought more RYCIX. We sold ENPIX and some TGNA. On Thursday we bought SSO, RYAZX and more QQQ. We sold FDEV, some RYZAX and some FUTY.